PRI CE • Motor industry executives are no shrinking violets, but

Page 30

Page 31

If you've noticed an error in this article please click here to report it so we can fix it.

they become bashful when one sensitive topic arises. Prices. And when you start asking questions about comparisons between prices in the UK and other European markets, they sprint for cover, slam down the hatches and hide. That was our experience when we began enquiring about truck and van prices in different EC markets.

While Volvo, Renault and Ford responded willingly to our request for list prices for new vehicles, others made it clear they did not want us to know. It would serve no meaningful purpose, they said.

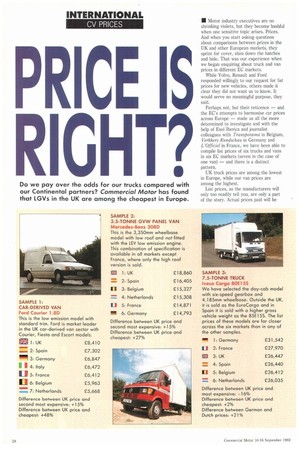

Perhaps not, but their reticence — and the EC's attempts to harmonise car prices across Europe — made us all the more determined to investigate and with the help of Exel Iberica and journalist colleagues with Transporatna in Belgium, Verkhers Rundschau in Germany and L'Officiel in France, we have been able to compile list prices of six trucks and vans in six EC markets (seven in the case of one van) — and there is a distinct pattern.

UK truck prices are among the lowest in Europe, while our van prices are among the highest.

List prices, as the manufacturers will only too readily tell you, are only a part of the story. Actual prices paid will be significantly lower in many cases and a huge variety of local circumstances (like the inclusion or exclusion of fifth wheels in some countries) will help determine the list price. But they are the best measure available to us, short of going out and buying fleets of similar spec vehicles in each country.

Discounts of up to 40% are available in many markets, but the level of discount will vary markedly from deal to deal, depending on the size of your business, whether you are offering vehicles in part exchange and what type of vehicle you want to replace.

Nick Buckley of international consultancy Knibb, Gormezano & Partners — a former Renault Trucks marketing director — stresses the importance of looking beyond list or actual prices. He is compiling a detailed study of European truck prices to help manufacturers prepare for next year's single European market and has already uncovered 40% differences in prices paid for near-identical models in different markets.

ICEBERG

"Truck pricing is the tip of the iceberg," he says. "Parts prices vary, labour rates vary and terms of warranty vary. You can buy three years' warranty in the UK, but can't get one year in Germany." The maturity of the secondhand market is critical, too. A used truck might hold 45% of its original price in France where used trucks are marketed more professionally. That will be reflected in the prices of new vehicles and may well explain why French truck list prices are the highest in our sample.

And there is the equally important issue of the buying power of large customers. Buckley reckons that there are more UK companies among Europe's top 50 transport fleets. They may well be pushing down truck prices here, as manufacturers battle to win the favour of their volume business, and he predicts that their buying power will intensify and quite possibly drive down prices in other markets.

"Large companies like rental companies will be well informed and will be able to pick and choose where they buy. If German prices are high, they will go to France, Belgium or the Netherlands instead. And that will bring specifications closer together.

"There are 12 big fleets in Europe with a combined turnover of Z1 billion," says Buckley. "They have enormous purchasing power and as the single market becomes real, it will become easier for them to disregard political boundaries. They will question price variations and they will knock on manufacturers' doors and demand agreed terms, as is dohe already in the UK where fleets are by-passing dealers."

That, in turn, could challenge another of the factors behind the variety of prices: the dominance of one manufacturer in a particular country. Today, the market leader (eg Mercedes in Germany or Renault in France), will influence its competitors' prices, but if major fleets start sourcing vehicles where they can get them cheapest, then local dominance will diminish.

VARIATIONS List. prices may aiso be governed by variations in VAT rates. All of the prices quoted are nett of VAT, but the rates range from 13% in Spain to 19.5% in Belgium. In between, VAT is 14% in Germany, 17.5% in the UK, 18.5% in the Netherlands, 18.6% in France and 19% in Italy.

For our survey, we selected six different manufacturers' vehicles, so each is likely to be a market leader somewhere, and six different categories of vehicle. Where possible, these are identical models, but we have gone for the nearest equivalent in markets where the exact model is not available. We converted all the prices into Sterling using exchange rates quoted on one day. LI by Alan Millar