THE HAULIERS' INQUIRE WITHIN.

Page 26

Page 27

If you've noticed an error in this article please click here to report it so we can fix it.

Operating Costs of •a Fleet of 15 Vehicles. A Consideration of a New Method of Operating the Depreciation and Maintenance Fund.

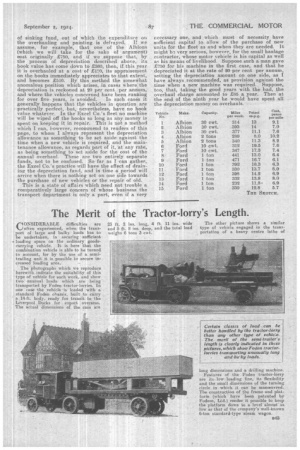

-r HAVE asked the Editor to reproduce the table of running costs of a fleet belonging to the Excel Co. from-last week's article, so that readers who have not that issue by them may refer to it. The figure in the last column—pence per mile—is the total operating cost for eadh vehicle, and includes the proper allowance for all the essential items, such as fuel, oil and grease, tyres; maintenance and depreciation. It includes allowance for cost of licence, wages of driver, garage rent, insurance and interest on first cost. Several of these items are calculated and reckoned by the manager of this particular fleet in ways -which are not quite usual, and it is to that feature that I wish to draw attention this week.

The fuel allowance is calculated in the usual manner. Every vehicle of the fleet is fitted with a . mileometer, and the daily mileage is recorded in the garage, as is also the quantity of petrol booked out. The consumption per mile for any machine is its weekly mileage divided by the number of gallons of petrol which have been booked out to it. Accurate records of the individual oil consumption of each vehicle are not kept. The total cost of lubricants for the fleet is obtained, and that amount is divided between them in proportion to their fuel consumption.

For tyres a flat rate of Li per week per vehicle has been taken. This is high, as no doubt many of my readers will agree, and, on the whole, it has been the experience of the Excel Co. that they have had a little in hand on the tyre account at the end of the year. Experiences differ, even with the same type of vehicle. For example, two of the Ford tonners were fitted at the beginning of February this year with new tyres, of 835 mm. by 135 mm. section all round. They have been running ever since, at the rate of about 350 miles a week, so that they have covered over '9,000 miles, and have still to be punctured for the first time. On the other hand, another of the -Ford tonnets; ,similarly equipped only three months ago, looks like needing a new set very soon. It has to be admitted, however, that -the latter ease is that Ford to

..-which I have . already referred. in the previous 'article, 'as beitig always ' fully loaded. hecaUse ',it is used by a traveller. w h o fills it up with saMples at the beginning of the week and may not part with any of them. This vehicle does 500 miles a week along comparatively • poor roads.

These two cases of tyre ex-pence show how impossible it is to quote an odd case of running cost as being applicable to a number of vehicles cif any. ,844

one size or type. Assuming that a set of 835 mm. by 135 mm. tyres costs 135, and that the tyres in the first of the two examples given above are going to last as long again as they have already, then the allocation for tyres for this vehicle should be no more than 14s. a week. On.:the other hand, in the second case the weekly tyre cost is over 30s.

A Flat Rate for Vehicle Depreciation.

Depreciation is reckoned at 20 per cent. per annum' which, in the ease of the Albions, which were bought when prices were high, would amount to ,E4 a week, and in the ease of the Fords ill a week. Actually, the depreciation is reckoned in the same way as the tyre cost, so that it is chargeable as a flat rate per vehicle per day. The total is £30 per week for the fleet, and this is calculated and apportioned amongst the different constituent vehicles of the fleet according to the number of working days of each. In case this description of the method may not be quite so clear as is desirable, I will take an actual example to show its application. Assume that one van of the fleet of 15 is off for three days during one week, two are not working for two days each in the same week, and a third has one day off in the same period. All the others work the full five and a half days per week. Eleven of the fleet, therefore, work in all 11 days, which is 60. days, durinathat week, one. works for 4,4 days, two others work for 34 days, and one other for only 21 days. The total of days worked during that week by the whole fleet is 741. The depreciation, 130, is divided by 74,1, and the quotient, practically es., is the depreciation per day per vehicle for that week. Each of those machines which did a full week's work will be

depreciated 511 times the 8s.—namely, 4s, a week. The one which lost a day will be depreciated .E1 16s , that which lost two days El 8s., and the one which lost three days £1. It will be noted that this method of reckoning depreciation is, in a way, a compromise between the orthodox accountant's method, which provides for time only at 20 per cent. per annum, regardless of the work which the

vehicle d e e a, and mine, which takes account of the work done only and apportions depreciation according to the mileage.

There is a novel • feature aboutthis concern's method of reckoning depreciation and in ainteriance which is yell worth noting. as in certain circumstances it has mach to recommend it. T h e depreciation account is treated as a sort September 2, 1924.

• of sinking fund, out of which the expenditure on the overhauling and painting is defrayed. I we assume, for example, that one of the Alhions (which we will take for the sake of argument) oost originally £750, and if we suppose that, by the process of depreciation described above, its book value has come down to 2360, then, if this year it is overhauled at a cost of i1.0, its appraisement on the books immediately appreciates to that extent, and becomes 2510. By this .method the somewhat anomalous position which arises, in case.s where: the depreciation is reckoned at 20 per cent per annum, and where the vehicles concerned have been running for over five years, is avoided. In such cases it generally happens that the vehicles in question, are practically perfect, .but, nevertheless, have no book value whatever. In the Excel Co.'s fleet no machine will be wiped off the books so long as any money is spent on keeping it in repair. This is not a method which I can, however, recommend to readers of this page, to whom I always represent the depreciation allowance as something to be set aside against the time when a new vehicle is required, and the main-j tenance allowance, as regards part of it, at any rate, as being something to set aside for the cost of the annual overhaul. These are two entirely separate funds, not to be confused. So far as I can gather, the Excel Co.'s practice will have the effect of draining the depreciation fund, and in time a period will arrive when there is nothing set on one side towards the purchase of new vehicles or the repair of old.

This is .a state of affairs which need not trouble ft, comparatively large concern of whose business the transport department is only a part, even if a very necessary one, and which must of necessity have sufficient capital to allow of the purchase of new units for the fleet as and when they are needed. It might b very serious, however, for the small haulage contractor, whose motor vehicle is his capital as well no his means of livelihood. Suppose such a man gave 2750 for his machine in the first case, and that he depreciated it at the rate of 20per cent per annum, setting the depreciation amount on one side, as I have always recommended, as provision against the time when a new machine was required. Suppose, too, that, taking the good years with the bad, the overhaul charge amounted to £85 a year. Then at the end of the ninth year he would have spent all the depreciation money on overhauls.