Spanish cauldron...

Page 36

Page 37

Page 38

Page 39

If you've noticed an error in this article please click here to report it so we can fix it.

If International Harvester succeeds in pulling out of its ENASA deal, the commercial vehicle industry in Spain could be thrown back into the melting pot. Eric Gibbins takes an in-depth look at the market

FIFTEEN MONTHS ago at the Spanish Motor Show at Barcelona, it looked as though the Spanish commercial vehicle and bus manufacturing industry had really taken its final shape before entry to the Common Market by Spain in 1984.

However, the recent news that International Harvester, bedevilled by monetary problems back at the ranch in the USA, could be pulling out of Empresa Nacional de Autocamiones SA (ENASA), which makes Pegaso and SAVA commercial vehicles, could throw things back into the melting pot. Signed on September 30, 1980, the agreement, between IH, ENASA and the Spanish Government, provided for IH to take a 35 per cent stake in ENASA and for IH to have a 65 per cent holding in a new company formed in Spain to manufacture IH Series-400 engines.

This company was to build a factory near Madrid estimated then to cost $200m with a capacity of 80,000 engines annually. IH is also withdrawing from this venture. When I spoke, at length, with Carl Levy, the then newly appointed director-general of ENASA, at the Barcelona Show last year, he had high hopes of the IH-ENASA deal.

The company's main objective, he told me, was to restore the situation which existed there 10 years ago when the company had 70 per cent of the Spanish truck market from the 40 per cent to which it had slipped.

Although International Harvester as a result of the deal clinched in 1980 had a 35 per cent interest in ENASA, the remaining 65 per cent was held by Institute Nacionales de Industries, the Spanish Government agency which controls all government-owned companies. IH was obviously in the driving seat but with a solid commitment to introduce ENASA's main brand (Pegaso) in the European Econo mic Community when Spain be comes a member.

The significance of the 198. date in this context become: more apparent when it i: realised that this was the tim( that the IH diesel engine plant t( be constructed by a new corn pany, ENASA International d( Motores SA, was due to COME

wn stream. This will now not wappen if the Spanish Governnent agrees to the withdrawal IH. IH is giving reduced enline demand as the reason for erminating the agreement.

There is no doubt that the IH management has had a benefi;ial effect on ENASA's manageilent techniques. There has not, lowever, been any major proluct change although, obriously, long-term plans were in land to introduce replacements for the ageing Pagaso ranges.

IH has made no attempt to in:roduce its own models badged as Pegaso or otherwise. It has, however, shown in Spain examples of IH models such as the bonneted S-Series F2654 with 157kW (210bhp) diesel engine, the S-Series 2575 with 224kW (300 bhp) engine and the F5070 of 201kW (270bhp) from the Paystar range. This reflects the IH policy of importing vehicles into Spain which are complementary to, as opposed to competitive with, Pegaso models.

The Pegaso name first appeared in Spain in 1946 in the same year that ENASA was formed. The first lorries produced were built at the old Hispano-Suiza factory at Barcelona (the Hispano-Suiza name, of course, goes back to 1903) and production continued there until 1960 when production was transferred to a new factory in Madrid.

It was in 1966 that ENASA took control of Sociedad Anon ima de Vehiculos Automoviles (SAVA) which has since concentrated on light commerical vehicle production leaving medium and heavyweights to ENASA. The second big name in trucks and buses in Spain is Dodge. Dodge's Spanish operations began in 1951 as Barreiros Diesel, a company which then specialised in converting petrol engines to diesel. It started to manufacture industrial, agricultural and commercial vehicles in 1959 and passenger buses in 1962. The company became Chrysler Espana SA in 1970 and Automoviles Talbot SA on January 1, 1980, Dodge's Madrid plant at Villaverde manufactures trucks from 14 tonnes to 38 tonnes gross weight. The range embraces 17 tonnes gross four-wheelers, 6x2 and 6x4 rigids, 8x2 and 8x4 rigids — including an 8x2 with steerable rear axle and 4x2 tractive unit. Currently, Dodge has about 50 per cent of its domestic market in that category. Current production is around 5,000 a year, roughly 20 per cent being exported primarily to Europe, Middle East and Africa, Dodge reports.

The Villaverde complex has a considerable range of its own facilities including a foundry and manufactures its own chassis frames, cabs, engines, gearboxes and axles. Talbot said that it was spending around £47m on modernising the Villeverde complex, but within months it announced that it had sold 50 per cent of the Dodge truck making activity in Spain to Renault Vehicules Industriels (RVI). That was in April last year.

Without doubt, the most significant move in the truck and bus making industry in Spain for many years in the broadest sense — not just for Spain — is a quietly introduced rights issue of shares.

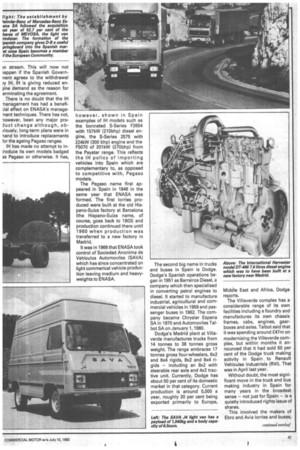

This involved the makers of Ebro and Avia lorries and buses, Motor lberica of Barcelona, Spain's third largest producer, in which Nissan Motor Co of Japan originally had a 36 per cent share holding. The rights issue has led to it increasing its stake to 54.6 per cent.

The move means that Nissan is the first Japanese truck and bus manufacturer to establish a manufacturing base in Europe. The development established strong presence in the European commercial vehicle manufacturer with the possiblity of badging Ebros and Avias as Nissans.

Already, Motor lberica has a strong presence in the Benelux countries and the Ebro name has been seen increasingly in Britain as a result of sales to local authorities. There is also the much wider market implication when Spain joins the European Community.

As a result of the increase in the shareholding, Nissan is to nominate a number of directors to the Motor lberica board. These have yet to be announced.

Currently, Motor lberica produces light and medium-weight goods vehicles of up to 16 tonnes gross vehicle weight under the Ebro and Avia names. These are mostly powered by Perkins diesel engines reflecting the fact that Massey Ferguson (Perkins parent) for some years had a major shareholding in Motor lberica until it was bought by Nissan.

Motor lberica is currently laying down production lines in Barcelona for building the Patrol (with Perkins engines) early next year and a Nissan light van range (the Datsun C20, again with Perkins engines), 12 months after that.

To obtain an 85 per cent Spanish content with these vehicles, the Perkins engines (built in

Spain) are matched with Motc lberica four-speed manual geal boxes.

This Nissan development c Motor lberica is believed to b costing the Japanese compan 4,000 million pesetas (£22m).

Motor lberica has an interest ing background. Because of th Massey Ferguson background, has substantial agricultural an industrial equipment manufa( turing interests but its stake i commercial vehicle manufactur is not negligible. The compan was founded in 1920 as the For Motor Company, later to be come Ford Motor lberica in 1921 and Motor lberica SA in 1954.

In 1966 a major grouping o companies occurred, includin, the incorporation of Perkins His pania SA. The association witl Massey Ferguson dates. fron this time.

A year later, in 1967, Moto lberica obtained a majorit, holding in Fabricacion de Auto moviles Diesel SA (FADISA), I commercial vehicle manufac turer and steady development o the commercial vehicle side c things followed. This culminate( in the launch in 1971 of a nev medium-weight series of Ebr( trucks and the acquiring o

further truck manufacture interests. A holding in Aeronautica Industrial SA {AISA) — a company also involved in aircraft production — was acquired and the SIATA commercial vehicle range was incorporated.

The following year saw the AISA holding become a majority one and a new Ebro assembly plant opened at Zopa Franca in Barcelona.

In 1973, the company entered into an agreement with Valpadare SA to manufacture articulated tractive units.

The year 1975 saw the opening of a new Perkins engine plant in the Zona de Cuatro Vientos of Madrid and the acquisition of a 55 per cent take in Talleres Vigata SA, manufacturer of truck bodies and trailers. Currently, commercial vehicle production is around 15,000 annually.

If bets could be laid on which of the local manufacturers in Spain is most likely to succeed in the long term, however, the front runner could be Mercedes!

This is because last year Daimler-Benz set up a new company in Spain called MercedesBenz Espana SA following its acquisition of 52.7 per cent of the shares of Mevosa of Vitoria and Barcelona, a company in which it had had for many years a parity interest with the Spanish Government's Institut° Nacional de lndustria (INI).

Mevosa is traditionally a light commercial vehicle manufacturer building its own purposebuilt light van range but with the Mercedes badge in payloads from 500kg to 2.5 tonnes. Negotiations to obtain a majority interest in Mevosa began when the German company reached agreement with INI to indease Mevosa's capital by 420m pesetas, all underwritten by Daimler-Benz.

Then, at an extraordinary general meeting in April last year, the company's new name was approved and it was decided to increase the capital further by 535.3m pesetas, to which both the main shareholders contributed. The Mevosa name disappeared at the same time. The company capital of MercedesBenz Espana SA now stands at 3,480.75m pesetas.

These increases in capital are part of a major 5,000m peseta investment plan to be executed over the next five years, says Daimler-Benz.

As with the other manufacturers, by this move, MercedesBenz Espana SA is preparing itself for the expected increase in demand in the automotive sector caused by Spain's entry into the EEC in 1984.

The investment plan involves modernisation and an increase in capacity at the Vitoria and Barcelona works.

Such are the major commercial vehicle manufacturers in Spain. There are, in addition, a number of producers of specialist smaller vehicles, like Santana (Metalurgica de Santa Ana SA of Madrid) which builds among other things its own rugged version of the LandRover. This is not a small concern — its production has topped 10,000 vehicles a year. Then there are the car-based light van producers. These include Ford with the Fiesta van built at the Valencia car plant (production 5,706 last year).

The market leader in the light van sector when car-derived vans are counted is Citroen-Hispania which has factories at Vigo and Orense. Van production at this company in the record 1979 year was over 50,000 vehicles although it has dropped back since. The figures stem from sales of the Acadian which is the van derivative of the Diane.

The Renault connection in the car-derived van market is not insignificant, either. Spanish production of car-derived vans at Fasa-Renault works out at between 15,000 and 20,000 annually.

Otherwise, Talbot and SEAT, both of whom have strong car manufacturing operations in Spain, make up the domestically produced light van numbers with around 5,000 car-derived vans each.