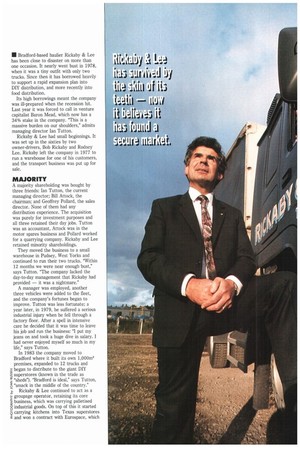

IN Bradford-based haulier Rickaby & Lee has been close to

Page 38

Page 39

If you've noticed an error in this article please click here to report it so we can fix it.

disaster on more than one occasion. It nearly went bust in 1978, when it was a tiny outfit with only two trucks. Since then it has borrowed heavily to support a rapid expansion plan into DIY distribution, and more recently into food distribution.

Its high borrowings meant the company was ill-prepared when the recession hit. Last year it was forced to call in venture capitalist Baron Mead, which now has a 34% stake in the company. "This is a massive burden on our shoulders," admits managing director Ian Tutton.

Rickaby & Lee had small beginnings. It was set up in the sixties by two owner-drivers, Bob Rickaby and Rodney Lee. Rickaby left the company in 1977 to run a warehouse for one of his customers, and the transport business was put up for sale.

MAJORITY

A majority shareholding was bought by three friends: Ian Tutton, the current managing director; Bill Attock, the chairman; and Geoffrey Pollard, the sales director. None of them had any distribution experience. The acquisition was purely for investment purposes and all three retained their day jobs. Tutton was an accountant, Attock was in the motor spares business and Pollard worked for a quarrying company. Rickaby and Lee retained minority shareholdings.

They moved the business to a small warehouse in Pudsey, West Yorks and continued to run their two trucks. "Within 12 months we were near enough bust," says Tutton. "The company lacked the day-to-day management that Rickaby had provided — it was a nightmare."

A manager was employed, another three vehicles were added to the fleet, and the company's fortunes began to improve. Tutton was less fortunate; a year later, in 1979, he suffered a serious industrial injury when he fell through a factory floor. After a spell in intensive care he decided that it was time to leave his job and run the business: "I put my jeans on and took a huge dive in salary. I had never enjoyed myself so much in my life," says Tutton.

In 1983 the company moved to Bradford where it built its own 1,000m2 premises, expanded to 12 trucks and began to distribute to the giant DIY gsuperstores (known in the trade as "sheds"). "Bradford is ideal," says Tutton, o "smack in the middle of the country."

Rickaby & Lee continued to act as a groupage operator, retaining its core business, which was carrying palletised 8 industrial goods. On top of this it started 15 carrying kitchens into Texas superstores E and won a contract with Eurospace, which

makes flat-packed furniture for B&Q.

"We then expanded at a hell of a rate when B&Q shovelled a few accounts with its suppliers at us in quick succession," says Tutton. "B&Q promoted us because we specialised in DIY, offering a consolidated service for small suppliers."

A eonsultancy company was brought in to look at the company and concluded that the industrial side of the business was standing still while the DIY side was expanding fast. "We were told 'you are in a damn good market, go for it'. So we did, and then the recession came along," says Tutton.

In 1986 the company moved again, still in Bradford, but this time to a 4,500m2 warehouse. Two years later an additional 6,500m2 was built. The fleet expanded to 30 with the acquisition of haulier SS Vanlines and from then on it continued to grow.

However, the DIY market did not prove to be easy: "DIY is difficult, it is not like carrying a pallet of beans," says Tutton. "It is labour intensive and involves non-compatible objects. Rates are very keen because the sheds are so competitive." Europace refused to accept higher rates so Rickaby & Lee dropped the business, even though it made up about 30% of its turnover.

When Rickaby & Lee had first entered the DIY market it had carried easy loads, such as flat-packed furniture. However, the trend towards centralised warehousing meant such loads started going through main warehouses, such as those run by Tibbett and Britten for B&Q. This left Rickaby & Lee with the awkward loads, such as lighting, and furniture. "Sheds stock about 30,000 different products, and the buying power of the DIY superstores is so powerful that they can reloading was prohibitive. We shut it at had to lay off 18 people in the warehouse."

The recession then began to take a hold and, hot on the heels of the construction industry, the DIY market was one Of the first to suffer — the customer base remained wide but volur went down.

Despite picking up its first dedicated contract, a 12-vehicle deal with bathroc furniture manufacturer Spring Ram, Rickaby & Lee had to take on £1.25m capital from Baron Mead. It also decide to diversify into the more recession hardy, although equally competitive, foc distribution market.

MARKET

"The DIY market will come back again, but in the meantime the food market is constant and high volume," says Tutton Contracts were won with Highland Spring, the mineral water manufacturer and confectionery maker Cadbury. This means that Rickaby & Lee will show a profit this year, says Tutton.

A Elm a year/three-year contract ha: been won with Mansfield brewery. Ten vehicles deliver 300,000 cases a year tc supermarkets and off-licences nationwid from a dedicated 3,900m2 depot in Nottingham.

At present about half of Rickaby & Lee's turnover comes from 30 DIY customers; 25% is from food customers and 25% is from 60 small industrial customers. Food tends to be carried separately whereas industrial and DIY goods go on the same trucks.

In the short term Rickaby & Lee wai to increase food loads to 50% of its £6.5m turnover, but despite the move DIY stores towards centralised distribution it is convinced tli its share of the DIY market will return once the recessia ends. "We are the only ones doing a consolidation service, which works out cheaper for small suppliers which only ne a two or three-day service," says Tutton. "And in five yea time we might be able to compete with organisations li Tibbett and Britten and offer centralised distribution for superstores. It is a good market to be in because ther are only a fixed number of delivery poin about 1,200 major outlets across the country.

"Rickaby & Lee has turned a corner i terms of profitability," Tutton believes, "although it has been a long hard road ii this market and the recession has just prolonged the agony."

0 by Mary Williams