Crippling fuel costs are set to fall

Page 14

Page 15

If you've noticed an error in this article please click here to report it so we can fix it.

• Rocketing diesel costs are pushing some operators close to bankruptcy, but relief is in sight.

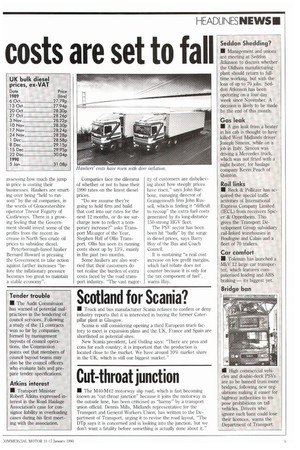

The latest lp/litre increase in bulk dery prices, taking the price to 31.08p/litre, is the fourth price hike in five weeks, forcing up costs by as much as 2p/km over the past three months.

RHA director-general Bryan Colley warns of "testing times" ahead for the road transport industry, "Small hauliers will have problems because they will have to pay their fuel bills within the month, but will not receive payment from their customers until March or later." Operators should negotiate surcharges immediately with their customers, the RHA advises.

However, market analyst John Hall says the latest diesel price increase was a mistake on the part of the oil companies who pre-empted the international Rotterdam spot market price which peaked and began to drop last weekend. On Monday, the international price of diesel fell by $19/ton, which is expected to be reflected in a drop of around 0.5p/litre in UK bulk diesel prices.

"The demand for dery in creased dramatically, both from the US and from France, who are having to supplement their hydroelectric power, and everyone panicked, and talked up the price of gas oil on the Rotterdam market," says Hall. "Buyers are very quick to pass these costs onto their UKbased customers but in fact only a sruall proportion of the gas oil used in the UK is actually traded in Rotterdam."

Price drops

Fuel price analysts Oil Price Assessment suggest that some of the increases seen in December may be reversed as the market experiences "extraordinary movements", but he does not expect prices to plummet at this time of year.

The oil companies see the market remaining volatile probably until the spring at least, when demand for heating oil usually drops. Mobil reports that the surge in demand from the US, up as much as 17% over the last year's levels, dropped last week as conditions returned to nearer normal. The market is "particularly likely to pan out after the spring but will quite possibly be as volatile until then," says Esso's Dave Stewart.

Meanwhile, operators are

assessing how much the jump in price is costing their businesses. Hauliers are smarting over being "held to ransom" by the oil companies, in the words of Gloucestershire operator Trevor Fogarty of Castleways. There is a growing feeling that the Government should invest some of the profits from the recent increase in North Sea crude oil prices to subsidise diesel.

Peterborough-based haulier Bernard Howard is pressing the Government to take action against further increases "before the inflationary pressure becomes Lou great to maintain a stable economy".

Companies face the dilemma of whether or not to base their 1990 rates on the latest diesel prices.

"Do we assume they're going to hold firm and build that cost into our rates for the next 12 months, or do we surcharge now to reflect a temporary increase?" asks Transport Ma:lager of the Year, Stephen Hall of 011is Transport. 01lis has seen its running costs shoot up by 13%, mainly in the past two months.

Some hauliers are also worried that their customers do not realise the burden of extra costs faced by the road transport industry. "The vast major

ity of customers are disbelieving about how steeply prices have risen," says John Barbour, managing director of Grangemouth firm John Russell, which is finding it "difficult to recoup" the extra fuel costs generated by its long-distance 150-strong HGV fleet.

The PSV sector has been been hit "badly" by the surge in diesel prices, says Barry Hoy of the Bus and Coach Council.

It is sustaining "a real cost increase on low profit margins, which fuel rebate does not counter because it is only for the tax component of fuel", warns Hay.