;Wilting a company in Europe

Page 39

Page 40

Page 41

If you've noticed an error in this article please click here to report it so we can fix it.

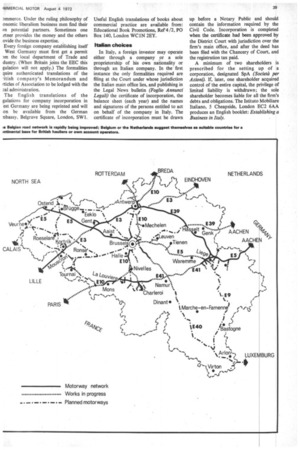

John Darker AMBIM ■ 1Y road transport company wishing to )loit the opportunities for expansion on Continent must seriously consider tablishing a bridgehead across the lannel. The Department of the ivironment will soon be inviting British uliers to apply for the "go-anywhere" )mmon Market carriers' licences to which UK will become entitled on joining the 1C on January 1 next year.

Road transport and distribution firms th well-established links with Continental uliers, and companies confident enough to mch one or more companies in the mamon Market, will clearly be in a good .sition to qualify for one of the potentially luable carriers' licences.

Agency arrangements and reciprocal )rking agreements with Continental tillage, warehousing and distribution mpanies provide one means of entry to =mon Market trading but the larger itish road hauliers may now be .nsidering the pros and cons of launching European subsidiary. The study must turay be related to the location of the )ntinental branch. It would not make ach sense to choose a country of the Six th a pint Most firms already operating oss Channel or cross North Sea services 11 wish to exploit a particular flow of affic, probably on behalf of welltabtished exporting firms in their home ea. If regular two-way flows of exports id imports can be arranged the viability of .vv services is much more likely to be sured.

where to get advice Eventually, a European statute for )mpany incorporation will greatly ease the sk of international businesses, but for the .esent it is necessary for the various itional laws and regulations to be implied with. Advice is available from the ade associations, and particularly from the onfederation of British Industries. The nbassies of Common Market countries in mclon and their associated commercial telligence sections, and many European mks in London offer abundant literature English setting out the legal requirements id commercial background. There is no fficulty in getting information about irticular areas; maps and brochures owing present and planned road layouts, il and waterway connections, and sites 'ailable for development can be obtained Of course, no British company should contemplate setting up a business in the EEC without a serious examination of the wider aspects. Expertise to do the formal company registration work — including the services of English speaking lawyers — is available. Expertise actually to operate a company in the Common Market must be hired or acquired painfully by the British firm. In all countries of the Community the responsible chief executive authorized to speak for the company in legal or administrative matters, must be readily accessible to the local authorities.

Any company wishing to establish itself abroad must first apply to the Bank of England for permission to export capital. London based merchant banks with international affiliations may be helpful if some of the capital required is to be raised abroad.

Though Belgium, the Netherlands and France offer obvious attractions in terms of nearness to the UK, Luxembourg, Germany and Italy cannot be ruled out; all countries in the Community seem most anxious to attract capital investment from Britain. Naturally, it would take an expert accountancy assessment to decide the relative merits of the tax reliefs, investment grants, etc, which are offered by the various countries.

In Belgium, for example, the country provides the same right to investment grants, tax reliefs, licensing and customs facilities to British firms as to Belgian companies. Profits may be freely remitted and invested capital repatriated if desired. It is not necessary to appoint Belgian directors or bring in Belgian shareholders; if necessary, the Board may be wholly British.

Belgian co-operation

Another alternative in Belgium is a joint venture with a local firm. The Belgian authorities welcome this form of collaboration and will seek out a suitable partner on request. Currently, over 700 British or partly British firms operate in Belgium.

The director of a British firm starting up in Belgium will require a provisional residence visa and carte professionelle; salaried or wages employees need a residence visa and a work permit. Within a week of arrival the holder of a provisional residence visa must report to the local authority for registration as an alien. An identity card, valid for two years, is then issued.

No visa is required of a foreign director of a Belgian branch or subsidiary if he visits Belgium for not more than three months at a time, nor is a carte professionnelle needed, but the latter is required by the responsible local chief executive and by whoever registers the company. A British firm may send a a salaried employee over to found a subsidiary and such an employee may apply for his own work permit and professional residence permit.

British companies may open a branch office under their own name in Belgium without forming a special Belgian company. Under the Code of Commerce a foreign company is recognized as a body corporate with power to plead in Belgian courts, but its place of business must be registered and it must publish certain information as a Belgian company must do. A British firm opening a branch in Belgium must nominate at least one person to be responsible for payment of taxes. He must reside in the country and be of good financial standing.

The choice between company incorporation and setting up a branch is a complex one depending upon estimates of initial losses (if any) and future profits for some years ahead, and on forecasts of how such profits will be reinvested — to ignore changes in tax laws and taxation levels in Britain and Belgium.

Six forms of company or partnership are recognized in Belgian law but only two are likely to concern British firms. The abbreviation SA stands for societe anonyme equivalent to a public company, and SPRL for societe de person net a responsabilite limit& equates to a private company; NV and PVBA, are the Dutch (or Flemish) equivalents of these abbreviations.

Registre du Commerce With the exception of a person engaging in occasional transactions in Belgium, everyone engaging in business must first register at the local Registre du Commerce obtaining registration forms from any Tribunal de Commerce. The nature of the proposed business must coincide with a standard list of occupations. If any licence is required for a particular kind of business the formalities must be completed before registration is finalized.

As with English law, all companies must publish statutory information. Deeds forming companies must be formally drawn up and recorded before a qualified notary. Fees relate to the capital employed.

The standard rate of VAT (value-added tax) applying to most service trades is 20 per cent. An English translation of the Belgian value-added tax code is available from Commerce Clearing House Inc, 42 rue Pasquierm, Paris 8e, and other detailed information can be obtained from The Economic Officer, Belgian Embassy, 103 Eaton Square, London SW IW 9AB. (Transport is one of a long list of occupations requiring a licence, special qualifications, and various formalities before business is commenced.)

Luxembourg preference

Luxembourg welcomes foreign fimis but gives special preference to projects with economic and social merits. There are generous investment incentives including substantial temporary tax reliefs until a business gets established.

Companies are formed by special deeds received by a public notary. All establishments of commercial enterprises are subject to Government permit issued by the Ministry of Economic Affairs, 19 rue Beaumont, Luxembourg, on payment of a special tax of 500 francs. Fees for company registration relate to capital employed.

All businesses must be registered with the Tribunal of Commerce and a variable tax is payable. In addition to the name, purpose and capital employed the names of responsible associates and those authorized to manage, administer and sign for the company must be recorded. A leaflet setting out the fairly involved system of personal and company taxation is available from the Luxembourg Embassy, 27 Wilton Crescent, London SW1X 85D.

Formalities to start a business in France are specified in a leaflet issued by the Consulate General, 24 Rutland Gate, London, SW7. A Carte de Commercant must first be obtained by an individual or company in the name of the person of foreign nationality who is to become chairman or general manager. If a French national is to be the chief executive he applies for the Carte de Commercant in his own name.

A detailed application must be made in quadruplicate to which four passport photographs are attached. The relevant application forms are obtained from a French Consulate.

An affidavit (one original and three certified copies) drawn up and signed in the presence of a Commissioner for Oaths, or a Notary Public, says whether or not the applicant has ever been convicted of any criminal offence or been declared bankrupt in any country. The articles of the company or broad details of its object must be produced. The certificate of appointment of the applicant, ie the chief executive, must be produced in triplicate.

Transferving funds to France "Artisan" activities must show the address from which business will be conducted and the juridical form of the business. The applicant must produce documents detailing his professional qualifications and a letter from the Bank of England confirming authorization to transfer funds to France. The amount of capital must be shown.

All above documents with French translations must be handed in to the Commercial Counsellor of the French Embassy 12 Stanhope Gate, London, WI. The Counsellor may be consulted for advice; he will ultimately pass the documents to the local French consul. A delay of four to six months is normal before the decision is notified. Taxation in France does not di between French and foreign compa the precise legal form of incorpo affects the tax payable. English translatt of tax laws relating to income tax a company tax are available from the Fren Consul General in London and Briti accountants will find the system prei complicated to understand.

For example, in France all employ( (except craftsmen) are subject to a 0.60 f cent apprenticeship tax based on t payroll. The tax is used to finance technic training, apprenticeship, etc.

All industrial and commercial fin employing more than 10 wage-earners France are required to invest in housi projects a sum equal to 1 per cent of t total 'annual payroll, payable within a year after the end of each operating perioc Strategic Netherlands The Netherlands is perhaps the nu strategically placed of all countries i British investment in transport to ma sense. The industrial centres of Germa and Belgium and much of France are witi a day's drive from any place in t Netherlands.

A branch office may be set up in Holla by a British company in preference setting up a formal company. The only cc involved is the registration fee for the enl in the trade register of the local Chamber Commerce. Generous investment grants t available for certain development areas t these may be conditional on the perman( employment of at least 75 people. ' establish a company that is foreign ownec licence must be obtained from 1 Nederlandshe Bank, preferably through commercial bank, but the normal procedt is for application to be made by letter to t Ministry of Economic Affairs at T Hague. The Ministry subsequently adviE the Bank, which issues the licence.

The legal form and proposed name oft Dutch venture, its place of business, t nature of the business, an estimate of futt sales (of goods or services), and estimate the number of male and female employe, the capital needed, etc, are the sort questions requiring to be covered. The iss of the licence also includes the authorizati to transfer profits and to repatriate capit A useful booklet, Commerce and Indus' in the Netherlands, is available from 1 Amsterdam-Rotterdam Bank, 595 Hen gracht, Amsterdam.

The German way

It is possible for a British company to up a branch in the Federal Republic Germany but a locally incorporat company is regarded as more credit-wort and representative. German law recogni:i the concept of partnership or limit partnership and many sizeable firms are r on this basis. The partnership idea mea that every partner is liable without limit I debts incurred by the business. T advantage is that bank credit is grant much more easily. The limited partnerst system lessens the risks of the principals.

In West Germany virtually eve company must join its local Chamber )mmerce. Under the ruling philosophy of onotnic liberalism business men find their vn potential partners. Sometimes one ,rtner provides the money and the others ovide the business expertise.

Every foreign company establishing itself West Germany must first get a permit )m the local department of Trade and dustry. (When Britain joins the EEC this gulation will not apply.) The formalities quire authenticated translations of the -itish company's Memorandum and rticles of Association to be lodged with the al administration.

The English translations of the gulations for company incorporation in est Germany are being reprinted and will on be available from the German nbassy, Belgrave Square, London, SW'.

Useful English translations of books about commercial practice are available from: Educational Book Promotions, Ref-4/2, PO Box 140, London WC 1N 2EY.

Italian choices

In Italy, a foreign investor may operate either through a company or a sole proprietorship of his own nationality or through an Italian company. In the first instance the only formalities required are filing at the Court under whose jurisdiction the Italian main office lies, and publishing in the Legal News bulletin abglio Annunci Legal!) the certificate of incorporation, the balance sheet (each year) and the names and signatures of the persons entitled to act on behalf of the company in Italy. The certificate of incorporation must be drawn

up before a Notary Public and should contain the information required by the Civil Code. Incorporation is completed when the certificate had been approved by the District Court with jurisdiction over the firm's main office, and after the deed has been filed with the Chancery of Court, and the registration tax paid.

A minimum of two shareholders is prescribed for the setting up of a corporation, designated SpA (Societa per Azion0. If, later, one shareholder acquired control of the entire capital, the privilege of limited liability is withdrawn; the sole shareholder becomes liable for all the firm's debts and obligations. The Istituto Mobifiare Italiano, 5 Cheapside, London EC2 6AA produces an English booklet: Establishing a Business in Italy.