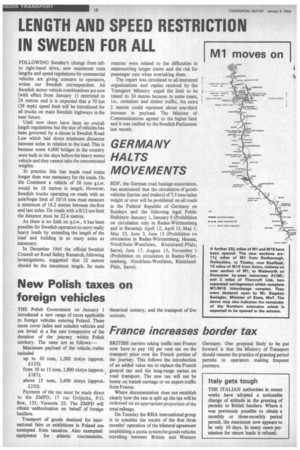

New Polish taxes on foreign vehicles

Page 20

If you've noticed an error in this article please click here to report it so we can fix it.

THE Polish Government on January 1 introduced a new range of taxes applicable

to foreign vehicles entering Poland. These taxes cover laden and unladen vehicles and are levied at a flat rate irrespective of the duration of the journey within Polish territory. The rates are as follows:—

Maximum payload of the vehicle, trailer included up to 10 tons, 1,200 zlotys (approx. £125); from 10 to 15 tons, 1,800 zlotys (approx.. £187); above 15 tons, 2,400 zlotys (approx. £250).

Payment of the tax must be made direct to the ZMPD, 17 rue GrOjecka, P.O.

Box, 133, Varsovie 22. The ZMPD will obtain • authorization on behalf of foreign hauliers.

Transport of goods destined for international fairs or exhibitions in Poland aro exempted from taxation. Also exempted: equipment for athletic tournaments, theatrical scenery, and the transport of live animals.