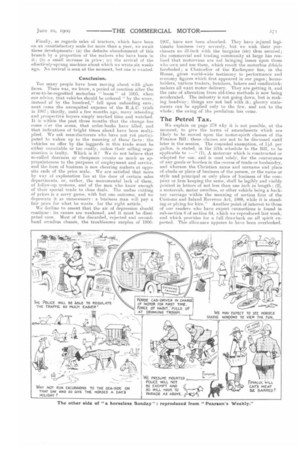

The Petrol Tax.

Page 3

If you've noticed an error in this article please click here to report it so we can fix it.

We explain on page 278 why it is not possible, at the moment, to give the terms of amendments which are likely to be moved upon the motor-spirit clauses of the Finance Bill: these clauses are not to he discussed until later in the session. The conceded exemption, of 14d. per gallon, is stated, in the fifth schedule to the Bill, to be applicable to :—" (1), A motorcar which is constructed or adapted for use, and is used solely, for the conveyance of any goods or burden in the course of trade or husbandry, and whereon the Christian name and surname and place of abode or place of business of the person, or the name or style and principal or only place of business of the company or firm keeping the same, shall be legibly and visibly printed in letters of not less than one inch in length ; (2), a motorcab, motor omnibus, or other vehicle being a hackney carriage within the meaning of section four of the Customs and Inland Revenue Act, 1888, while it is standing or plying for hire." Another point of interest to those of our readers who have export connections is found in sub-section 6 of section 64, which we reproduced last week, and which provides for a full drawback on all spirit exported. This allowance appears to have been overlooked.