Harvest bonus in sale

Page 12

If you've noticed an error in this article please click here to report it so we can fix it.

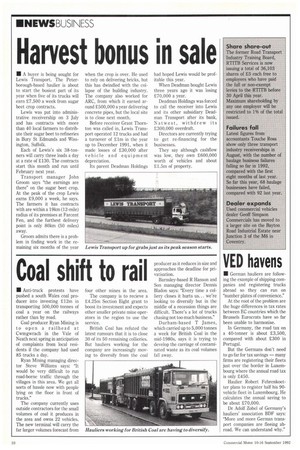

• A buyer is being sought for Lewis Transport. The Peterborough-based haulier is about to start the busiest part of its year when five of its trucks will earn £7,500 a week from sugar beet crop contracts.

Lewis was put into administrative receivership on 3 July and has contracts with more than 40 local farmers to distribute their sugar beet to refineries in Bury St Edmunds and Wissington, Suffolk.

Each of Lewis's six 38-tonners will carry three loads a day at a rate of £130. The contracts start this month and run until February next year.

Transport manager John Groom says "the earnings are there" on the sugar beet crop. At the peak of the crop Lewis earns £9,000 a week, he says. The farmers it has contracts with are within a 19km (12-mile) radius of its premises at Farcent Fen, and the furthest delivery point is only 80km (50 miles) away.

Groom admits there is a problem in finding work in the remaining six months of the year when the crop is over. He used to rely on delivering bricks, but this has dwindled with the collapse of the building industry. The company also worked for ARC, from which it earned around E500,000 a year delivering concrete pipes, but the local site is to close next month.

Before receiver Grant Thornton was called in, Lewis Transport operated 12 trucks and had a turnover of £1m in the year up to December 1991, when it made losses of £30,000 after vehicle and equipment depreciation.

Its parent Deadman Holdings had hoped Lewis would be profitable this year.

When Deadman bought Lewis three years ago it was losing £70,000 a year.

Deadman Holdings was forced to call the receiver into Lewis and its other subsidiary Deadman Transport after its bank, Natwest, withdrew its £300,000 overdraft.

Directors are currently trying to get re-financing for the businesses.

They say although cashtlow was low, they own £600,000 worth of vehicles and about £1.5m of property.