B efore diesel engines came to dominate the truck market North

Page 36

Page 37

Page 38

If you've noticed an error in this article please click here to report it so we can fix it.

American road hauliers relied on petrol or, as they termed it, gas. By the end of the century gas engines may well be back in favour—this time literally

The gas most likely to succeed is natural gas, but the way it is used is likely to set the planned alternate fuel engines apart from existing petrol and gas engines.

To increase fuel density engine designers are looking at cycles that use the gaseous fuel in a true diesel cycle, eliminating ignition circuits, coils and spark plugs while gaining the diesel cycle's thermal efficiency They are also looking at injectors instead of the usual modified carburettors, so while the fuel may be gases, the engine of the future may well be a diesel.

Much research has gone into liquid petroleum gas (LPG) and propane, but the emerging favourite for alternate-fuelled diesels is natural gas. Currently under evaluation are compressed natural gas (CNG) and liquefied natural gas (LNG).

Much of the research is being carried out not by academic institutions but by hauliers working in collaboration with their engine manufacturers.

Overnight Transportation of Richmond, Virginia, for example, is running a Cummins L10-powered tractor on LNG; Vons Markets in Los Angeles has a Caterpillar 34068-powered tractor running on CNG; package giant UPS has experimented with CNG; and Roadway Express has also been running LNG-powered tractors in its fleet of more than 6,000 vehicles.

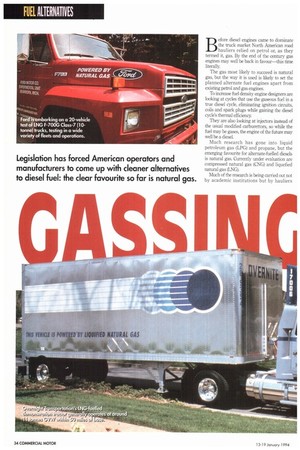

At the lightweight end of the US market gas-fuelled vehicles are already available. General Motors has CNG versions of its pickup with a converted 5.7-litre vee-eight petrol engine. Chrysler is offering vans, with a similarly sized vee-eight. Ford's nine 15-tonne F-600 and F-700 conventional two-axle rigids are available with LPG (propane) fuelling for their 7.0-litre converted petrol engines. Ford has also launched a two-year test programme with 20 F-700G trucks running on CNG.

As in Europe, truck design is being influenced more and more by emissions laws. The driving force behind alternative fuel research is the Clean Air Act of 1990. This requires fleets of 10 or more vehicles in certain high-emission urban areas to phase in alternate fuelled vehicles. Methanol has been used in bus fleets with some success and LPG has been well received in Canada, but natural gas is emerging the winner in the US for a number of reasons

Domestic demand

First, the act does not specify a fuel. This leaves the field open for the powerful gas utilities lobby, as well as gas-rich states like Texas, to push natural gas as the alternative. Domestic demand for natural gas has dwindled as homes become more efficient and the gas companies see transportation as a huge potential market. States like Texas and Louisiana, with much to gain from stimulating demand for their abundant natural gas, are pushing hard with demonstration programmes and, within their jurisdiction, are passing laws requiring natural-gas-powered vehicles for municipal, state and school-bus contracts.

In fact natural gas would probably be a winner even without this lobbying. It has relatively low emissions and is plentiful in the US which makes it cheap. Also, in the case of CNG, the distribution infrastructure already exists.

On the downside, while the diesel engine celebrates its centenary this year, natural gas development is still in its infancy. Natural gas is also less convenient than diesel or petrol when it comes to filling up and storing on the vehicle—but Cummins is among the engine manufacturers which believe the pros outweigh the cons.

"We believe natural gas is the likely alternative fuel of the future," says company president James Henderson. Overnight Transportation's president, Thomas W. Boswell, is more pragmatic: "I'm not out to save the world with this," he says. "One of the biggest problems we have is politicians entering the fray and they might want to dictate the technology to us. We're trying to take the lead. We want to get out in front before somebody tells us what to do. We don't lcnOw if it will work. We hope it does"

Overnight's test truck is a Volvo GM White GMC WG model with a Cummins L10 converted to spark ignition. This is an engine which Cummins has developed for natural gas power; it's certified for bus applications, which currently face tougher emissions limits than trucks. Overnight has invested in a $100,000 fuel tank to keep the LNG at the required -260°F. Much of the cost is for the hitech insulation which is also needed on the truck's 120gal tank.

The L10-240G, rated at 179kW (240hp), is more efficient than existing natural gas Cummins engines that are used in oilfield pumps Cummins is not working on directinjection fuelling it prefers to concentrate on lean-burn technology.

Distribution fleet

Roadway Express operates 2,700 tractors on terminal-to-terminal operations. To feed these hubs Roadway also runs an even larger consolidation and distribution fleet, This distribution fleet is a prime target of the Clean Air Act as much of its work is in polluted areas such as Dallas, Denver and Los Angeles.

Roadway says it will need experience with alternative fuels if it is to operate in Southern California through to the end of the decade.

It has five gas-fuelled trucks operating out of its Copley, Ohio, terminal. Three are relatively new GMC TopKicks/Chevrolet Kodialcs: two-axle conventional tractors with 6,8-litre vee-eight petrol engines converted by Techogen Corp to run on natural gas. They haul 28ft trailers at 36 tonnes GVW to customers within a 100-miles of base.

The other two gas burners are Ford LN8000s with turbocharged Hercules leanburn engines converted from diesel with 110

spark ignition. Roadway has spent some £300,000 to the program, matched by over £4000,000 from cryogenic hardware and r — tank suppliers.

The LNG is stored in a $250,000, ' 9900-gallon tank which is supplied by Liquid Carbonic, a cryogenic transport specialist that brings fuel all the way from Houston. Liquid Carbonic has recently expanded into Houston in preparation for Houston Metro's conversion of its fleet of 1,000 buses to LNG.

Vons Markets' gas evaluation vehicle is a Class 8 (36-tonne) Ford AemMax 106 powered by a big-bore Caterpillar 3406C engine rated at 261kW (350hp) with spark ignition. It runs between Los Angeles—smog capital of the US—and Bakersfield, some 100 miles to the north.

This is a tough route as it includes the Tejon Pass, which 4,000ft, higher than LA.

The Ford is fuelled by CNG with long pressure tanks installed along the frame. Fuel is available at compressor fuelling points in Bakersfield and Los Angeles so fuel storage— one of the major problems of CNG—is less of a problem. The engine is a hybrid, using some of the 3406 diesel technology with the ignition system from the G3406 natural gas pumping engine.

However Caterpillar says its main thrust will be with the 10-litre G3306, which is about to be released as a natural gas unit for the refuse, mixer and tipper sectors.

Caterpillar is developing direct injection of natural gas to pursue the efficiency of the diesel cycle. The first application of this will be a tram in LA powered by a 3516 engine.

Wayne Bowyer, Overnight's director of fleet services, reports that the company's test rig has been trouble-free since going into service last summer. The company's drivers are happy with its performance, but refuelling takes longer than they anticipated.

Roadway's vice-president of maintenance Bill Dernastus says minute fuel leaks developed, but the fuel tanks were re-engineered in 1992 and now the trucks are back in service and doing well.

But as the Roadway example shows, conversion costs are significant. Adapting Hercules engines costs $4,000 apiece with another $4,000 for the 88-gallon cryogenic tanks. So far fuel costs are on a par with diesel because Roadway and Overnight both have to draw LNG from Houston, 1,200 miles away. Using compressed gas, the Vons' unit does not have this problem and can cut its fuel bill by up to 50%.

Bowyer says Overnight had to make a major investment in its first demonstration unit, which runs only around 50 miles a day. But even without the payback of cheaper fuel—which will come with time Overnight plans to buy another rig to continue its research programme.

Roadway is also continuing its programme. Demastus hopes the operational and cost data he is generating will convince truck manufacturers to introduce natural gas options.

Most of these projects are based on diesels converted to spark ignition, but research by Caterpillar and Detroit Diesel show the potential of direct-gas injection.

Detroit has the Pilot Ignition Natural Gas engine which starts and idles on diesel but runs on natural gas. So far it has built 150 of these, based on 6V92 two-stroke engines. The company is also well advanced on its fourcylinder Series 50 directinjection natural-gas engine. This is due to be launched early this year, a Series 60 running on gas later.

Direct injection may become the industry standard, but it is not all plain sailing. According to Caterpillar, running a gas engine like a diesel tends to boost NOx levels Nonetheless in the US gasfuelled CVs are becoming established as a sound business proposition. And where the Americans lead, Europe is likely to follow.

by Steve Sturgess