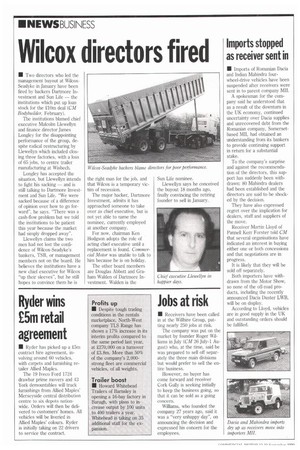

Wilcox directors fired

Page 14

If you've noticed an error in this article please click here to report it so we can fix it.

/ Two directors who led the management buyout at WilcoxSeadyke in January have been fired by backers Dartmore Investment and Sun Life — the institutions which put up loan stock for the £10m deal (CM Bodybuilder, February).

The institutions blamed chief executive Malcolm Llewellyn and finance director James Longley for the disappointing performance of the group, despite radical restructuring by Llewellyn which included closing three factories, with a loss of 65 jobs, to centre trailer manufacturing at Wisbech.

Longley has accepted the situation, but Llewellyn intends to fight his sacking — and is still talking to Dartmore Investment and Sun Life. "We were sacked because of a difference of opinion over how to go forward", he says. "There was a cash-flow problem but we told the institutions to be patient this year because the market had simply dropped away".

Llewellyn claims the two men had not lost the confidence of Wilcox-Seadyke's bankers, TSB, or management members not on the board. He believes the institutions have a new chief executive for Wilcox "up their sleeves", but he still hopes to convince them he is the right man for the job, and that Wilcox is a temporary victim of recession.

The major backer, Dartmore Investment, admits it has approached someone to take over as chief executive, but is not yet able to name the nominee, currently employed at another company.

For now, chairman Ken Hodgson adopts the role of acting chief executive until a replacement is found. Commercial Motor was unable to talk to him because he is on holiday.

The other board members are Douglas Abbott and Graham Walden of Dartmore Investment. Walden is the Sun Life nominee.

Llewellyn says he conceived the buyout 18 months ago, finally convincing the retiring founder to sell in January.