REMOVALS a Practical Charging Method

Page 49

Page 50

If you've noticed an error in this article please click here to report it so we can fix it.

Our Costs Expert Continues -His Examination of the Special Problems of Furniture Removers and Gives Examples of the Way to Assess Costs and Profitable Rates

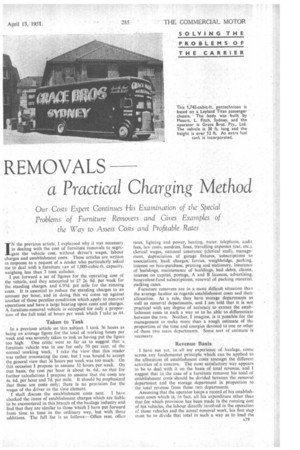

IN the previous article, I explained why it was necessary in dealing with the cost of furniture removals to segregate the vehicle cost, without driver's wages, labour charges and establishment costs. These articles are written in response to a request of a reader who particularly asked me to deal with a furniture van of 1,000-cubic-ft. capacity, weighing less than 3 tons unladen.

I put forward a set of figures for the operating cost of the vehicle, and they amounted to /7 2s. 8d. per week for the standing charges, and 6.95d. per mile for the running costs. It is essential to reduce the standing charges to an amount per hour, and in doing this we come up against another of those peculiar conditions which Apply to removal operations and have a large bearing upon costs and charges. A furniture-removal vehicle is occupied for only a proportion of the full total of hours per week which I take as 44.

Taken to Task

In a previous article on this subject. I took 36 hours as being an average figure for the total of working hours per week and was severely taken to task as having put the figure

too high. One critic went so far as to suggest that a furniture vehicle was in use for only 50 per cent, of the normal working week. I take the view that this reader was rather overstating the case. but I was bound to accept the general view that 36 hours per week was too much. On this occasion I propose to assume 32 hours per wee-k. On that basis, the cost per hour is about 4s. 6d., so that for further calculations I propose to assume that the costs are 4s. 6d. per hour and 7d. per mile. It should be emphasized that these are costs only; there is no provision for the wages of the driver in the time element. I shall discuss the establishment costs next. I have checked the items of establishment charges which are liable to be encountered in this branch of the haulage industry and find that they are similar to those which I have put forward from time to time in the ordinary way, but with three additions. The full list is as follows:—Oflice rent, offitx rates, lighting and power, heating, water, telephone, audit fees, law costs, sundries, fines, travelling expenses (car, etc.), clerical wages, national insurance (cleriCal staff), management, depreciation of garage fixtures, subscriptions to associations, bank 'charges, ferries, weighbridge, parking. interest on hire-purchase, printing and stationery, insurance of buildings, maintenance of buildings, bad debts, claims. interest on capital, postage. A and B licences, advertising. benevolent-fund subscriptions, renewal of packing material, packing cases.

Furniture removers are in a more difficult situation than the average haulier as regards establishment costs and their allocation. As a rule, they have storage departments as well as removal departments, and I am told that it is not practical with any degree of accuracy to extract the establishment costs in such a way as to be able to differentiate between the two. Neither, I imagine, is it possible for the management to make more than a rough estimate of the • proportion of the time and energies devoted to one or other of these two main departments. Some sort of estimate is necessary.

Revenue Basis I have not yet, in all my experience of haulage, come across any fundamental principle which can be applied to the allocation of establishment costs amongst the different activities of a concern. The most satisfactory way appears to be to deal with it on the basis of total revenue, and suggest that in the case of a furniture remover his total of establishment costs should be divided between the removal department and the storage department in proportion to the total revenue from those two departments.

Assuming that the operator keeps a record of his establishment costs which is, in fact, all his expenditure other than that for which provision has been made in the running cost of his vehicles, the labour directly involved in the operation of: those vehicles and the actual removal work, his first step must be to divide that total in such a way as to load the two departments in proportion to their revenue-earning capacity.

Assume, for the sake of argument, 40 per cent, of the revenue from the business as a whole is storage. and 60 per cent. removals, then 40 per ceni of the total establishment charges should be loaded on to the storage department and the other 60 per cent, on to removals.

Next comes another problem which is almost peculiar to this branch of the haulage industry-the allocation of the 60 per cent. of the total of establishment charges against vehicles and labour. It does not seem to me to be practicable to do as one would in an ordinary haulage business, that is to say, allocate to each vehicle its proper proportion of the total. That, I think, would be wrong, because sometimes only two men are employed on the job of removing furniture and sometimes three, four or even five.

In a little book on costing issued by the National Association of Furniture Warehousemen and Removers, it is suggested that these establishment costs should be divided between labour and vehicles according to whether, in the opinion of the operator, management of labour is considered to be more costly than that of transport, or vice versa. I cannot see how any decision on that point can be reached, and my suggestion is that the total of establishment costs to be debited to the removal side which may he, as suggested, 60 per cent. of the grand total, should be assessed as a percentage of the total cost, that is, of vehicles and labour.

Adding for Overheads

Assume, for example, that in a concern having five vehicles as is the case with this inquirer, the total cost of operating them plus the cost of labour (drivers, foremen and packers) was £10,000. Assume also that the grand total of establishment costs is £4.000, of which £2,400 is to be debited to removals. That £2.400 would represent 24 per cent, of the labour and vehicle costs. I suggest that when the cost of removal has been ascertained from The above figures of vehicle and labour costs, the 24 per cent. for establishment costs should be added to that amount in order to ascertain the total cost of the job.

Next let us consider labour names. There are four grades of workmen employed and the rates of wages are different for each of them. Assume a Grade I area, the driver's basic wage for a 44-hour week would be £5 I4s.; that of the foreman, £5 13s.; the packer, £5 8s.; and the porter, £5 fis. In addition to the net wages there are other things to be taken into consideration and I propose to deal only with the first three and leave out the fourth.

The driver has a basic wage of £5 I4s. for a 44-hour week. To that must be added provision for insurances.

First there is the employer's contribution of 4s. 2d. per week in respect of national insurance, also the premium to cover claims against the employer under common law; for that I assume a figure of 10d. per week. Then there is the question of holidays with pay, and if I take approximately a fortnight out of each year, that means that f must add the wages for the holiday fortnight to the net wage on that account, approximately 4s. 6d. The total to be debited against the driver is thus £6 ls. 643.

No Full-time Use

'Now I must take into consideration the point that I have already raised and that is that furniture removers' vehicles and their labour are not employed full time for the whole 44 hours each week. I have some figures before me which show that in one example a particular vehicle did 30 hours work one week, 36 hours the next, then 26. and 36 the next week. For our purpose, it is not of much use to try to assess the wages bill in that manner, varying the charge per hour each week according to the number of hours to be debited against removals.

What must be done in this case is to make one more estimate, this time of the average number of hours which the driver will work on actual removals. Individual operators' experiences may differ, but if I take the average of the foregoing figures I get 32 hours per week. In order to arrive at the appropriate hourly debit on account of the driver's wage we must divide £6 3s. 6d. by 32, so that the actual amount paid to the driver per hour in respect of actual removal work is 3s. 1043.

For the foreman, the £5 13s. must be increased, as in the case of the driver's wage, by 4s. 2d. for national insurance, e40

1043. for common law ipeureace.. and 4s, .543...for holid-ays with pay. making £6 2s. 5d.. Which, on a',32-bout week, is equivalent once again. to 3s: 10d. per hour, to:the nearest penny.

For the packer there is first, £5 8s. plus 4s. 2d. plus 1043. plus 45.. giving £5 17s. per week, which for 32 hours is equivalent to 3s. Rd. per hour. .These amounts I pin forward as basic figures for the cost-not the charge-of labour in connection with the operation of a vehicle on removal work. I do not suggest that there should be an attempt to segregate time spent on actual removing from time spent in the yard doing odd jobs. I am still aiming at simplicity.

Now for some examples of the application dl thee foregoing figures to typical removal jobs. In cases I, 2.and 3 it is assumed that the time to load and unload the van is nine hours. I have, from the figures given at the beginning of this article the standing charge for the vehicle of 4. 6d. per hour and the running cost of "id. per mile. The wage allowances are: for the driver. 3s. 1043. per hour; for the foreman, 3s. 1043. per hour:and for the packers, 3s. ltd. per hour. Establishment costs are assessed at 24 per cent. of the total of vehicle standing charges, running costs and wages.