Big firms' shares up

Page 20

If you've noticed an error in this article please click here to report it so we can fix it.

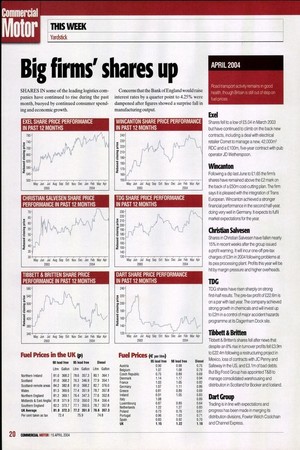

SHARES IN some of the leading logistics com panies have continued to rise during the past month, buoyed by continued consumer spend

ing and economic growth. Concerns that the Bank of England would raise interest rates by a quarter point to 4.25% were dampened after figures showed a surprise fall in

manufacturing output. Exel

Shares fell to a low of £5.04 in March 2003 but have continued to climb on the back new contracts, including a deal with electrical retailer Comet to manage a new, 42,000m2 RDC and a £100m, five-year contract with pub operator JD Wetherspoon. Wincanton

Following a dip last June to £1.65 the firm's shares have remained above the £2 mark on the back of a £50m cost-cutting plan. The firm says it is pleased with the integration of Trans European. Wncanton achieved a stronger financial performance in the second half-year, doing very well in Germany. It expects to fulfil market expectations for the year. Christian Salvesen

Shares in Christian Salvesen have fallen nearly 15% in recent weeks after the group issued a profit warning. It will incur one-off pre-tax charges of £3m in 2004 following problems at its pea processing plant. Profits this year will be hit by margin pressure and higher overheads. TDG

TDG shares have risen sharply on strong first-half results. The pre-tax profit of £22.6m is on a par with last year. The company achieved strong growth in chemicals and will invest up to £2m in a control of major accident hazards programme at its Dagenham Dock site. Tibbett & Britten

Tibbett & Britten's shares fell after news that despite an 8% rise in turnover profits fell £3.9m to £22.4m following a restructuring project in Mexico, loss of contracts with JC Penny and Safeway in the US, and £3.1m of bad debts. But Big Food Group has appointed T&B to manage consolidated warehousing and distribution in Scotland for Booker and Iceland. Dart Group

Trading is in line with expectations and progress has been made in merging its distribution divisions, Fowler Welch Coolchain and Channel Express.