RUNNING ON PLASTIC

Page 25

Page 26

Page 27

If you've noticed an error in this article please click here to report it so we can fix it.

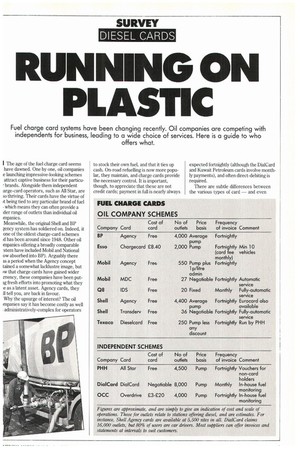

Fuel charge card systems have been changing recently. Oil companies are competing with independents for business, leading to a wide choice of services. Here is a guide to who

I The age of the fuel charge card seems have dawned. One by one, oil companies e launching impressive-looking schemes attract captive business for their particubrands. Alongside them independent Large-card operators, such as All Star, are so thriving. Their cards have the virtue of A. being tied to any particular brand of fuel which means they can often provide a Kier range of outlets than individual oil mpanies.

Meanwhile, the original Shell and BP gency system has soldiered on. Indeed, it one of the oldest charge-card schemes id has been around since 1948. Other oil • mpanies offering a broadly comparable stem have included Mobil and National ow absorbed into BP). Arguably there as a period when the Agency concept tamed a somewhat lacklustre image, but iw that charge cards have gained wider trrency, these companies have been putig fresh efforts into promoting what they ,e as a latent asset. Agency cards, they

tell you, are back in favour.

Why the upsurge of interest? The oil mpanies say it has become costly as well administratively-complex for operators

to stock their own fuel, and that it ties up cash. On-road refuelling is now more popular, they maintain, and charge cards provide the necessary control. It is important, though, to appreciate that these are not credit cards; payment in full is nearly always

expected fortnightly (although the DialCard and Kuwait Petroleum cards involve monthly payments), and often direct-debiting is required.

There are subtle differences between the various types of card — and even Agency cards. In spite of the apparent universality of the Agency concept, these cards have always tended to be manufacturer-specific. The long-established Big A symbol was in fact a piece of promotional paraphernalia.

Shell and BP continue to share the same Agency system. Each company now has its own customers and provides its own administration for them: but the cards are valid at either company's outlets. This gives them much the biggest range of outlets available among oil company schemes.

The Mobil Agency scheme stands apart from this, offering many of the same facilities, but only through Mobil stations.

Agency cards still give the operator consolidated fuel and lubricant charges for all drivers, anywhere in the country. Nowadays, however, they offer a range of other services. For example, BP will present its transaction details in card order, date order, registration number order — or any other order — to suit customers.

FLEXIBILITY

Shell offers similar flexibility. Cards can be vehicle (or driver) specific, and the companies can also provide "open" cards to allow for use of rented vehicles or hired drivers. For larger operators BP can monitor bulk fuel supplies held by the operator.

The first widely-promoted alternative to the traditional Agency approach was the Rapidiesel card from Conoco. Ironically, this failed to win the expected support in the marketplace, and was eventually drop ped. "It was too early for its time," the company says, hinting that a replacement might appear eventually.

So for a while it was left mainly to the outside card schemes, such as All Star, DialCard and Overdrive, to offer an alterni tive. These cards allow the holder to draw fuel from any participating garage, whatev er make of fuel it sells. There is no service charge for the All Star card, although the others carry an administrative cost which varies with fleet size.

These schemes put stress on the qualit3 of management information they offer. Foi instance, the All Star scheme can provide transaction data on magnetic tape or flopp3 disk for direct input into the operator's computer system. Both All Star and DialCard will transmit data to the operator b3 telephone line. Management of the oper toes own fuel supplies is offered by Iverdrive and All Star. Other facilities dude fuel consumption calculations, collaon of data and allocation of charges to idividual cost centres.

A further contender is the West Germanased DKV Europa card, but this is less Aated to fuel, offering its users scope to ay for spare parts, repairs, ferry tickets, :commodation and other services. Its hief appeal is probably to international perators.

Now that the concept of charge cards has ecome better established, some of the oil ampanies have been prompted to meet the ampetition by launching their own

:themes. The resulting new generation of il-company card schemes has avoided the .gency tag, although in many ways they are imilar in practice to the established sys:iris. Like the independent schemes, they :nd to offer more sophistication in terms of ie management information they offer. ideed, the Texaco system is administered y PHH, the company behind the All Star ard.

NFORNUITION

ometimes these new charge cards carry n administrative cost; for instance, Esso's hargecard works out at around 28 per card ach year (but this is payable monthly, not s a lump sum). Others, such as Mobil's IDC (Mobile Diesel Club) card and Texco's Dieselcard, are free. Usually they ffer a variety of permutations of managelent information. A nice touch in Esso's tateinents, for instance, is a "flag" against aspect registration numbers or weekend urchases.

In terms of fuel costs, the independent ard companies do not negotiate rates iemselves; they tend to quote ordinary ump prices. Their data capture, however, sually allows purchases from specific fuel ompanies to be isolated, so that an oper

ator can claim any rebates it may have negotiated with individual suppliers.

The oil companies also quote pump prices, although they admit that in reality, purchasing power can often bring discounts. The Shell and BP Agency schemes differ slightly in quoting a "schedule" price, which is meant to represent the national average pump price, but this too can sometimes be negotiable.

Two oil companies, Shell and Kuwait Petroleum, have now taken the potential of their card systems a stage further. Both have developed networks of unmanned, automatic diesel filling stations aimed specifically at truck drivers. The 45,500-litre (100,000-gal) storage tank is mounted above ground, and there are two fuel pumps adjacent. The driver inserts a special fuel card into a slot and keys in a PIN number (personal identification number), and can then draw fuel up to a set amount (250 litres in the case of Shell's Transderv system).

DISCOUNTED FUEL

These networks are limited, partly through intention. Shell has 36 outlets, and plans 40. Kuwait has 20 in the UK, but has several dozen more on the Continent. In each case, the sites are at established truck stops on major trunk routes. The cards are free and discounted fuel prices are offered. Shell says they compare favourably with typical bunker rates (traditionally 2-2.5% below retail). Kuwait quotes a specific figure for its International Diesel Service; in September this was 29. 2p/litre (21.32/gallon).

Meanwhile, Mobil's new MDC card scheme attempts to draw together the benefits of all these modern systems, offering automatic pumps at some stations, management reporting, control of home-based supplies (even extending to an on-site card terminal), and competitive rates for fuel.

There are 27 public sites in Britain and another 100 abroad.

0 by Peter Rowlands