STITCH -INTIME POLICY REWARDED

Page 40

Page 41

If you've noticed an error in this article please click here to report it so we can fix it.

in Transport Accountancy

AFIRST:RATE example of the application of the proverb "A stitch in time saves nine" is in relation to the accounts of road-transport operating concerns. I have mentioned many a time the principle underlying this, in referring to methods of keeping records of costs.

Only 'last week, in describing a scheme for keeping such records, I emphasized that one of the merits of the scheme dealt with was that a close check was kept upon expenditure on each individual vehicle, that check being made at brief intervals. It is equally important, perhaps, even more so, to keep a close watch upon the revenue which is being earned and, especially, to make frequent comparisons between that item and the operating cost of the vehicle.

For this reason, it is essential that a haulier should know what his minimum daily revenue must be if he is to earn a net profit. The figure can be arrived at quite simply, and to show how it ought to be done I will take a fairly easy example of a vehicle carrying 4-5-ton loads.

It should hardly be necessary for me to point out that the figure for revenue will have to include cost of operation of the vehicle, supplementary expenditure, establishment costs, and profit. times there may be a difference in the wage paid, either on account of overtime, or because the man may be rewarded on a results basis.

Leaving the latter out of the question for the moment and taking the simplest case, the difference as between one day and another will normally be bound up in the mileage covered. That will affect only the naming costs, the expenditure on petrol, oil, tyres; maintenance and depreciation, or, if not actual expenditure, at least a combination of actual expenditure, as on petrol and oil, and estimated provision for expenditure on the other three.

Ascertaining Standing Charges.

Now, the standing charges in the case of a vehicle carrying 4-5-ton loads can easily be ascertained. The tax at 230 a year is equivalent to 12s. per week or 2s. per day for a six-day week. The insurance, probably. reaches the same total. As regards garage rent, it may be anything from 6d. to is. 6d. per day, according to circumstances. Suppose I take is. Interest on first cost probably reaches 3s. per week, which is another 6d. per day. So far, we have accounted for 5s. 6d. per day.

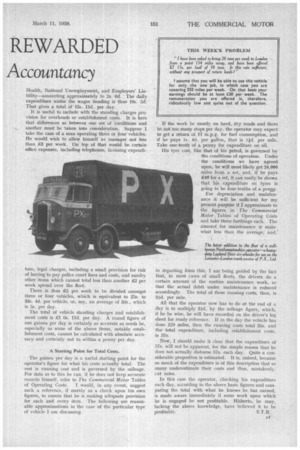

The next item is wages. Assume that the man is paid 23 per week, to which must be added provision for the three • insurances—Naticzal Health, National Unemployment, and Employers' Liability—amounting approximately to 2s. 6d. The daily expenditure under the wages heading is thus 10s. 5d. That gives a total of 15s. 1/d, per day.

It is useful to include with the standing charges provision for overheads or establishment costs. It is here that differences as between one set of conditions and another must be taken into .consideration. Suppose I take the case of a man operating three or four vehicles. He would wish to allow himself as manager not less than £3 per week. On top of that would be certain office expenses, including telephones, licensing expendi

ture, legal charges, including a small provision for risk of having to pay police court fines and costs, and sundry other items which cannot total less than another £2 per week spread over the fleet.

There, is thus £5 per week to be divided amongst three or four vehicles, which is equivalent to 25s. to 33s. 4d. per vehicle, or, say, an average of 30s., which is 5s. per day.

The total of vehicle standing charges and establishment costs is £1 Os. 11d, per day. A round figure of one guinea per day is certainly as accurate as needs be, especially as some of the above items, notably establishment costs, cannot be calculated with absolute accuracy and certainly not to within a penny per day.

A Starting Point for Total Costs.

The guinea per day is a useful starting point for the operator's figure for what his costs actually total. The rest is running cost and is governed by the mileage. For data as to this he can, if he does not keep accurate records himself, refer to The Commercial Motor Tables of Operating Costs. I would, in any event, suggest such a reference, if merely as a check upon his own figures, to ensure that he is making adequate provision for each and every item. The following are reasonable approximations in the case of the particular type of vehicle I am discussing. If the work be mostly on hard, dry roads and there be not too many stops per day, the operator may expect to get a return of 11 m.p.g. for fuel consumption, and if he pays Is. 4d. per gallon, that is lid. per mile. Take one-tenth of a penny for expenditure on oil.

His tyre cost, like that of his petrol, is governed by the conditions of operation. Under the conditions we have agreed upon, he will most likely get 24,000 miles from a set, and, if he pays £40 for .a set, it can easily be shown that his expenditure on tyres is going to be four-tenths of a pew.

For depreciation and maintenance it will be sufficient for my present purpose if I approximate to the figures in The Commercial Motor Tables of Operating Costs and take three farthings each. The amount for maintenance is somewhat less than the average, and; in departing from this, I am being guided by the fact that, in most cases of small fleets, the drivers do a certain amount of the routine maintenance work, so that the actual debit under maintenance is reduced accordingly. The total of these running costs, then, is 3;d. per mile.

All that the operator now has to do at the end of a day is to multiply aid. by the mileage figure, which, if he be wise, he will have recorded on the driver's log sheet for ready reference. If in the day the vehicle has done 120 miles, then the running costs total 35$. and the total expenditure, including establishment costs, is 57s.

Now, I should make it clear that the expenditure of 57s. will not be apparent, for the simple reason that he does not-actually disburse 57s. each day. Quite a considerable proportion is estimated. It is, indeed, because so much of the expenditure is of this description that so many underestimate their costs and thus, mistakenly, cut rates.

In this case the operator, checking his expenditure each day, according to the above basic figures and comparing the total with what he knows he has earned, is made aware immediately if some work upon which he is engaged be not profitable. Hitherto, he may, lacking the above knowledge, have believed it to be profitable. S.T.R.