Quarries boost Leyland Daf aims for tippermen to regain top slot

Page 18

If you've noticed an error in this article please click here to report it so we can fix it.

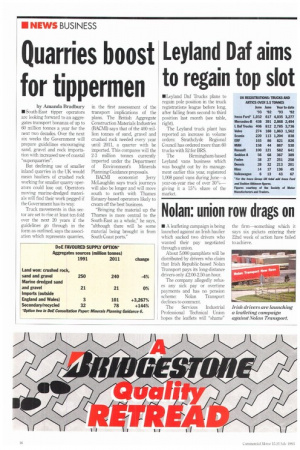

UK REGISTRATIONS: TRUCKS AND ARTICS OVER 3.5 TONNES

by Amanda Bradbury • South-East tipper operators are looking forward to an aggregates transport bonanza of up to 60 million tonnes a year for the next two decades. Over the next six weeks the Government will prepare guidelines encouraging sand, gravel and rock importation with increased use of coastal "superquarries".

But declining use of smaller inland quarries in the UK would mean hauliers of crushed rock working for smaller quarry operators could lose out. Operators moving marine-dredged materials will find their work pegged if the Government has its way.

Truck movements in this sector are set to rise at least ten-fold over the next 20 years if the guidelines go through in the form as outlined, says the association which represents quarries. in the first assessment of the transport implications of the plans. The British Aggregate Construction Materials Industries (BACMI) says that of the 400 million tonnes of sand, gravel and crushed rock needed every year until 2011, a quarter with be imported. This compares will the 2-3 million tonnes currently imported under the Department of Environment's Minerals Planning Guidance proposals.

BACMI economist Jerry McLaughlin says truck journeys will also he longer and will move south to north with Thames Estuary-based operators likely to cream off the best business.

"Bringing the material up the Thames is more central to the South-East as a whole," he says, "although there will be some material being brought in from South Coast ports." • Leyland Daf Trucks plans to regain pole position in the truck registrations league before long, after falling from second to third position last month (see table, right).

The Leyland truck plant has reported an increase in volume orders: Strathclyde Regional Council has ordered more than 60 trucks with 52 for BRS.

The Birmingham-based Leyland vans business which was bought out by its management earlier this year, registered 1,008 panel vans during June—a year-on-year rise of over 30%— giving it a 15% share of the market.