mg the price for development

Page 40

Page 41

Page 42

If you've noticed an error in this article please click here to report it so we can fix it.

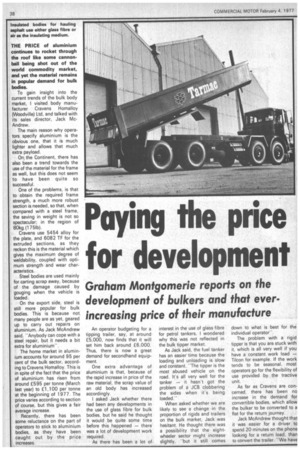

Graham Montgomerie reports on the development of bulkers and that ever increasing price of their manufacture

THE PRICE of aluminium continues to rocket through the roof like some cannonball being shot out of the world commodity market, and yet the material remains in popular demand for bulk bodies.

To gain insight into the current trends of the bulk body market. I visited body manufacturer Cravens Homalloy (Woodville) Ltd, and talked with its sales director, Jack McAndrew.

The main reason why operators specify aluminium is the obvious one, that it is much lighter and allows that much extra payload.

On the Continent, there has also been a trend towards the use of the material for the frame as well, but this does not seem to have been quite so successful.

One of the problems, is that to obtain the required frame strength, a much more robust section is needed, so that, when compared with a steel frame, the saving in weight is not so spectacular; in the region of 80kg (1751b).

Cravens use 5454 alloy for the plate, and 6082 TF for the extruded sections, as they reckon this is the material which gives the maximum degree of weldability, coupled with optimum strength and wear characteristics.

Steel bodies are used mainly for carting scrap away, because of the damage caused by gouging when the vehicle is loaded.

On the export side, steel is still more popular for bulk bodies. This is because not many people are as yet, geared up to carry out repairs on aluminium. As Jack McAndrew said. "Anybody can cope with a steel repair, but it needs a bit extra for aluminium-.

The home market in aluminium accounts for around 95 per cent of the bulk sector, according to Cravens.Homalloy. This is in spite of the fact that the price of aluminium has risen from around £595 per tonne (March last year) to £1,100 per tonne at the beginning of 1977. The price varies according to section of course, but this gives a fair average increase.

Recently, there has been some reluctance on the part of operators to stick to aluminium bodies, as they have been caught out by the price increases, An operator budgeting for a tipping trailer, say, at around £5,000, now finds that it will set him back around £6,000. Thus, there is now a great demand for secondhand equipment.

One extra advantage of aluminium is that, because of the rapid increase in price of the raw material, the scrap value of an old body has increased accordingly.

I asked Jack whether there had been any developments in the use of glass fibre for bulk bodies, but he said he thought it would be quite some time before this happened — there was a lot of development work required.

As there has been a lot of. interest in the use of glass fibre for petrol tankers, I wondered why this was not reflected in the bulk tipper market.

As Jack said, the fuel tanker has an easier time because the loading and unloading is slow and constant. "The tipper is the most abused vehicle on the road. It's all very well for the tanker — it hasn't got the problem of a JCB clobbering the sides when it's being loaded."

When asked whether we are likely to see a change in the proportion of rigids and trailers on the bulk market, Jack was hesitant. He thought there was a possibility that the eightwheeler sector might increase slightly, "but it still comes down to what is best for the individual operator".

The problem with a rigid tipper is that you are. stuck with it, which is all very well if you have a constant work load — Tilcon for example. If the work tends to be seasonal, most operators go for the flexibility of use provided by the tractive unit.

As far as Cravens are concerned, there has been no increase in the demand for convertible bodies, which allow the bulker to be converted to a flat for the return journey.

Jack McAndrew thought that it was easier for a driver to spend 20 minutes on the phone looking for a return load, than to convert the trailer. "We have also noticed that there has been some driver reluctance to the convertible operation' said Jack, with a remarkably straight face.

At present, the most popular bulk tipping trailer has a capacity of 30 cu rr (40cu yd) with a body length of 8.5m (28ft). Continental operators tend to go for a longer body at 10m (33ft).

Stability problem One of the disadvantages of a tipper is the problem of stability during the actual tipping operation. Because of this, many operators go for the bottom discharge bulker.

This is becoming very popular with breweries, cattle feed and grain companies, although the unloading process has to be geared into the production programme because of the limited discharge areas — it can't be unloaded anywhere.

So, unless the operator is geared up for bottom discharge (like the breweries) it is an expensive unit, costing almost twice as much as a conventional tipping trailer, depending on the specification.

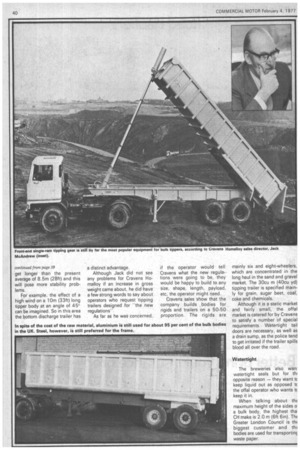

If there is an increase in gross weight (!) then trailers will get longer than the present average of 8.5m (28ft) and this will pose more stability problems.

For example, the effect of a high wind on a 10m (33ft) long tipper body at an angle of 45' can be imagined. So in this area the bottom discharge trailer has a distinct advantage.

Although Jack did not see any problems for Cravens Homalloy if an increase in gross weight came about, he did have a few strong words to say about operators who request tipping trailers designed for "the new regulations" As far as he was concerned, if the operator would tell Cravens what the new regulations were going to be, they would be happy to build to any size, shape, length, payload, etc, the operator might need.

Cravens sales show that the company builds bodies for rigids and trailers on a 50-50 proportion. The rigids are mainly six and eight-wheelers, which are concentrated in the long haul in the sand and gravel market. The 30cu m (40cu yd) tipping trailer is specified mainly for grain, sugar beet, coal, coke and chemicals.

Although it is a static market and fairly small, the offal market is catered for by Cravens to satisfy a number of special requirements. Watertight tail doors are necessary, as well as a drain sump, as the police tend to get irritated if the trailer spills blood all over the road.

Watertight The breweries also wan• watertight seals but for thi opposite reason — they want tc keep liquid out as opposed tc the offal operator who wants tc keep it in.

When talking about thE maximum height of the sides o a bulk body, the highest tha CH make is 2.0 m (6ft 6in). ThE Greater London Council is thE biggest customer and thE bodies are used for transportinc waste paper.