POWER TO THE

Page 24

Page 25

Page 26

If you've noticed an error in this article please click here to report it so we can fix it.

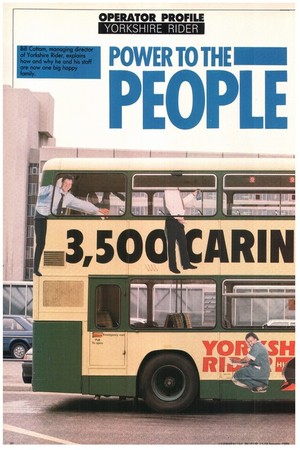

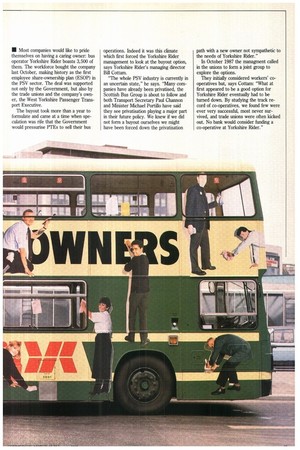

PEOPLE Most companies would like to pride themselves on having a caring owner: bus operator Yorkshire Rider boasts 3,500 of them. The workforce bought the company last October, making history as the first employee share-ownership plan (ESOP) in the PSV sector. The deal was supported not only by the Government, but also by the trade unions and the company's owner, the West Yorkshire Passenger Transport Executive.

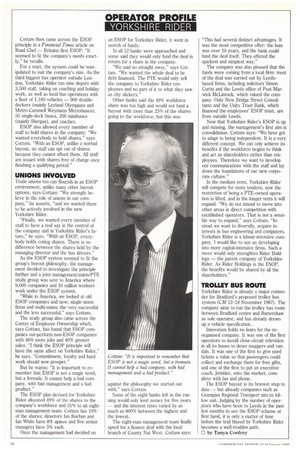

The buyout took more than a year to formulate and came at a time when speculation was rife that the Government would pressurise FTEs to sell their bus operations. Indeed it was this climate which first forced the Yorkshire Rider management to look at the buyout option, says Yorkshire Rider's managing 'director Bill Cottam.

"The whole PSV industry is currently in an uncertain state," he says. "Many companies have already been privatised, the Scottish Bus Group is about to follow and both Transport Secretary Paul Channon and Minister Michael Portillo have said they see privatisation playing a major part in their future policy. We knew if we did not form a buyout ourselves we might have been forced down the privatisation path with a new owner not sympathetic to the needs of Yorkshire Rider."

In October 1987 the managment called in the unions to form a joint group to explore the options.

They initially considered workers' cooperatives but, says Cottarn: "What at first appeared to be a good option for Yorkshire Rider eventually had to be turned down. By studying the track record of co-operatives, we found few were ever very successful, most never survived, and trade unions were often kicked out. No bank would consider funding a co-operative at Yorkshire Rider." Cottam then came across the ESOP principle in a Financial Times article on Road Chef — Britains first ESOP. "It seemed to fit the company's needs exactly," he recalls.

For a start, the system could be manipulated to suit the company's size. As the third biggest bus operator outside London, Yorkshire Rider ran nine depots with 3,5()0 staff, taking on coaching and holiday work, as well as local bus operations with a fleet of 1,160 vehicles — 900 doubledeckers (mainly Leyland Olympians and Metro-Cammeli Weymann Metrobuses); 50 single-deck buses, 200 minibuses (mainly Sherpas), and coaches.

ESOP also allowed every member of staff to hold shares in the company: "We wanted everybody to hold shares," says Cottom. "With an ESOP, unlike a normal buyout, no staff can opt out of shares because they cannot afford them. All staff are issued with shares free of charge once finishing a qualifying period."

UNIONS INVOLVED

Trade unions too can flourish in an ESOP environment, unlike many other buyout options, says Cottam: "We strongly believe in the role of unions in our company," he asserts, "and we wanted them to be actively involved in the new Yorkshire Rider.

"Finally, we wanted every member of staff to have a real say in the control of the company and in Yorkshire Rider's future," he says. "With an ESOP, everybody holds voting shares. There is no difference between the shares held by the managing director and the bus drivers."

As the ESOP system seemed to fit the group's buyout philosophy, the management decided to investigate the principle further and a joint managernentJunion/PTE study group was sent to America where 9,000 companies and 10 million workers work under the ESOP system.

"While in America, we looked at old ESOP companies and new; single-union firms and multi-union; the very successful and the less successful," says Cottam.

The study group also came across the Centre of Employee Ownership which, says Cottam, has found that ESOP companies out-perform non-ESOP companies with 46% more jobs and 40% greater sales. "I think the ESOP principle will have the same affect on Yorkshire Rider," he says. "Commitment, loyalty and hard work should now prosper."

But he warns: "It is important to remember that ESOP is not a magic word, but a formula. It cannot help a bad company, with bad management and a bad product."

The ESOP plan devised for Yorkshire Rider allocated 49% of the shares to the company's workforce and 51% to an eightman management team. Cottam has 10% of the shares; directors Ian Buchan and Ian White have 8% apiece and five senior managers have 5% each.

Once the management had decided on an ESOP for Yorkshire Rider, it went in search of funds.

In all 12 banks were approached and some said they would only fund the deal in return for a share in the company.

"We said no straight away," says Cottam. "We wanted the whole deal to be debt financed. The PTE would only sell the company to Yorkshire Rider employees and no part of it to what they saw as city slickers."

Other banks said the 49% workforce share was too high and would not fund a buyout with more than 25% of the shares going to the workforce, but this was against the philosophy we started out with," says Cottam.

Some of the eight banks left in the running would only lend money for five years — and the interest rates varied by as much as 600% between the highest and the lowest.

The eight-man management team finally opted for a finance deal with the local branch of County Nat West. Cottam says: "This had several distinct advantages. It was the most competitive offer: the loan was over 10 years, and the bank could fund the deal itself. They offered the quickest and simplest way."

The company was also pleased that the funds were coming from a local firm: most of the deal was carried out by Leedsbased firms, including solicitors Simon Curtis and the Leeds office of Peat Marwick McLintock, which valued the company. Only New Bridge Street Consultants and the Unity Trust Bank, which financed the employees' ESOP trust, are from outside Leeds.

Now that Yorkshire Rider's ESOP is up and running, the management's first aim is consolidation. Cottam says: "We have got to adapt to being independent. It is a very different concept. We can only achieve its benefits if the workforce begins to think and act as shareholders rather than employees. Therefore we want to develop our communications with the staff and lay down the foundations of our new corporate culture."

In the medium term, Yorkshire Rider will compete for more tenders, now the restriction of being a PTE-owned operation is lifted, and in the longer term it will expand. "We do not intend to move into other areas in direct competition with established operators. That is not a sensible way to expand," says Cottam. "Instead we want to diversify, acquire interests in bus engineering and computers. Yorkshire Rider is a labour-intensive company. I would like to see us developing into more capital-intensive firms. Such a move would only strenghten Rider Holdings — the parent company of Yorkshire Rider. As Rider Holdings is the ESOP, the benefits would be shared by all the shareholders."

TROLLEY BUS ROUTE

Yorkshire Rider is already a major contender for Bradford's proposed trolley bus system (CM 12-18 November 1987). The company aims to run the trolley bus route between Bradford centre and Buttershaw as sole operator, and has already drawn up a vehicle specification..

Innovation holds no fears for the reorganised company. It was one of the first operators to install close-circuit television in all its buses to deter muggers and vandals. It was one of the first to give used tickets a value so that passengers could collect and exchange them for free gifts, and one of the first to put an executive coach, Jetrider, onto the market, complete with fax and phone.

The ESOP buyout is its bravest step to date — but already companies such as Grampian Regional Transport aim to follow suit. Judging by the number of operators who have been to Leeds in the past few months to see the ESOP scheme at first hand, it is only a matter of time before the trail blazed by Yorkshire Rider becomes a well-trodden path.

0 by Tanya Cordrey