Fuel costs ris

Page 6

Page 7

If you've noticed an error in this article please click here to report it so we can fix it.

In

price sting

• Higher diesel prices are matched by a dramatic change in pricing strategy, says market analyst John Hall.

"Oil companies have dropped their strategy of 'deep dive' pricing where they bid a silly price below the market level to win a contract and then, to get their money back, increase fuel price across the board," he says. "Now the oil companies are banging up their prices like mad, using any excuse, quicker than buyers can re-negotiate their contracts."

The oil companies' latest strategy is to quote higher initial prices for bulk-delivery contracts to make up for the loss of scheduled price increases.

Hall, who compiles the Freight Transport Association's oil price survey, points out the latest price increase is the third in less than a month.

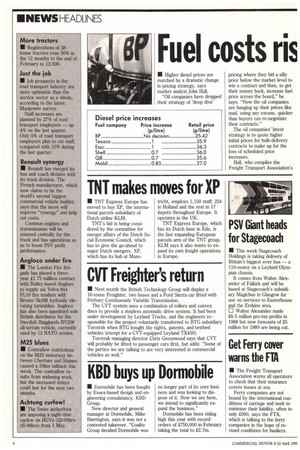

Texaco kicked off with a lp/ litre hike last Thursday; Esso put up its prices by the same amount on Monday, and Shell weighed in with a 0,7p/litre rise yesterday (Wednesday). BP has not yet taken action but is "reviewing" its prices.

"Last October oil was selling at only $12.50 a barrel on the Rotterdam spot market; now it is $20 or more," says Paul Huffeknann of Oil Price Assessment. "Numerous factors have come together — OPEC'S announcement that it will set viable quotas; the decision of non-OPEC nations to cut production by 5%; the Piper Alpha disaster, and the recent Exxon Valdez spillage — to force up prices, and diesel is not immune." We are reviewing the situation and increases cannot be ruled out," says Shell. Esso believes the diesel market will be affected, but not as badly as the petrol market. "The dery sector is not as pressurised as the petrol market so increases will be smaller," it says. "As for future rises, it is extremely difficult to predict because things are so volatile."

The oil companies have come under heavy fire for recent fuel price hikes and are currently under the eye of the Monopolies & Mergers Commission (following previous probes in 1965 and 1979). The majors refute allegations of a cartel, although their market share has shot up from 25% in 1964 to over 60% today. Shell says the increases are justified when it is losing 21.5 million a week on its fuel operations.