Pay your debts PRE-PACK administrations and company voluntary arrangements (CVAs)

Page 10

Page 11

If you've noticed an error in this article please click here to report it so we can fix it.

are different formats of business rescue united by a common hatred, it would seem. We've written more stories about prepacks and CVAs this year than fuel duty, and we've had plenty of letters and phone calls on the subject, thus it seemed time to gauge the industry's reaction via our Trucking Britain survey.

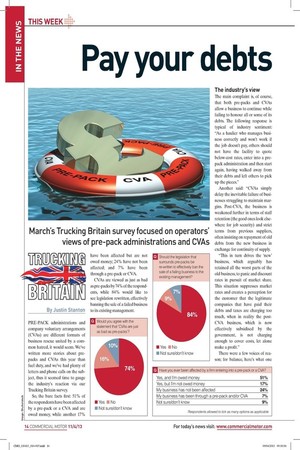

So, the bare facts first: 51% of the respondents have been affected by a pre-pack or a CVA and are owed money, while another 17% have been affected but are not owed money; 24% have not been affected; and 7% have been through a pre-pack or CVA.

CVAs are viewed as just as bad as pre-packs by 74% of the respondents, while 84% would like to see legislation rewritten, effectively banning the sale of a failed business to its existing management. The industry's view The main complaint is, of course, that both pre-packs and CVAs allow a business to continue while failing to honour all or some of its debts. The following response is typical of industry sentiment: "As a haulier who manages business correctly and won't work if the job doesn't pay, others should not have the facility to quote below-cost rates, enter into a prepack administration and then start again, having walked away from their debts and left others to pick up the pieces."

Another said: "CVAs simply delay the inevitable failure of businesses struggling to maintain margins Post-CVA, the business is weakened further in terms of staff retention (the good ones look elsewhere for job security) and strict terms from previous suppliers, often insisting on repayment of old debts from the new business in exchange for continuity of supply.

"This in turn drives the 'new' business, which arguably has retained all the worst parts of the old business, to panic and discount rates in pursuit of market share. This situation suppresses market rates and creates a perception for the customer that the legitimate companies that have paid their debts and taxes are charging too much, when in reality the postCVA business, which is now effectively subsidised by the government, is not charging enough to cover costs, let alone make a profit."

There were a few voices of reason; for balance, here's what one such said: "A CVA is not the same as administration. In administration, everybody loses everything (except maybe the taxman).

"In a CVA, the creditors get to agree or disagree to support the debtor and will receive an agreed amount of the money they are owed. While neither choice is preferable, it is much better to try to protect employees and suppliers under a CVA than put people out of work and cost your suppliers everything if the situation has got to that point."

A respondent who underwent a CVA told us: "A CVA saved our company and protected not only 500 people's jobs but also another 250 through suppliers. There is a massive difference between a prepack and a CVA. A pre-pack is a coward's way out and people who do this do not care about staff or suppliers, whereas our approach meant that we have protected staff and suppliers, and ensured that we are in control of our own future."

Perhaps more crucial than operators' views of pre-packs and CVAs is how the traffic commissioners (TCs) approach them. So how do operators think TCs should react?

"A requirement of an operator licence is to prove funds," remarked one respondent. "Surely the fact that the previous management has failed should be taken into account and thoroughly investigated?" This response was typical of the total audience.

An impassioned respondent said TCs should treat firms that have undergone pre-packs or CVAs "as aggressively as the law allows them to".

Again, for the sake of balance, we should point out that the owner of one firm that had undergone a pre-pack or CVA felt victimised by their TC and that they didn't get a fair opportunity to present the reasons and full context behind their business's failure.

This debate will no doubt continue — stay tuned. • jr.1IIllhII1s(sAAjIIl1I1.

The EU tyre labelling regulations, introduced late last year, mean all new tyres are rated for wet grip, fuel efficiency and noise. All the major tyre suppliers welcomed the regulations on the basis that they would, over time, force cheaper suppliers to up their game (and therefore their price) or suffer a decline in sales as operators move away from cheap tyres that don't perform to the highest standards.

This scenario relies on operators being made aware of the regulations and understanding the impact on their operations.

It's a little surprising then that when we asked Trucking Britain respondents how much they know about the regulations, the majority (71%) answered either "not very much" or "a little". Only 6% said they knew a lot about the regulations.

Given these responses, it's no surprise that tyre labelling is having an impact on the choice of tyres for just 13% of the respondents.

Finally, we asked whether tyre labelling "allows you to make an effective comparison between differ ent truck tyres". Just 11% said it provides them with all the information they need.

It's worth noting that there is no statistically significant variance when analysing these responses by size of fleet, type of operation or primary industry sector served. Clearly, the tyre manufacturers and the transport press still have much to do to communicate the benefits of tyre labelling to the industry.

Optimism OPTIMISM LEVELS slipped from February's four-month high of 54 to 44 in March. Of the respondents, 70% were either very optimistic or fairly optimistic about their firm's prospects over the next year, while 31% weren't very optimistic or were not at all optimistic.

Logistics and contract distribution firms were the most positive in March and were almost as posi tive as they were in February. Their optimistic/not optimistic split was 80/20 compared with 81/19 the previous month. Own-account operators were also upbeat, although not as much as the month before: their split was 78/21 compared with 83/17 in February. Optimism levels among hire or reward hauliers slipped: this sector registered a split of 68/33 in March compared with 72/28 in February.

• Go to conunercialmotor.com/ truckingbritain to take part in the next survey. Those who complete the survey will be entered into a draw to win £100.