The year cv sales stood still

Page 59

Page 60

Page 61

Page 62

Page 63

If you've noticed an error in this article please click here to report it so we can fix it.

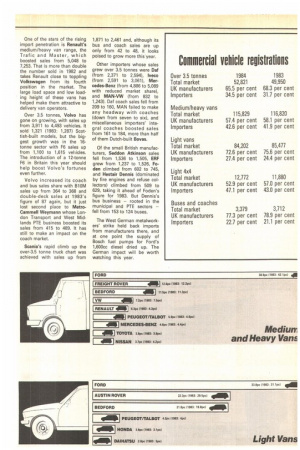

WHEN we reviewed the end-ofyear commercial vehicle registration figures a year ago, we interpreted analysts' forecasts to suggest that the 15.9 per cent increase in sales in 1983 was a false dawn. That was a wise move, as the market grew only by 0.43 of a per cent last year, according to figures released on Monday by the Society of Motor Manufacturers and Traders.

They show that registrations of all classes of new commercial vehicle climbed from 267,839 in 1983 to 269,003, although the over-3.5 tonne sector — probably the best barometer of the fortunes of the operating industry -grew by 5.75 per cent from 49,950 to 52,821.

This year's sales are unlikely to be much better, according to the SMMT, which is revising earlier and more optimistic forecasts for 1985 in the light of economic depression created by the miners' strike.

When it last looked at the future, in September, its economists reckoned on the over3.5 tonne market growing to 60,000 vehicles this year as the vehicles bought in 1978-80 boom period fell due for replacement. But it is unlikely to see a market of much more than 56,000 vehicles when the forecasts are revised next month.

For the entire market, earlier expectations of 280,000 regis trations this year (216,000 c them in the light, medium/ heavy and light 4x4 sectors) ar being revised downwards, Ma' ters are made worse by the inpossibility of makin meaningful forecasts of nes. bus and coach sales. All thE can be said on that score is th. forecasters appear to be riva ling one another to produce th most gloomy predictions of co lapsed business.

Sales were dropping anywa as the abolition of new bu grant and cash controls rE duced public sector operator ability to buy new vehicles, bi the uncertainty created by th White Paper on bus deregulE tion and privatisation is havin a devastating effect. On on hand, many operators ar freezing investment plans unt they can see how the bus bus ness will settle, while foreca: ters are unable to say anythin meaningful until they know what operators might buy.

It would be idle to pretend that the boom business in new trucks in 1979 will ever return. The transformation of the British economy into a servicebased regime means that the heavy loads used for some primary industrial production are unlikely ever to roll again, and the industry has become much more efficient.

Department of Transport figures show that hire-orreward hauliers were busier in 1983 than in any year since 1977, but the own-account sector is steadily declining as industrial companies contract out their distribution. The impending removal of first year capital allowances could accelerate that trend.

For its figures, the SMMT classes light vans as mainly car-derived models of under one ton; medium/heavy vans are in the one to 3.5 tonne category; the over-3.5 tonne sector covers virtually all "proper" trucks; and the bus and coach and light 4x4 sectors are selfexplanatory. Car-style 4x4s like the Range Rover are excluded from the commercial vehicle figures.

Because sales over 3.5 tonnes are highest at the bottom end of the weights scale, greatest penetration is achieved by companies selling in that volume market.

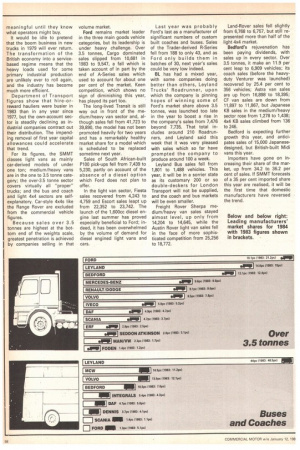

Ford remains market leader in the three main goods vehicle categories, but its leadership is under heavy challenge. Over 3.5 tonnes, Cargo dominated sales slipped from 10,681 in 1983 to 9,547, a fall which is taken account of in part by the end of A-Series sales which used to account for about one per cent of the market. Keen competition, which shows no sign of diminishing this year, has played its part too.

The long-lived Transit is still way out in front of the medium/heavy van sector and, although sales fell from 41,723 to 39,890, the model has not been promoted heavily for two years and has a remarkably healthy market share for a model which is scheduled to be replaced sometime next year.

Sales of South African-built P100 pick-ups fell from 7,439 to 5,230, partly on account of the absence of a diesel option which Ford does not plan to offer.

In the light van sector, Fiesta sales recovered from 4,243 to 4,759 and Escort sales leapt up from 22,352 to 23,742. The launch of the 1,600cc diesel engine last summer has proved especially beneficial to Ford; indeed, it has been overwhelmed by the volume of demand for diesel engined light vans and cars. Last year was probably Ford's last as a manufacturer of significant numbers of custom built coaches and buses. Sales of the Trader-derived R-Series fell from 188 to only 43, and as Ford only builds them in batches of 30, next year's sales could be very low indeed.

BL has had a mixed year, with some companies doing better than others, Leyland Trucks' Roadrunner, upon which the company is pinning hopes of winning some of Ford's market share above 3.5 tonnes, was launched too late in the year to boost a rise in the company's sales from 7,476 beyond 7,735. That total includes around 210 Roadrunners, and Leyland said this week that it was very pleased with sales which so far have prompted the company to produce around 100 a week.

Leyland Bus sales fell from 1,801 to 1,488 vehicles. This year, it will be in a sorrier state as its customary 200 or so double-deckers for London Transport will not be supplied, and the coach and bus markets will be even smaller.

Freight Rover Sherpa medium/heavy van sales stayed almost level, up only from 14,204 to 14,645, while the Austin Rover light van sales fell in the face of more sophisticated competition from 25,256 to 18,772. Land-Rover sales fell slightly from 6,768 to 6,757, but still represented more than half of the light 4x4 market.

Bedford's rejuvenation has been paying dividends, with sales up in every sector. Over 3.5 tonnes, it make an 11.9 per cent leap to 6,909 vehicles; its coach sales (before the heavyduty Venturer was launched) recovered by 25.4 per cent to 356 vehicles; Astra van sales are up from 16,898 to 18,395; CF van sales are down from 11,897 to 11,867, but Japanese KB sales in the medium/heavy sector rose from 1,278 to 1,438; 4x4 KB sales climbed from 136 to 246.

Bedford is expecting further growth this year, and anticipates sales of 15,000 Japanesedesigned, but British-built Midi vans this year.

Importers have gone on increasing their share of the market, up from 34.2 to 36.2 per cent of sales. If SMMT forecasts of a 35 per cent imported share this year are realised, it will be the first time that domestic manufacturers have reversed the trend. One of the stars of the rising import penetration is Renault's medium/heavy van range, the Trafic and Master, which boosted sales from 5,048 to 7,253. That is more than double the number sold in 1982 and takes Renault close to toppling Volkswagen from its fourth position in the market. The large load space and low loading height of these vans has helped make them attractive to delivery van operators.

Over 3.5 tonnes, Volvo has gone on growing, with sales up from 3,911 to 4,493 vehicles. It sold 1,321 (1983: 1,287) Scottish-built models, but the biggest growth was in the 16tonne sector with F6 sales up from 1,100 to 1,615 vehicles. The introduction of a 12-tonne F6 in Britain this year should help boost Volvo's fortunes even further.

Volvo increased its coach and bus sales share with B1OM sales up from 364 to 368 and double-deck sales at 1983's figure of 87 again, but it just lost second place to MetroCammell Weymann whose London Transport and West Midlands PTE business boosted its sales from 415 to 489. It has still to make an impact on the coach market.

Scania's rapid climb up the over-3.5 tonne truck chart was achieved with sales up from 1,871 to 2,461 and, although its bus and coach sales are up only from 42 to 48, it looks poised to grow more this year.

Other importers whose sales grew over 3.5 tonnes were Daf (from 2,371 to 2,594), lveco (from 2,591 to 3,061), Mercedes-Benz (from 4,886 to 5,089 with reduced market share), and MAN-VW (from 832 to 1,243). Daf coach sales fell from 209 to 160, MAN failed to make any headway with coaches (down from seven to six), and miscellaneous importers' integral coaches boosted sales from 161 to 184, more than half of them Dutch-built Bovas.

Of the small British manufacturers, Seddon Atkinson sales fell from 1,536 to 1,505, ERF grew from 1,237 to 1,526, Foden climbed from 602 to 745, and Hestair Dennis (dominated by fire engines and refuse collectors) climbed from 509 to 629, taking it ahead of Foden's figure for 1983. But Dennis's bus business rooted in the municipal and PTE sectors fell from 153 to 124 buses.

The West German metalworkers' strike held back imports from manufacturers there, and at one point the supply of Bosch fuel pumps for Ford's 1,600cc diesel dried up. The German impact will be worth watching this year. CONTACT between operator and manufacturer so often depends on the relationship established with both by the local main dealer. Over the years most manufacturers' dealerships have formed individual associations to iron out the problems that will inevitably arise at some time or another.

I visited the chairman of one such association to find out if and how the concept works with the UK's second largest importer of vehicles for 16 tons and above.

Bill Beadnell, group managing director of North East Daf Trucks, told me that there is nothing new in having an association for dealers, but the way in which the Daf Dealers Association works assures direct lines of contact so that problems can be headed off before they are allowed to develop.

Daf entered the UK commercial vehicle market back in 1973 and has since established a network of 22 main dealers, supplemented by specialist bus and service dealers, strategically placed from Aberdeen to Bristol. As almost all of these are autonomous operations it will be no surprise that at first they formed into two groups, located in the north and south, to regulate their activities.

Although both followed the same code of practice the groups remained separate for several years. But, encouraged by Daf, they amalgamated to form a national dealer association in mid-1978.

The way in which contact down the line to and from the user is maintained was instigated by former Daf managing director Phil Ives. Recognising that the dealer is closer to the haulage operator, Daf established four panels of association members. Each member company has one representative on each of the panels, which cover the areas of fin ance, parts, service and sales. And heading each of the panels are Daf department directors Cliff Grant (finance), John Ruane (parts), Peter Cutmore (service) and Ian Jones (sales).

The association chairman can Sit in on any panel meeting, and Daf's recently appointed managing director Roger Philips will continue to meet all members at an annual association meeting.

The flow of information works in both directions. Where any aspect of dealer operation is in question, it can be thrashed out at panel level before being referred to the general membership for ratification.

Conversely, where it is a product matter perhaps raising complaints from operators, the matter can be raised quickly in the appropriate quarter and a solution found to suit all parties.

While recognising that there can be problems, Daf sets standards for the dealerships to aspire to. All are assessed on every discipline to produce a rating for commercial effect. From time to time the panel may deem it necessary to revise the standards. These refer to such things as premises, tools, training and stock levels.

Bill Beadnell's group, North East Daf Trucks, is the largest Daf Truck distributor in the UK, with premises at Bil'Ingham and Carlisle and service facilities at Newcastle-upon-Tyne. It carries around £250,000 of stock items sufficient to offer a 94 per cent first-pick availability on parts. A 24-hour workshop service extends to cover parts, breakdown recovery while repair and convertions incorporate speclalist welding facilities such as aluminium and conversions to petroleum regulations.

But however good the dealer he cannot expect to influence the manufacture totally, although he can and does contribute to overall marketing philosophy. Perhaps the most important example was the charge in production when Eindhoven began to produce vehicles to a British specifica

tion instead of converting lefthand drive models.

One of the biggest problems facing dealers is how to increase sales while the current trading climate shows promise of only a small uplift for 1985. Daf presently claims about 10 per cent of the UK market above 16 tons, with 2,590 registrations last year.

At the moment there is no move to bring in lighter models to provide dealers with extra volume. This has been confirmed by a number of them setting up separate franchises to sell the six 7.5 tonne Spanish Ebro range of integral vans and chassis cabs. The range will be extended by the introduction of a one-ton panel van powered by a two-litre Nissan diesel engine later this year.

A more recent example of cooperatIon between manufacturer and dealer for the benefit of the operator was Daf's Winter Service check. Last November Daf operators were invited to submit their vehicles for a 20 point inspection covering electrics, fuel and brake systems. Though charged for the inspection, operators were charged for replacement parts at a special discounted price.

Should the vehicle break down and the driver call out either Dafaid or Busaid, he does not have to worry about the uncertainty of the cost. A national scale was established in agreement with the Daf dealer association.

Daf's Topec System (Truck optimum performance and economy calculations) is a selling aid which, provided with certain parameters, will help customers to chose a suitable specification when purchasing a new vehicle. It is intended to assist all operators, however big or small, who want to buy the best equipment to operate most efficiently.

With body and drive line determined, Topec can be used to calculate operating costs while another part of the package v look at specific transport p jects analysing the type a number of vehicles and St needed to transport an agre quantity of goods within a c tam n period. Available with 1 project data is advice on 1 best maintenance interva how much to allow f downtime and an estimate the accidental risk factor to count for damage repair.

According to Bill Beadni "Haulage is a hard but peol related business, and on a to-day basis the dealer is clo: to them than the manufactur If they have problems we try sort it out locally. If we cai then with the Daf dealer as ?,iation's panel system there a direct path of contact all way to the top, even to Eindl ven If need be."