Buying abroad: a right result?

Page 27

If you've noticed an error in this article please click here to report it so we can fix it.

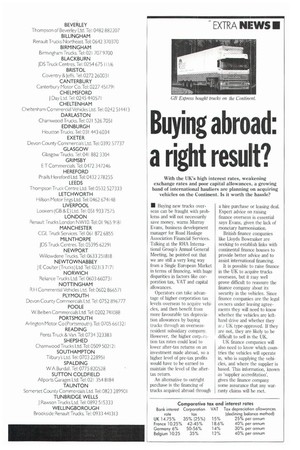

With the UK's high interest rates, weakening exchange rates and poor capital allowances, a growing band of international hauliers are planning on acquiring vehicles on the Continent. Is it worth the hassle?

• Buying new trucks overseas can be fraught with problems and will not necessarily save money, warns Murray Evans, business development manager for Road Haulage Association Financial Services. Talking at the RHA International Group's Annual General Meeting, he pointed out that we are still a very long way from a Single European Market in terms of financing, with huge disparities in factors like corporation tax, VAT and capital allowances.

Operators can take advantage of higher corporation tax levels overseas to acquire vehicles, and then benefit from more favourable tax depreciation allowances by buying trucks through an overseasresident subsidiary company. However, the higher corporation tax rates could lead to lower after-tax returns on an investment made abroad, so a higher level of pre-tax profits would have to be earned to maintain the level of the aftertax return.

An alternative to outright purchase is the financing of trucks acquired abroad through

a hire purchase or leasing deal. Expert advice on raising finance overseas is essential says Evans, given the lack of monetary harmonisation.

British finance companies like Lloyds Bowmaker are seeking to establish links with continental finance houses to provide better advice and to assist international financing.

It is possible to raise finance in the UK to acquire trucks overseas, but it may well prove difficult to reassure the finance company about its security in the vehicles. Since finance companies are the legal owners under leasing agreements they will need to know whether the vehicles are lefthand drive and whether they ai.2 UK type-approved. If they are not, they are likely to be difficult to sell in the UK.

UK finance companies will also need to know which countries the vehicles will operate in, who is supplying the vehicles, and where the supplier is based. This information, known as 'supplier accreditation', gives the finance company some assurance that any warranty claims will be met.