C &A has an image of predictability: middle-market, middle aged, dated,

Page 42

Page 43

If you've noticed an error in this article please click here to report it so we can fix it.

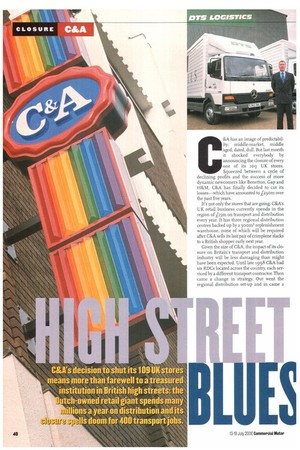

dull. But last month it shocked everybody by announcing the closure of every one of its 109 UK stores. Squeezed between a cycle of declining profits and the success of more dynamic newcomers like Benetton, Gap and H&M, C&A has finally decided to cut its losses—which have amounted to L250m over the past five years.

Its not only the stores that are going. C8rA's UK retail business currently spends in the region of f15m on transport and distribution every year. It has three regional distribution centres backed up by a 500mz replenishment warehouse, none of which will be required after C&A sells its last pair of crimplene slacks to a British shopper early next year.

Given the size of C&A, the impact of its closure on Britain's transport and distribution industry will be less damaging than might have been expected. Until late 1998 C&A had six RDCs located across the country, each serviced by a different transport contractor. Then came a change in strategy. Out went the regional distribution set-up and in came a new centralised logistics concept. "The idea was to have just one transport contractor by the end of 1999. We also commissioned a new replenishment warehouse," says C&A distribution manager David Hughes.

That single transport contractor is Fashion Logistics, a division of top UK logistics firm Tibbett & Britten. The replenishment warehouse, at Daventry International Rail-Freight Terminal, is also owned by T&B.

Triumph to disaster

Eighteen months ago, when C&A decided to change its distribution strategy, Tibbett Britten were sharing the work with DTS Logistics, Bibby Distribution, Lane Group, Ryder Group and Rochdale-based Top Gear. All six firms were invited to bid for the sole distribution contract, and Tibbett & Britten must have congratulated itself when it won a three-year transport contract and a five-year contract to supply replenishment warehousing. Who could have predicted that this triumph would turn so quickly to disaster?

Tibbett & Britten certainly didn't. No senior Tibbett & Britten directors were available to talk to CM, but the firm's statement said that, having worked for C&A since 1958, it was sad that the store was pulling out of the UK. But it added: "...these activities [transport and warehousing] represent less than 3% of our UK revenues, and we are confident that we will secure new business to fill the void."

Tibbett & Britten has to put on a brave face. It has invested a lot of money in the Daventry warehouse and has to find work for, or a means of disposing of, the large number of vehicles and specialist equipment that it was required to buy from the five other transport firms when if won the single-supplier contract. It might be only 3% of group turnover, but it's still a lot of money.

The logistics supplier will be looking for substantial compensation for the loss of such a valuable contract. "We're discussing it," says Hughes, "but we've only had one meeting since the news of the closure broke."

Michael Daly, managing director of DTS Logistics, the firm which used to service C&A's Woking RDC, says the news of C&A's closure is of little consequence to him and the four other ex-C&A UK distributors. "We lost our contracts 18 months ago and have moved on since then," he points out.

Angus Pickup, director of Top Gear, goes even further: "We had a lucky escape," he says. "We had 24 years of good business with C&A. They put our business on its feet and they were great to work for. But morale just went right down towards the end—they brought in new management strategists and things went from happy families to misery in less than three years."

Pickup adds that his firm was lucky to have sold 17 of its C&A-dedicated vehicles to Tibbett & Britten when its contract with C&A was terminated. "It was a good thing for us; we weren't left with a load of oddball vehicles to find work for," he says. "I'm glad we got out when we did." Top Gear has since taken on work for the Argos group which has helped fill its warehouse space.

DTS is in a slightly different position. Although it lost out to Tibbett & Britten when it came to UK retail distribution, it's retained a large chunk of work for C&A: "Even when they've closed all their UK stores, they will still source hundreds of millions of pounds-worth of goods from UK suppliers," says Daly.

DTS Logistics has a "consolidation centre" in Milton Keynes to which all of C&A's UK suppliers ship their goods for distribution throughout Europe. Daly says DTS has the exclusive contract for this work, worth about £2rn a year. "I don't want to be smug, but this closure will have a marginal effect on DTS Logistics," he says.

Absorbing the shook

Outside the specialist hanging garment sector there are other transport providers who will lose work when C&A closes down. One of the biggest is Securicor Omega Express, which has a contract for all of C&A's inter-store data transfer. 'We collect sales information, marketing material and other paperwork from each store every day and take it to Marble Arch, C&A's flagship store in London," explains Securicor area sales manager Tony Faratro. This contract is worth about £300,000 a year, so while its loss isn't going to cripple Securicor, it's certainly bad news.

"It's a sizeable contract," says Faratro. "But the whole C&A situation sends a message throughout the sector, and retail's in a bad way already."

Securicor has similar contracts with other retailers, including M&S, Burton's, Somerfield, Kwiksave, and Tesco. But Faratro says this sort of work is dwindling: "With modern electronic data interchange and EPOS [electronic point-of-sale] systems, there's less for us to carry."

When a major retail chain drops a bombshell like this, the shockwaves spread a long way. Transport companies ()fall sizes will lose work, and although Tibbett & Britten's relationship with C&A has backfired in a most unfortunate way, many will agree that it is better that it happened to this firm than to one of C&A's other erstwhile contractors. As Angus Pickup puts it, "They're a very big international operator and they can take it. It would have crippled a company like us."

• by David Taylor