OPTARE'S OPTIONS

Page 37

Page 38

If you've noticed an error in this article please click here to report it so we can fix it.

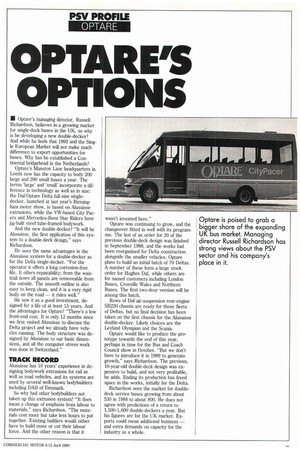

• Optare's managing director, Russell Richardson, believes in a growing market for single-deck buses in the UK, so why is he developing a new double-decker? And while he feels that 1992 and the Single European Market will not make much difference to export opportunities for buses. Why has he established a Continental bridgehead in the Netherlands?

Optare's Manston Lane headquarters in Leeds now has the capacity to body 200 large and 200 small buses a year. The terms 'large' and 'small' incorporate a difference in technology as well as in size: the Daf/Optare Delta full-size singledecker, launched at last year's Birmingham motor show, is based on Alusuisse extrusions, while the VW-based City Pacers and Mercedes-Benz Star Riders have jig-built steel tube-framed bodywork.

And the new double-decker? "It will be Alusuisse, the first application of this system to a double-deck design," says Richardson.

He sees the same advantages in the Alusuisse system for a double-decker as for the Delta single-decker. "For the operator it offers a long corrosion-free life. It offers repairability; from the waistrail down all panels are removeable from the outside. The smooth outline is also easy to keep clean, and it is a very rigid body on the road — it rides well."

He saw it as a good investment, designed for a life of at least 15 years. And the advantages for Optare? "There's a low front-end cost. It is only 12 months since we first visited Alusuisse to discuss the Delta project and we already have vehicles running. The body structure was designed by Alusuisse to our basic dimensions, and all the computer stress work was done in Switzerland."

TRACK RECORD

Alusuisse has 10 years' experience in designing bodywork extrusions for rail as well as road vehicles, and its systems are used by several well-known bodybuilders including DAB of Denmark.

So why had other bodybuilders not taken up this extrusion system? "It does mean a change of emphasis from labour to materials," says Richardson. "The materials cost more but take less hours to put together. Existing builders would either have to build more or cut their labour force. And the other reason is that it wasn't invented here."

Optare was continuing to grow, and the changeover fitted in well with its programme. The last of an order for 30 of the previous double-deck design was finished in September 1988, and the works had been reorganised for Delta construction alongside the smaller vehicles. Optare plans to build an initial batch of 70 Deltas. A number of these form a large stock order for Hughes Daf, while others are for named customers including London Buses, Crosville Wales and Northern Buses. The first two-door version will be among this batch.

Rows of Daf air-suspension rear-engine SB220 chassis are ready for those fleets of Deltas, but no final decision has been taken on the first chassis for the Alusuisse double-decker. Likely choices are the Leyland Olympian and the Scania.

Optare would like to produce the prototype towards the end of this year, perhaps in time for the Bus and Coach Council show in October. "But we don't have to introduce it in 1989 to generate growth," says Richardson. The previous, 10-year-old double-deck design was expensive to build, and not very profitable, he adds. Ending its production has freed space in the works, initially for the Delta.

Richardson sees the market for doubledeck service buses growing from about 530 in 1988 to about 800. He does not agree with predictions of a return to 1,500-1,600 double-deckers a year. But his figures are for the UK market. Exports could mean additional business — and extra demands on capacity for the industry as a whole. "The next jump will be into singledeckers," he says. "There are social reasons for this: an ageing population; problems of vandalism out of sight of the driver on double-deckers."

For the operator, the move to singledeckers could mean another marketing opportunity as well as a beneficial capital acquisition. At a cost substantially less than a double-decker, a single-decker provides 50 seats plus standing space to overcome the peaks. "For all but two hours of the day the top deck is not needed," says Richardson. There were also a large number of Nationals falling due for replacement: "In the last month, orders for 230 single-decks have been placed — a dramatic increase on 1988."

Deltas can be bought direct or through the Hughes Daf dealership, which will have ample stocks. Even with direct sales, finance can be arranged through Hughes Daf, as can leasing arrangements or contract hire.

It seems likely that the new doubledecker bus will incorporate many features of the single-deck Delta, not least its ease of maintenance and corrosion-free construction. "We offer 12 months' warranty on our vehicles, and we have negotiated extended warranty, but suppliers give us only 12 months." Alusuisse would give a full warranty, he adds.

Turning to Optare's trolleybus project, Richardson explains: "We were asked by Metro West Yorkshire to do some visual work 18 months ago to support their application to the EC for a grant. We used what we had, but it didn't imply that we would build that." He points out that development work would have had to be done for initially only 10 or 11 vehicles, which might now be either doubleor single-deckers. At the same time, the Alusuisse construction, with its strong extrusions for the sides of the roof above cant rail level, would form a good base for mounting trolleybus overhead current collector gear.

Optare has done well in the minibus market, with its 25-seat VW-based City Pacer followed by the 33-seat Star Rider on the Mercedes Benz 811D chassis. But here the market has changed, and it is still changing. "We've built over 300 City Pacers as the market moved into 25 seaters," says Richardson, "but now the overall demand for minis has reduced; there's not much future for less than 25 seats."

He agrees that some operators still need 16-seat van conversions, but stresses that many are now looking for equipment to give longer life and profitability. The Swift and the Dart are options in the medium-sized bus range and the financial payback is particularly good on the Swift, but any move beyond 33 seats meant going beyond mass-produced, commercially available small bus chassis.

Nevertheless, there has been a clear demand for more seats. "We now sell three 33-seat Star Riders for every 25seat City Pacer," says Richardson.

Richardson sees a new wave of competition coming, and says Optare is in a good position to be flexible, offering the City Pacer in the welfare market as well as for bus and coach use. Several are in bus service in the Netherlands and one is being evaluated by DAB.

LEYLAND EMPIRE

There are several similarities between DAB and Optare; both had their origins in the Leyland empire, and both use the Alusuisse system for full-size bus construction. The minibus market is likely to remain small in Denmark and would not justify developing a vehicle specially, says Richardson, but DAB could find it useful to have the City Pacer available as a small bus to complete its range there.

What about the capacity of the UK bus building industry; is it sufficient to meet the emerging upturn in orders?

Richardson does not see any great problem with double-decker capacity. But clearly, if his prediction of single-decker growth is correct, there could be problems of undercapacity there, and Continental builders could move in.

If a demand for single-deckers grew rapidly, there could be scope for builders like Van Hool, whose designs could be adapted. It would be more difficult to bring in some of the expensive, highspecification service-bus designs from Dutch builders like Den Oudsten and Bainje.

Optare has room to expand by redeveloping the cluster of small buildings on the east side of its existing site. It is recruiting a further 30 to its 230-strong workforce. With the flexibility offered by its product range and the investment in technology provided by the changeover to Alusuisse methods, at least for the large buses, it looks well-placed to hold and expand its market share. The award of an MBE to Richardson in the New Year's Honours reflects the way he and the company have been able to do this already. 0 by Ian Yearsley