PROFILE

Page 42

Page 43

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

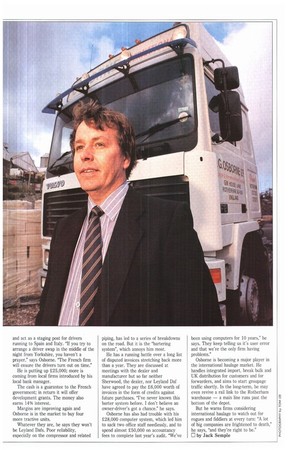

JG OSBORNE

• Short of going bust, business life over the past year could hardly have been tougher for Ron Osborne, a third generation Yorkshire haulier who is now specialising in international work. Low rates, turbulent employee relations and conflicts with suppliers have all threatened to put his trucks off the road.

Osborne was running a handful of trucks on scrap haulage in the mid-1980s but came up against diminishing returns as the decline of the steel industry started to affect the scrap business.

He turned to international work as a long-term project even though domestic rates were improving. It was tough going at first, but he learnt fast and started investing in new trucks; he has bought a dozen over the past three years, including eight Leyland Oaf 380 SpaceCabs and two Volvo F12s. Then came the crash in rates.

Osborne tackled the crisis head-on with an all-out attack on fuel costs. He banned drivers from going over 90km/h (55mph) and fitted Swiss-made AIC fuel monitors which cut fuel consumption from an average 51.4lit/1001un (5.5mpg) to 34.4lit/100Iun (8.2mpg).

The AIC 2002 system, supplied by AIC (UK) of Rugby, monitors the amount of fuel passing through the engine. It gives an average lit/100km reading and an on-board fuel system instantly tells the driver his fuel consumption.

International hauliers ACH and Canvin International are among other users of the AIC 2002 system.

Bottom-line fuel savings this year are expected to reach £40,000 — and that doesn't include the benefits of reduced wear and tear. Compare that with the outlay of £1,000 per truck and the price doesn't seem that high.

I estimated we were losing £500 a week on fiddles. I thought some of my drivers were fiddling," says Osborne. Some drivers were sacked in February and another went this summer based on evidence from the 2002s. "Either they went or I called in the CID," he says. "They call me a bloody Hitler, but if you don't try to keep on top of the job you'll lose the business tomorrow."

Osborne says good drivers appreciate the monitors: "They just need to ease the muscles in the right foot to see the fuel consumption improving thanks to the instant read-out," he says. The firm pays a £20 a week bonus to drivers who better 35.31it/100km (8mpg).

The AIC 2002 has been fitted on UK demonstrators by several manufacturers, including Volvo, Scania and MAN. Osborne reckons that they should be fitted to new heavy trucks as standard.

JG Osborne has seen an extraordinary turnover in drivers, although the situation is improving.

"We've only lost 28 since April," says Osborne. Some leave then return, others have been sacked — some for fuel fiddles, others for breaking drivers' hours rules," he says, "Continental drivers think that once they go out on the road they can suit themselves."

Control has been boosted further using the Autoroute computerised road map of Europe. Transport manager and director Bryan Else, a former Continental driver, says it allows him to organise precise routeing and scheduling, which is particularly useful for new drivers.

To stay legal and compete with the big groups Osborne has had to do a lot of double-manning, hence the big cabs. However, he is taking a tip from the big transport groups by setting up an associate French company.

Based at Clermont Ferrand in the centre of France it will help win business and act as a staging post for drivers running to Spain and Italy. "If you try to arrange a driver swap in the middle of the night from Yorkshire, you haven't a prayer," says Osborne, "The French firm will ensure the drivers turn out on time."

He is putting up 225,000; more is coming from local firms introduced by his local bank manager.

The cash is a guarantee to the French government; in return it will offer development grants. The money also earns 14% interest.

Margins are improving again and Osborne is in the market to buy four more tractive units.

Whatever they are, he says they won't be Leyland Dafs. Poor reliability, especially on the compressor and related piping, has led to a series of breakdowns on the road. But it is the "bartering system", which annoys him most.

He has a running battle over a long list of disputed invoices stretching back more than a year. They are discussed at meetings with the dealer and manufacturer but so far neither Sherwood, the dealer, nor Leyland Daf have agreed to pay the 26,000 worth of invoices in the form of credits against future purchases. "I've never known this barter system before. I don't believe an owner-driver's got a chance." he says.

Osborne has also had trouble with his 228,000 computer system, which led him to sack two office staff needlessly, and to spend almost 250,000 on accountancy fees to complete last year's audit. "We've been using computers for 10 years," he says. They keep telling us it's user error and that we're the only firm having problems."

Osborne is becoming a major player in the international haulage market. He handles integrated import, break bulk and UK distribution for customers and for forwarders, and aims to start groupage traffic shortly. In the long-term, he may even revive a rail link to the Rotherham warehouse — a main line runs past the bottom of the depot.

But he warns firms considering international haulage to watch out for rogues and fiddlers at every turn: "A lot of big companies are frightened to death," he says, "and they're right to be." fl by Jack Semple

• Ford Australia and Victoria's Gas & Fuel Corporation (GAFCOR NGV) have converted a Cummins-engined Ford Louisville LTA9000 tractive unit into what is claimed to be the first heavy commercial vehicle to run on 100% compressed natural gas (CNG).

The Louisville rig has joined Ford Australia's 30-strong fleet transporting vehicle components from Geelong to Melbourne, a round trip of 180km, five times daily. A second rig will join it at the end of the year.

The vehicle's round-the-clock operation provides GAFCOR and Ford with an environment in which to analyse the efficiency and economy of using natural gas (CNG) in trunking applications.

In addition to the benefits of "cleaner" exhaust emissions, there is an estimated savings potential of around £600,000 a year on the fuel bill — Ford's spares delivery fleet uses three million litres of dery annually.

The GAFCOR conversion requires the Cummins N14 engine to be refitted with specially matched pistons, cylinder head and camshaft to reduce the compression ratio by up to 20%.

Performance is regulated by the GAFCOR NGV/Bosch Lambda 2 electronic engine management system. A mong its many special features is an anti-knock control unit built into the electronic ignition system which is designed to safeguard the engine from overload damage.

The Lambda 2 system also includes an electronic control unit to regulate the combined gas and air flows and adjust engine advance during working operations.

THREE SENSORS

Three sensors are spaced evenly between the engine's six pots. These measure the vibration frequency and retard the timing if it begins to knock.

An alarm in the cab warns the driver to lift off the throttle pedal to reduce the loading on the engine if the knocking continues.

Separate sensors monitor engine speed and loading plus the air and gas operating temperatures and pressures within the inlet manifold. This ensures correct ignition timing and gas flow to achieve optimum operating efficiency.

On the N14, the natural gas is vapourised and fed into the inlet manifold to mix with the air from the turbocharger.

A safety valve ensures that turbocharger boost pressure is held at the correct level for CNG (this is somewhat less than for diesel) before the air/gas mixture is injected into the cylinders. According to GAFCOR, Australia's natural gas has a slightly higher energy content, at 46.4 MJ/kg (55.1 MJ/litre), than standard derv.

Using the Lambda 2 control the converted N14 engine emulates the original power and torque curves; ie 298kW (400hp) at 1,900rpm and 1,535Nin (1,1321bft) at 1,200rpm.

The Louisville's converted engine operates on an air/fuel ratio of 29:1. Although trial figures are not yet available, on average it is only 1-2% less efficient than in standard diesel form, says GAFCOR.

When liquified natural gas occupies only 1/600th of its gaseous volume at a pressure slightly higher than atmospheric which allows it to be transported more easily.

FABER CYLINDERS

On vehicles such as this, CNG is compressed to 2bar (20 megapascais) and stored in eight 100-litre (water capacity) composite Faber cylinders on the truck.

This allows storage of approximately 150kg of compressed gas or the equivalent of 200 litres of fuel.

Although this is believed to be the first heavy CV to run on 100% natural gas, GAFCOR has long been converting a wide range of European, US and Japanese engines to run on a CNG/derv mix in trucks, buses and fork-lifts.

GAFCOR has also developed futuristic compressed natural gas refuelling stations for fleet use that can be permanent or portable, and is working on faster, cylinder filling methods.

With the equivalent of 140 years' reserve of natural gas, Australia is vigorously pursuing its use as an alternative fuel for heavy trucks. Demand for diesel in Australia is expected to increase by 4.6% a year up to the end of the century.

In dual-fuel operation its industry is already achieving diesel substitution levels of 50% over the whole range of engine applications.

The technology development at state gas utilities' three alternative fuel engine research facilities in Brisbane, Melbourne and Sydney (set up at a capital cost of nearly Um) should help substitute levels to grow to an average of 70%.

CAPITAL COST

The disadvantage of converting to CNG from diesel is the high capital cost. However, for much of the development work on the Ford Louisville, funding was provided by Australia's Energy Research and Development Commission.

Ford Australia's general operations manager David Stobbart predicts that the reduced fuel costs from converting the entire fleet to CNG within a year would allow payback in less than two years. In practice it will be closer to 21/2 years.

GAFCOR's chairman Keith Fitzmaurice believes it will also demonstrate that natural gas engine technology is finally viable for commercial use in heavy truck engines.

0 by Bryan Jarvis