SPREADING Ovi

Page 40

Page 41

If you've noticed an error in this article please click here to report it so we can fix it.

HEADS OVER THE FLEET

Further Discussion of Establishment Costs, Particularly of the Operation of Small to Methum-sizzed Fleets.

THE first criticism of the data given in this series of .articles has arrived. It is particularly welcome, because it raises a point which I want to discuss. A correspondent has drawn attention to the fact that there is no provision for the repair department in the big schedule of maximum establishment costs which was published in the issue dated July 30.

The repair department is not a debit against establishment oosts—at least, it is not directly so. In the case of al fleet operator who has his own repair department, the cost of operating that department is presumed to be provided for in the item of maintenance in the vehicle operating costs. It is true that, in ascertaining the cost of that repair department, it should itself be debited with a proportion of the establishment costs as a whole.

The establishment costs should be totalled, just as described in the article to which I have referred above, and a portion of the total allocated to the repair department, that figure generally being on the basis of floor area. For instance, if the total floor area of the buildings were 50,000 sq. ft. and the repair department occupied 5,000 sq. ft., one-tenth of the total of establishment costs should be debited against the repair department and be included as such in ascertaining the total amount actually spent on maintenance.

AssuminW4that the foregoing details apply to the organization,'. the figures concerning which were dealt with in the July 30 article (the total-of establishment costs was £5,250), £525 should be taken from that sum and allocated to maintenance, leaving £4,725 for establishment costs.

' Having given that explanation, I propose to proceed, as before, with my calculations, ignoring the mainten

ance department and leaving the operator who looks B6 after his own vehicles in this way to make provision according to the above method. In so doing, I come now to compane the case of an operator with six vehicles and, later, one operating 12 machines, with that of the owner of three vehicles, whose establishment costs were set out in the previous article.

It will be recalled that it was discovered at the conclusion of the article, that, whilst the total of .establishment costs of this three-vehicle owner could reasonably be described as minimum, the incidence of those costs per vehicle was greater than in the case of the operator of 100 vehicles. The figure was 71d. per hour for a lightweight 4-5-tonner, against 3d. per hour in the case of a 5-tonner in a big fleet.

This differentiation, which goes in favour of bigger operators, is seen to apply even if we do not consider such extreme examples as fleets of 100 vehicles, as against teams of only three vehicles.

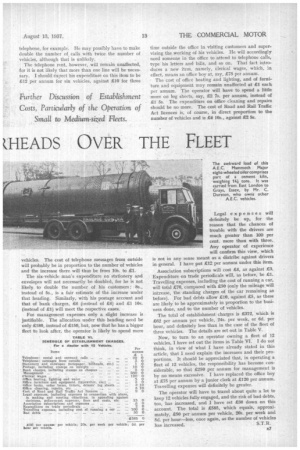

Take the case of an operator having six vehicles and let us compare his probable establishment costs with those of the three-vehicle operator. It will immediately be apparent that many of the items of cost do not increase with the size of the fleet. Take the cost of his

telephone, for example. He may possibly have to make double the number of calls with twice the number of vehicles, although that is unlikely.

The telephone rent, however, will remain unaffected, for it is not likely that more than one line will be.necessary. I should expect his expenditure on this item to be £12 per annum for six vehicles, against £10 for three

vehicles. The cost of telephone messages from outside will probably be in proportion to the number of vehicles and the increase there will thus be from 10s. to £1.

The six-vehicle man's expenditure on stationery and envelopes will not necessarily be doubled, for he is not likely to double the number of his customers : 8s., instead of Ss., is a fair estimate of the increase under that heading. Similarly, with his postage account and that of bank charges, £6 (instead of E4) and Ll 10s. (instead of 21) will meet the respective cases.

For management expenses only a slight increase is justifiable. The allocation under this heading need be only £180, instead of £150, but, now that he has a bigger fleet to look after, the operator is likely to spend more

time outside the office in visiting customers and supervizing the working of his vehicles. He will accordingly need someone in the Office to attend to telephone calls, type his letters and, bills, and so on. That fact introduces a new item, namely, clerical wages, which, in effect, means an office boy at, say, £75 per annum.

The cost of office heating and lighting, and of furniture and equipment may remain unaffected at £1 each per annum. The operator will have to spend a little more on log sheets, say, £2 7s. per annum, instead of £1 5s. The expenditure on office cleaning and repairs should be no more. The cost of Road and Rail Traffic Act licences is, of course, in direct proportion to the number of vehicles and is £4 10s., against £2 5s.

Legal expe nses will definitely be up, for the reason that the chances of trouble with the drivers are much greater than 100 per cent, more than with three.

Any operator of experience will confirm this view, which is not in any sense meant as a diatribe against drivers in general. I have put £12 per annum under this item.

• Association subscriptions will cost £4, as against E3. Expenditure on trade periodicals will, as before, be £1. Travelling expenses, including the cost of running a car, will tot-al £70, compared with £50 (only the mileage will increase, the standing charges of the car remaining as before). For bad debts allow £10, against £5, as these are likely to be approximately in proportion to the business done, and to the number of vehicles.

The total of establishment charges is £372, which is £62 per annum per vehicle, 24s. per week, or 6d. per hour, and definitely less than in the case of the fleet of three vehicles. The details are set out in Table V.

Now, to turn to an operator owning a fleet of 12 vehicles, I have set out the items in Table VI. I do not think, in view of what I have already stated in this article, that I need explain the increases and their proportions. It should be appreciated that, in operating a fleet of 12 vehicles, the responsibility has become considerable, so that £250 per annum for management is by no means excessive. I have replaced the office boy at £75 per annum by a junior clerk at £120 per annum. Travelling expenses will definitely be greater.

The operator will have to travel about quite a lot to keep 12 vehicles fully engaged, and the risk of bad debts, too, has increased, and I have set £30 down on this account. The total is £585, which equals, approximately, £50 per annum per vehicle, 20s. per week and 5d. per hour—less, once again, as the number of vehicles has increased. S. T . R .