CV back costs the gtdf widens

Page 7

If you've noticed an error in this article please click here to report it so we can fix it.

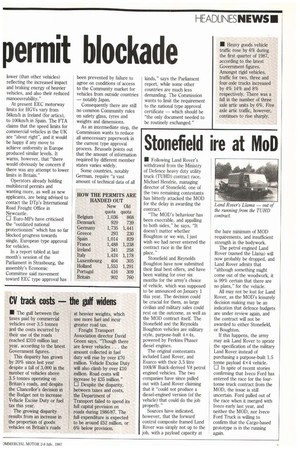

111 The gulf between the taxes paid by commercial vehicles over 3.5 tonnes and the costs incurred by their use of the roads reached £310 million last year, according to the latest Government figures.

This disparity has grown by 20% since last year despite a fall of 3,000 in the number of vehicles above 3.5 tonnes operating on Britain's roads, and despite the Chancellor's decision in the Budget not to increase Vehicle Excise Duty or fuel tax this year.

The growing disparity results from an increase in the proportion of goods vehicles on Britain's roads at heavier weights, which use more fuel and incur greater road tax.

Freight Transport Association director David Green says, "Though there are fewer vehicles. . . the amount collected in fuel duty will rise by over 270 million. Vehicle Excise Duty will also climb by over 210 million. Road costs will increase by £35 million."

Despite the disparity, between taxes and costs, the Department of Transport failed to spend its full capital provision on roads during 1986/87. The full expenditure is expected to be around 252 million, or 6% below provision.