THE TREATMENT OF DEPRECIATION.

Page 94

Page 95

If you've noticed an error in this article please click here to report it so we can fix it.

By S. Howard Withey, F.C.I., etc. (Accountant and Auditor). Author of "The Book-keeper's Vade Mecum," "Converting Into a Limited Company," "The Principles of Banking," Etc.

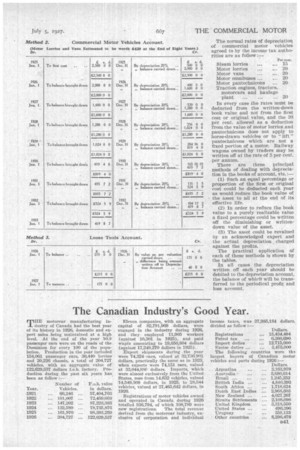

BEFORE the amount of net Method profit made or the extent of Dr. the net loss sustained during the

actounting period can be viewed in proper perspective, and before any profits are distributed among the partners or shareholders, it will be necessary to charge an adequate sum to cover the depreciation of all the wasting assets

employed in the business. The book value of all vehicles propelled by steam or internal combustion that actually diminish in value as the result of use must be subjected to a proper deduction in respect of depreciation during the period under review, and this applies also to assets, suCh as machinery, plant, business premises, fixtures, tools, patents, leases, goodwill, etc., the values of which automatically diminish by reason of use, obsolescence or lapse of time.

In this matter of depreciation the essential requirement is that the periodical profit and loss account should be debited and that the account of each particular asset should be credited, but in order to ensure that the charges are really equitable as between one accounting period and another the method of treatment in the books of account will depend largely upon the precise nature of each particular asset.

n40 The normal rates of depreciation, of commercial motor vehicles agreed to by the income tax authorities are as follow:

Per rent.

Steam lorries ... 15 Motor lorries ... 20 Motor vans ... 20 Motor omnibuses .„ 20 Motor pantechnicons ... 20 Traction engines, tractors,. motorcars and haulage plant ... •• • ... -20 In every case the rates mist be deducted from the written-down book value and not from the first cost or original value, and the 20 per cent. allOwed as a deduction froin the value of motor lorries and pantechnicons does not apply to horse-drawn vehicles or to " lift " pantechnicons which are not a fixed portion of a motor. Railway wagons owned by traders may be written off at the rate of 5 per cent. per -annum.

There are three principal methods of dealing with depreciation in the books of account, viz. :

(1) Such an equal percentage or proportion of the first or original cost could be deducted each year as would reduce the book value of the asset to nil at the end of its effective life.

(2) 'In order to reduce the book value to a purely realizable value a fixed percentage could be written off the diminishing or writtenclown value of the asset.

(3) The asset could be revalued by an acknowledged expert and the actual depreciation charged against the profits.

The practical application of each of these methods is shown by the tables.

In all cases the depreciation written . off each year should be debited to the depreciation account, tile balance of which will be transferred to the periodical profit and loss account.