Money for nothing

Page 58

Page 59

Page 60

Page 61

If you've noticed an error in this article please click here to report it so we can fix it.

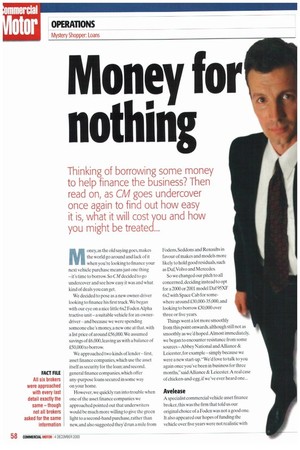

Thinking of borrowing some money to help finance the business? Then read on, as CM goes undercover once again to find out how easy it is, what it will cost you and how you might be treated...

Money, as the old saying goes. makes the world go around and lack of it when you're looking to finance your next vehicle purchase means just one thing it's time to borrow. So CM decided to go undercover and see how easy it was and what kind of deals you can get.

We decided to pose as a new owner-driver looking to finance his first truck.We began with our eye on a nice little 6x2 Foden Alpha tractive unit -a suitable vehicle for an ownerdriver and because we were spending someone else's money, a new one at that. with a list price of around £56.000. We assumed saving of £6,000, leaving us with a balance of £50.000 to borrow.

We approached two kinds of lender first. asset finance companies, which use the asset itself as security for the loan; and second, general finance companies, which offer any-purpose loans secured in some way on your home.

However,we quickly ran into trouble when one of the asset finance companies we approached pointed out that underwriters would be much more willing to give the green light to a second-hand purchase, rather than new, and also suggested they'd run a mile from Fodens,Seddons and Renaults in favour of makes and models more likely to hold good residuals.such as Daf,Volvo and Mercedes.

So we changed our pitch to all concerned, deciding instead to opt for a 2000 or 2001 model Daf 95XF 6x2 with Space Cab for somewhere around £30,000-35.000. and looking to borrow £30,000 over three or five years.

Things went a lot more smoothly from this point onwards, although still not as smoothly as we'd hoped. Almost immediately, we began to encounter resistance from some sources-Abbey National and Affiance & Leicester, for example -simply because we were a new start-up."We'd love to talk to you again once you've been in business for three months," said Alliance & Leicester. A real case of chicken-and-egg, if we've ever heard one...

Avelease

A specialist commercial vehicle asset finance broker,this was the firm that told us our original choice of a Foden was not a good one. It also appeared our hopes of funding the vehicle over five years were not realistic with asset finance, as depreciation on the vehicle would make such a long term more of a risk for the lender. Once we'd lowered our expectations to £30,000 for the second-hand Daf,Avelease said it could probably get us either a eeor four-year finance lease, with payments of around £1,066 a month over the shorter term and £852/month over the longer one.This,said our contact, represented an interest rate of around 10%. Some kind of set-up fee, around £1004250, would be payable, depending on the eventual lender,and a 15% deposit would also probably be needed.

We got good advice from Avelease on the difference between a finance lease (whereby the lending company ends up owning a small percentage of the asset but pays for the VAT up front for you) and hire purchase (in which you own the truck outright at the end but have to stump up the VAT in advance),and its gentle and sensible guidance away from the new Foden towards a second-hand Daf was appreciated.

Although it said it wasn't worth getting firm quotes from the lenders as we hadn't yet secured our 0-licence, we felt we were in pretty good hands. A shame, however, that its quote was the most expensive by around two grand. In addition, although it sent us some follow-up information a week later, it merely confirmed the documents and information it would require from us, rather than the rates it had quoted, and gave no further information about doing business with it.

Close Asset Finance

Recommended by Nationwide Asset Finance (which treated us to a wonderfully condescending and extraordinarily lengthy spiel about how we couldn't possibly expect a quote if we didn't have a business plan —thanks, Nationwide), Close Asset Finance was, when we finally got hold of the right person,fairly straightforward to deal with. It checke the vehicle details and amount we had in mind, and then produced a ballpark figure for a three-yea finance lease of about £1,020 a month at at interest rate of 7%.This would, it stressed, involve having a deposit of 10-15%. Its standard fee emerged later in the conversE at,£150 and it said we'd need to discuss oth options, including life insurance and gener asset protection insurance.

Again, we got good advice on the VAT implications of hire purchase and a finance lease, and again,it said we might be able to a four-year deal if we preferred.

Overall, Close Asset Finance was obviously knowledgeable and helpful — though a promise to e-mail some sample quotes along with some general inforrnatie sadly came to nothing.

Lombard Asset finance arm of the Royal Bank of Scotland (which gave us some excellent advice about the pros and cons of securing loan against our home, rather than the truc itself, before passing us on), Lombard was very friendly and helpful. Our contact there took down a few details of the vehicle we had in mind and our basic circumstances before coming up very quickly with a quote of about 1940a month for a three-year hire purchase deal at 8.5%.

We asked about five-year deals. Our contact gave us some well-considered advice to the effect that financing the truck over this period could be more risky for us. as well as the lender, given the possible residual value of a truck that old relative to the amount outstanding in years four and five. However, he still provided a quote -1610/month at the same fixed interest rate. He also pointed out we'd need to have the VAT handy on a hire-purchase deal and suggested we'd probably need to come up with a deposit of 10-20%, depending on the underwriters involved and our personal circumstances.

Lombard also made clear it would need a business plan,six months' worth of personal banking history (given our lack of business history) and a face-to-face visit from us before things could come to fruition.

No mention was made of a fee but when confirmation of the quote reached us by e-mail, it was clearly shown at a figure of £195. We also found the figures had changed slightly. to £941.39/month for three years and £613.29/ month for five.

To its credit, Lombard also offered us some figures based on a variable interest rate which came to £929.80 and 1597.63/month for the two periods. both a slight improvement on the fixed rates.

Freedom Finance Freedom Finance took just over 20 minutes to gather various information about our home and mortgage, our marital status, employment record and other debts. It also wanted to know about our partner's earnings and employment record, pointing out that any agreement against a jointly-owned property would be a joint agreement involving both partners.

As soon as this marathon of information-gathering was over, we had an agreement in principle for the loan and a promise to dispatch an application pack and further information. However, it was reluctant to gjve us a firm quote until the application had been signed and returned. With a bit of encouragement, however, our contact revealed that as a rough guide,the monthly repayments over three years would be £932 a month at a 7.7% fixed rate which would make total repayment £33552. No fees, eit her, depending on lender.And in some cases, added our contact, that interest rate could be an even lower 6.9%. again depending on eventual lender.

When the information arrived, it consisted of a standard letter telling us what to do next, an application form and a small information pack that included a Borrower Infonnation Guide produced by The Finance industry Standards Association.

No confirmation of the quoted deal, however, was included, leaving us wondering just how rough its "rough guide" might be.This doubt aside, our experience was quick, pleasant and largely straightforward.

Ocean Finance After checking that we were a home-owner and enquiring about our mortgage and any other debts secured on the house. Ocean Finance gathered some basic information about our marital status. our partner's occupation and their earnings (pointing out, as Freedom did, that any agreement on the house would involve both home-owners) before informing us after just minutes on the phone in total that there would be no problem arranging the loan.

However, no three-year deals could be struck with Ocean for the amount we wanted.The monthly repayment on 130,000 borrowed over five years would be 1609.56, which our contact told us was an interest rate of 8.4%. Both fixed and variable interest deals are available and, as with the other two general finance houses we approached for this investigation,no fee is applicable, leaving the total cost at £36,573.60.

Our contact was efficient and quick, and the promised posted material arrived the next day.This confirmed that a loan would be offered, with a monthly repayment guide confirming the quoted price.Also included were an application form,a Borrower Information Guide fromThe Finance Industry Standards Association,a video and a brochure about payment protection insurance.

Dealing with Ocean was easy and it was also the quickest quote we received.The quality of the follow-up information,meanwhile,was excellent.

Norton Finance

Our contact checked first to see if we had any business premises our loan could be secured against instead of the house unlike any of the others we talked to and then took some basic details before giving us the quote.Again, a five-year minimum term applied for the proposed sum and the monthly repayments, with a variable 8.4% rate,came to £609.57. No fees apply.

The posted material arrived as promised and included application form,a monthly repayment guide and the Borrower Information Guide, as well as a Norton Finance-produced guide entitled Borrowing made easy which contained a basic chronological guide to taking out a loan along with answers to some frequently-asked questions.

We liked the fact that Norton Finance checked about our business premises as an alternative to securing the loan on a private dwelling, and found the company fast, courteous and efficient throughout