Soper's links for Lynx

Page 10

If you've noticed an error in this article please click here to report it so we can fix it.

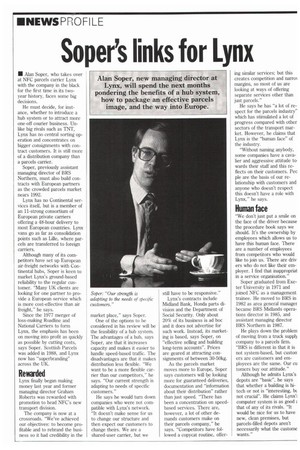

Alan Soper, new managing director at Lynx, will spend the next months pondering the benefits of a hub system, how to package an effective parcels image, and the way into Europe.

• Alan Soper, who takes over at NFC parcels carrier Lynx with the company in the black for the first time in its twoyear history, faces sonic big decisions.

He must decide, for instance, whether to introduce a hub system or to attract more one-off courier business. Unlike big rivals such as TNT, Lynx has no central sorting operation and concentrates on bigger consignments with contract customers. It is still more of a distribution company than a parcels carrier.

Soper, previously assistant managing director of BRS Northern, must also build contracts with European partners as the crowded parcels market nears 1992.

Lynx has no Continental services itself, but is a member of an 11-strong consortium of European private carriers offering a 48-hour delivery to most European countries. Lynx vans go as far as consolidation points such as Lille, where parcels are transferred to foreign carriers.

Although many of its competitors have set up European air-freight networks with Continental hubs, Soper is keen to market Lynx's ground-based reliability to the regular customer. "Many UK clients are looking for one partner to provide a European service which is more cost-effective than air freight," he says.

Since the 1977 merger of loss-making Roadline and National Carriers to form Lynx, the emphasis has been on moving into profit as quickly as possible by cutting costs, says Soper. Scottish Parcels was added in 1988, and Lynx now has "superbranding" across the UK.

Rewarded

Lynx finally began making money last year and former managing director Graham Roberts was rewarded with promotion to head NFC's new transport division.

The company is now at a crossroads. "We've achieved our objectives: to become profitable and to rebrand the business so it had credibility in the market place," says Soper.

One of the options to be considered in his review will be the feasibility of a hub system. The advantages of a hub, says Soper, are that it increases capacity and makes it easier to handle speed-based traffic. The disadvantages are that it makes distribution less flexible. "We want to be a more flexible carrier than our competitors," he says. "Our current strength is adapting to needs of specific customers."

He says he would turn down companies who were not compatible with Lynx's network. "It doesn't make sense for us to change our structure and then expect our customers to change theirs. We are a shared-user carrier, but we still have to be responsive."

Lynx's contracts include Midland Bank, Honda parts division and the Department of Social Security. Only about 20% of its business is ad hoc and it does not advertise for such work. Instead, its marketing is based, says Soper, on "effective selling and building long-term accounts". Prices are geared at attracting consignments of between 30-50kg.

As the parcels market moves more to Europe, Soper says customers will he looking more for guaranteed deliveries, documentation and "information about their distribution" rather than just speed. "There has been a concentration on speedbased services. There are, however, a lot of other demands customers make on their parcels company," he says. "Competitors have followed a copycat routine, offer ing similar services; but this creates competition and narror margins, so most of us are looking at ways of offering separate services other than just parcels."

He says he has "a lot of respect for the parcels industry'' which has stimulated a lot of progress compared with other sectors of the transport market. However, he claims that Lynx is the "human face" of the industry.

"Without naming anybody, some companies have a cavalier and aggressive attitude to wards their staff and this reflects on their customers. Pea pie are the basis of our relationship with customers and anyone who doesn't respect this doesn't have a role with Lynx," he says.

Human face

"We don't just put a smile on the face of the driver because the procedure book says we should. It's the ownership by employees which allows us to have this human face. There are a number of employees from competitors who would like to join us. There are driv ers who do not like their employer. I find that inappropriat in a service organisation."

Soper graduated from Exeter University in 1971 and joined NFC as a management trainee. He moved to BRS in 1982 as area general manager became BRS Midlands operations director in 1985, and assistant managing director BRS Northern in 1987.

He plays down the problem of moving from a truck supp13. company to a parcels firm. "BRS is different in that it is not system-based, but custon ers are customers and employees are the same. Our cu torners buy our attitude."

Although he admits Lynx's depots are "basic", he says that whether a building is hitech or not is "interesting, bi not crucial". He claims Lynx': computer system is as good ,1 that of any of its rivals. "It would be nice for us to have new, clean premises, but parcels-filled depots aren't necessarily what the custome wants."