Delivering the goods

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

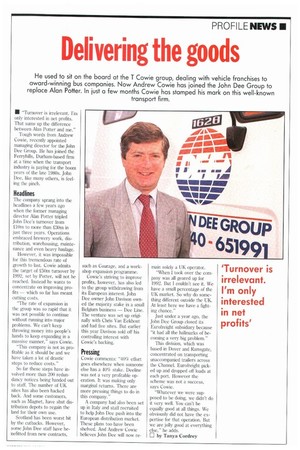

• "Turnover is irrelevant. I'm only interested in net profits. That sums up the difference between Alan Potter and me."

Tough words from Andrew Cowie, recently appointed managing director for the John Dee Group. He has joined the Ferryhills, Durham-based firm at a time when the transport industry is paying for the boom years of the late 1980s. John Dee, like many others, is feeling the pinch.

The company sprang into the headlines a few years ago when the former managing director Alan Potter tripled John Dee's turnover from ElOm to more than 20m in just three years. Operations embraced brewery work, distribution, warehousing, maintenance and even heavy haulage.

However, it was impossible for this tremendous rate of growth to last. Cowie admits the target of .50m turnover by 1992, set by Potter, will not be reached. Instead he wants to concentrate on improving profits — which so far has meant cutting costs.

"The rate of expansion in the group was so rapid that it was not possible to continue without running into major problems. We can't keep throwing money into people's hands to keep expanding in a missive manner," says Cowie.

"This company is not as profitable as it should be and we have taken a lot of drastic steps to reduce costs."

So far these steps have involved more than 200 redundancy notices being handed out to staff. The number of UK sites has also been hacked back. And some customers, such as Magnet, have shut distribution depots to regain the land for their own use.

Scotland has been worst hit by the cutbacks. However, some John Dee staff have benefitted from new contracts,

such as Courage, and a workshop expansion programme.

Cowie's striving to improve profits, however, has also led to the group withdrawing from its European interest. John Dee owner John Davison owned the majority stake in a small Belgium business — Dee Line. The venture was set up originally with Chris Van Eekhout and had five sites. But earlier this year Davison sold off his controlling interest with Cowie's backing.

Cowie comments: "40% effort goes elsewhere when someone else has a 40% stake. Decline was not a very profitable operation. It was making only marginal returns. There are more pressing things to do in this company."

A company had also been set up in Italy and staff recruited to help John Dee push into the European distribution market. These plans too have been shelved. And Andrew Cowie believes John Dee will now re

main solely a UK operator.

"When I took over the company was all geared up for 1992. But I couldn't see it. We have a small percentage of the UK market. So why do something different outside the UK. At least here we have a fighting chance."

Just under a year ago, the John Dee Group closed its Eurofreight subsidiary because "it had all the hallmarks of becoming a very big problem."

This division, which was based in Dover and Ramsgate, concentrated on transporting unaccompanied trailers across the Channel. Eurofreight picked up and dropped off loads at each port. However the scheme was not a success, says Cowie.

"Whatever we were supposed to be doing, we didn't do it very well. You can't be equally good at all things. We obviously did not have the expertise for that operation. But we are jolly good at everything else," he adds.

El by Tanya Cordrey