NO DELIC IT N TURKEY

Page 50

Page 51

Page 52

If you've noticed an error in this article please click here to report it so we can fix it.

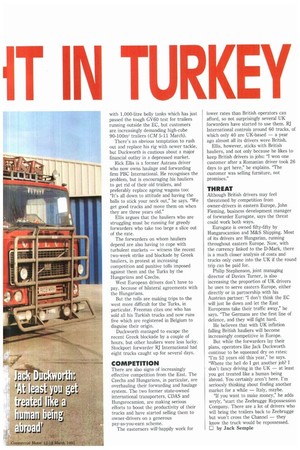

ife is tough for Jack Duckworth — no, not the TV barman in Coronation Street, but a

veteran international owner-driver who travels regularly across eastern Europe to Turkey and Greece.

Three years ago he started on the Turkish run: there was plenty of trade and the route paid well, but that's all changed. Now Duckworth is one of a dwindling band of British drivers on this long-haul route, squeezed by rising costs, static rates and reduced volumes. Last year he cleared just £7,000 before tax, and he doesn't expect things to get much better in the near future.

Fuel costs have soared in recent months. Drivers have to buy diesel in Hungary — not least because the Hungarians refuse to admit trucks carrying more than 200 litres — and the official price has almost doubled.

The black market for hard currency has gone, taking with it any scope for haggling over prices: "Freight forwarders priced the job on your ability to get really cheap diesel," says Duckworth. "Now that it is bought and sold openly that era has gone, but the rates have not moved.

At least some freight forwarders are sympathetic to the hauliers' plight. Paul Freeman runs Belgian-owned forwarder Dornak (UK). "Hauliers face a big increase in costs," he says. "The trouble is that the increase is not easily quantifiable for the exporter. The rates are still soft, and the hauliers are not getting a viable rate for the job. "My principle problem is finding reliable owner-drivers, because so many have gone bust," Freeman adds. "The classic theory is that rates should go up, but at the moment they aren't."

Owner-drivers like Duckworth face a dilemma over investment. At the moment his equipment is bought and paid for. For the past two years he has been running an A-reg ex-Hoyer Volvo F12 6x2 which returns 43.51it/100km (6.5mpg) fully freighted, but after 700,000km it's beginning to show its age.

His trailer is a standard 12-metre tilt with 1,000-litre belly tanks which has just passed the tough GV60 test for trailers running outside the EC, but customers are increasingly demanding high-cube 90-100m trailers (CM 5-11 March).

There's an obvious temptation to rush out and replace his rig with newer tackle, but Duckworth is cautious about a major financial outlay in a depressed market.

Rick Ellis is a former Astrans driver who now owns haulage and forwarding firm PBC International. He recognises the problem, but is encouraging his hauliers to get rid of their old trailers, and preferably replace ageing wagons too: "It's all down to attitude and having the balls to stick your neck out," he says. "We get good trucks and move them on when they are three years old."

Ellis argues that the hauliers who are struggling must be running for greedy forwarders who take too large a slice out of the rate.

The forwarders on whom hauliers depend are also having to cope with turbulent markets — witness the recent two-week strike and blockade by Greek hauliers, in protest at increasing competition and punitive tolls imposed against them and the Turks by the Hungarians and Czechs.

West European drivers don't have to pay, because of bilateral agreements with the Hungarians.

But the tolls are making trips to the west more difficult for the Tllrks, in particular. Freeman cites one who has sold all his Turkish trucks and now runs five which are registered in Belgium to disguise their origin.

Duckworth managed to escape the recent Greek blockade by a couple of hours, but other hauliers were less lucky. Stockport forwarder RJ International had eight trucks caught up for several days.

COMPETITION

There are also signs of increasingly effective competition from the East. The Czechs and Hungarians, in particular, are overhauling their forwarding and haulage system. The two former state-owned international transporters, CDAS and Hungarocamion, are making serious efforts to boost the productivity of their trucks and have started selling them to owner-drivers on a generous pay-as-you-earn scheme.

The easterners will■happily work for lower rates than British operators can afford, so not surprisingly several UK forwarders have started to use them. RJ International controls around 60 trucks, of which only 40 are UK-based — a year ago almost all its drivers were British.

Ellis, however, sticks with British hauliers, and not only because he likes to keep British drivers in jobs: "I won one customer after a Romanian driver took 26 days to get here," he explains. "The customer was selling furniture, not promises."

THREAT

Although British drivers may feel threatened by competition from owner-drivers in eastern Europe, John Fleming, business development manager of forwarder Eurogate, says the threat could work both ways.

Eurogate is owned fifty-fifty by Hungarocamion and M&S Shipping. Most of its drivers are Hungarian, running throughout eastern Europe. Now, with the currency linked to the D-Mark, there is a much closer analysis of costs and trucks only come into the UK if the round trip can be paid for.

Philip Stephenson, joint managing director of Davies Turner, is also increasing the proportion of UK drivers he uses to serve eastern Europe, either directly or in partnership with his Austrian partner: "I don't think the EC will just lie down and let the East Europeans take their traffic away," he says. "The Germans are the first line of defence, and they will fight hard.

He believes that with UK inflation falling British hauliers will become increasingly competitive in Europe.

But while the forwarders lay their plans, operators like Jack Duckworth continue to be squeezed dry on rates: "I'm 52 years old this year," he says. "Where the hell do I get another job? I don't fancy driving in the UK — at least you get treated like a human being abroad. You certainly aren't here. I'm seriously thinking about finding another market for a while — Italy, maybe.

"If you want to make money," he adds wryly, "start the Zeebrugge Repossession Company. There are a lot of drivers who will bring the trailers back to Zeebrugge but won't cross the Channel — they know the truck would be repossessed. 0 by Jack Semple

Highway robbery

Si In our opinion, we have the highest taxed vehicles in the UK, if not the world, due to the increased Mersey Tunnel fees.

We run eight-wheel tippers and we tax them at six monthly periods, which works out at 0,574 a year.

These vehicles carry six loads a day Monday to Friday from our yard and three loads on Saturday morning — a total of 33 loads a week, which is now costing £264 per vehicle, per week. This amounts to £13,200 per year, plus a Road Fund Licence of 0,574, equals £16,774 per vehicle, per year. Add this to the fuel tax, oil tax and so on, and maybe we could buy our own tunnel. Barry's Skip Hire and Demolition Liverpool.

Not for specialists

• With reference to your article on associations I feel rather irritated that you didn't consider the Lady Truckers Club worthy of inclusion. My first thought was that we have the word 'Club' in our title rather than 'Association', but then I notice you mentioned the Truckstop Club, which is less of an association than we are.

You may not have enough information about us but a phone call would have remedied that. We have spent a lot of time working voluntarily for the promotion of our club, and after six years I do feel we should be given some credibility.

Ilona Richards Burton upon Trent, Staffs.

As the feature explained, it was meant to show what associations are available to general hauliers. While Commercial Motor appreciates the work done by the Lady Truckers Club, the feature did not include any specialist associations, whether they are for tipper operators, chilled goods operators, or female drivers — Ed. • I refer to the letter from D Copland in your Dear Sir column (CM 13-19 Feb) in which it is stated that all lorry loader operators are now required to possess a CITB training certificate.

The statement is inaccurate. This requirement is a recommendation to the construction industry and relates to lorry loader operating on construction sites it does not apply to all lorry loader operators.

The Association of Lorry Loader Manufacturers and Importers is the recognised representative organisation in the UK for manufacturers and installers of lorry loaders with membership comprising major quality and safety conscious companies in the industry.

All members already offer training of operators but to strengthen this service, the association is currently preparing a comprehensive integrated training programme which will be available through the membership and full certification will be part of the package. The HSE will be involved in this project to ensure that the needs of all sectors of the industry are fully catered for.

The association produced a Code of Practice for the safe use and installation of lorry loaders in 1981 and this document is now being used as a basis for a BST standard.

Copies of the code and further information may be obtained from: The Secretary, ALLMI, DS Brooke, 38 Shaw Crescent, Sanderstead, South Croydon CR2 9JA.

G Hawkyard Welfords Truck Bodies, Warley, West Midlands