Under Pressure

Page 32

Page 34

If you've noticed an error in this article please click here to report it so we can fix it.

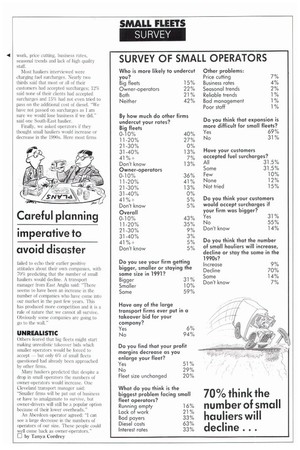

The economic downturn is hitting all operators, but small hauliers are the most vulnerable. CM's latest exclusive survey reveals what small fleet operators think about today's transport industry, and its prospects.

• Hard times are hitting all types of haulage operation, but there is little doubt that small fleets are the most vulnerable.

To find out how the economic climate is squeezing smaller operators, Commercial Motor conducted a survey of 200 hauliers running between six and 25 vehicles.

Just under 60% of operators complained about the undercutting of rates in the industry, even though most believed it was natural — one described transport as "a dog eat dog game". A Suffolk haulier commented: "If we are honest we are all at it. Everybody is at each other's throats. You do what you can to survive."

Almost a quarter of the hauliers questioned saw owner-operators as the . worst culprits of price undercutting. Some felt that owner-operators were undercharging through ignorance; others simply believed that owner-operators could operate cheaper because of their lower overheads. But most claimed that they were being undercut by 'cowboy' owneroperators.

About 15% of the hauliers questioned found big fleets more guilty of rates undercutting — and 20% said their rates were undercut from both directions, big fleets and owner-operators.

We then asked our respondents by what margin other transport operators undercut their rates. The answers varied drastically. Just under half replied that their rates were being undercut by less than 10%; Another 35% found other firms charging between 11% and 20% less.

What did come as a surprise was that 20% — one in five operators — claimed that their rates were being undercut by more than a third, and 7% said other firms were charging 40% less.

Next we asked if hauliers expected to expand or contract over the coming year. Despite the current downturn in the market, only 10% thought their companies would shrink: 59% said their businesses would stay the same size. However, most were still wary of the state of the industry.

One Kent transport manager said: "We are just going to try and stay steady over the next year and see if we can ride out the storm." These feelings were echoed by several firms.

AGAINST US

One Yorkshire operator commented: "We will be very happy if we can keep our business the same over the next couple of years. With everything against us, fuel costs and interest rates, that is about the best you can hope for.

"In the present economic climate you would be mad to try and expand your operation," added a Merseyside haulage firm.

Nonetheless, almost a third of operators expected their transport operation to get bigger. Many already had contracts on their books for 1991 and were putting in orders for new trucks. A second group were full of confidence in their clients, which were planning to expand onto the Continent.

Some were born optimists, like the Cheshire operator who said: "We are looking to expand; I am sure there will be an upturn in trade. You have got to live in hope."

Operators were asked if their profit margins had decreased as their fleets expanded.

More than half said yes, blaming higher overheads, interest rates, cash-flow problems and the uniform business rate. And 69% felt expansion was more difficult for small fleets because of problems of obtaining finance.

Some fear threat

of big-fleet

takeover bids Higher business rates blamed as profits fall

However, 29% said they had not had problems with declining profit margins. One Scottish manager said: "You will be okay as long as you put a lot of planning into things before embarking on an expansion programme. The problem is that a lot of companies go into it like a bull in a china shop with no forethought, and then wonder why they have problems."

The survey went on to look at the problems facing today's small fleet operators. Not surprisingly, 63% cited the high cost of diesel as their biggest burden. Next carne bad payers and interest rates at 33% apiece. Other difficulties listed by hauliers included running empty, lack of work, price cutting, business rates, seasonal trends and lack of high quality staff.

Most hauliers interviewed were charging fuel surcharges. Nearly two thirds said that most or all of their customers had accepted surcharges; 12% said none of their clients had accepted surcharges and 15% had not even tried to pass on the additional cost of diesel. We have not passed on surcharges as I am sure we would lose business if we did," said one South-East haulier.

Finally, we asked operators if they thought small hauliers would increase or decrease in the 1990s. Here most firms

Careful planning imperative to avoid disaster

failed to echo their earlier positive attitudes about their own companies, with 70% predicting that the number of small hauliers would decline. A transport manager from East Anglia said: "There seems to have been an increase in the number of companies who have come into our market in the past few years. This has produced more competition and it is a rule of nature that we cannot all survive. Obviously some companies are going to go to the wall."

UNREALISTIC

Others feared that big fleets might start making unrealistic takeover bids which smaller operators would be forced to accept — but only 6% of small fleets questioned had already been approached by other firms.

Many hauliers predicted that despite a drop in small operators the numbers of owner-operators would increase. One Cleveland transport manager said: "Smaller firms will be put out of business or have to amalgamate to survive, but owner-drivers will still be a popular option because of their lower overheads."

An Aberdeen operator agreed: "I can see a large decrease in the numbers of operators of our size. These people could well come back as owner-operators." CI by Tanya Cordrey