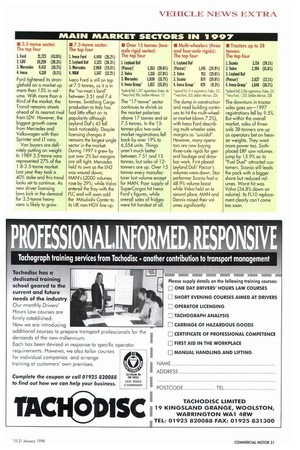

MAIN MARKET SECTORS IN 1997

Page 23

If you've noticed an error in this article please click here to report it so we can fix it.

• 3.5-tonne sector: The top four

L Ford 71,723 (43.0%) 2. LDV 10,259 (20.3%) 3. Mercedes 9,437 (18.7%) 4. Iveco 4,110 (8.1%) Ford tightened its stranglehold on a market up more than 15% in volume. With more than a third of the market, the Transit remains streets ahead of its nearest rival from LDV. However, the biggest growth came from Mercedes and Volkswagen with their Sprinter and LT vans.

Van buyers are definitely putting on weight. In 1989 3.5-tonne vans represented 27% of the 1.8-3.5-tonne market. Last year they took a 40% stake and this trend looks set to continue. As new driver licensing laws kick in the demand For 3.5-tonne heavy vans is likely to grow.

L lveco Ford 4,449 (35.2%) 2. Leyland Daf 3,323 (26.3%) 3. Mercedes 2,969 (23.5%) 4. MAN 1,547 (12.2%) Iveco Ford is still on top at 7.5 tonnes, as it is in the "no-man's land" between 3.51 and 7.4 tonnes. Switching Cargo production to Italy has had little effect on its popularity although Leyland Daf's 45 fell back noticeably. Despite licensing changes it remains the largest single sector in the market. During 1997 it grew by just over 2% but margins are still tight. Mercedes held its own as the LN2 was wound down; MAN's L2000 volumes rose by 29%; while Volvo entered the fray with the FLC and will soon add the Mitsubishi Canter to its UK non-HGV line-up.

• Over 15 tonnes (twoaxle rigid sector): The top four

1. Leyland Oaf

(Paccar). 1,353 (20.6%)

2. Volvo 1,116 (17.0%) 3. Mercedes 1,030 (15.1%)

4. Iveco Group'. 1,017 (15.5%) 'Leyland Dof, 1,307 registoiions; Foden, 46

"Woo ford, 886; Seddon Agenson, 131

• Multi-wheelers (three and four-axle rigids): The top four

1. Leyland Oaf

(Paccar). 1,145 (24.9%)

2. Volvo 911 (19.8%) 3. Scania 874 (19.0%)

4. Iveco Croup429 (9.3%) 'LeyIond Do". 614 reptronons, Foden 331. "Ivaco Ford, 205; Seddon Aikinson, 224.

• Tractors up to 38 tonnes: The top four 1. Scalia 3,714 (24.1%) 2. Volvo 2,394 (15.6%) 3. Leyland Oaf (Paccar) 2,627 (17.1%)

4. Iveco Croup1,648 (10.7%) 'Leyland Dof, 2,386 re9istrot■000, f oden, 241 "Iveco Ford, 1,320, Seddon Atkinson, 328.

The "1 7-tonne" sector continues to shrink as the market polarises above 17 tonnes and at 7.5 tonnes. In the 15tonnes-plus two-axle market registrations fell back by over 19% to 6,554 units. Things aren't much better between 7.51 and 15 tonnes, but sales of 12tanners are up. Over 15 tonnes every manufacturer lost volume except For MAN. Poor supply of SuperCargos hit Iveco Ford's figures, while overall sales of fridges were hit hardest of all. The slump in construction and road building continues to hit the multi-wheeler market (down 7.2%), with Iveco Ford describing multi-wheeler sales margins as "suicidal". However, many operators are now buying three-axle rigids for general haulage and drawbar work. First placed Leyland Daf/ Paccar's volumes were down. Star performer Scania had a 48.9% volume boost while Volvo held on to second place. MAN and Dennis raised their volumes significantly. The downturn in tractor sales goes on-1997 registrations fell by 9.5%. But within the overall market, sales of threeaxle 38-tonners are up as operators bet on heavier weights. They want more power too. Sixthplaced ERF saw volumes jump by 15.9% as its "Fuel Duel" attracted customers. Scania still leads the pack with a bigger share but reduced volumes. Worst hit was Volvo (34.8% down on volume). Its FL1 0 replacement clearly can't come too soon.