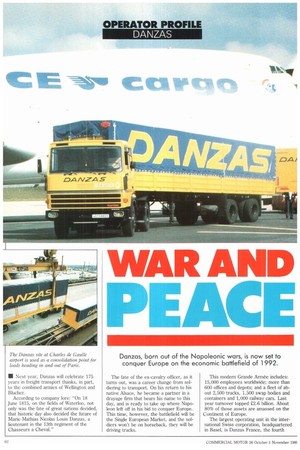

Danzas, born out of the Napoleonic wars, is now set to conquer Europe on the economic battlefield of 1992.

Page 60

Page 61

If you've noticed an error in this article please click here to report it so we can fix it.

• Next year, Danzas will celebrate 175 years in freight transport thanks, in part, to the combined armies of Wellington and Blucher.

According to company lore: "On 18 June 1815, on the fields of Waterloo, not only was the fate of great nations decided, that historic day also decided the future of Marie Mathias Nicolas Louis Danzas, a lieutenant in the 13th regiment of the Chasseurs a Cheval." The fate of the ex-cavalry officer, as it turns out, was a career change from soldiering to transport. On his return to his native Alsace, he became a partner in a drayage firm that bears his name to this day, and is ready to take up where Napoleon left off in his bid to conquer Europe. This time, however, the battlefield will be the Single European Market, and the soldiers won't be on horseback, they will be driving trucks. This modern Grande Artnee includes: 15,000 employees worldwide; more than 600 offices and depots; and a fleet of about 2,500 trucks, 1,500 swap bodies and containers and 1,000 railway cars. Last year turnover topped £2.6 billion. About 80% of those assets are amassed on the Continent of Europe.

The largest operating unit in the international Swiss corporation, headquartered in Basel, is Danzas France, the fourth largest transporter in the country with 5,000 employees and operations in 170 cities. Here, Danzas has developed its full-service approach to transport to a greater degree than anywhere else. In France it offers everything from freight forwarding to warehousing to a new fullload service meant to complement its consolidation service known as Eurapid.

"We used to be just an organiser of freight," said Klaus E Pfab, managing director of international shipments for Danzas France. "But today we are becoming more and more an operator."

The shift from a freight forwarding organiser to freight manager and operator was required because of the new demands on transporters the SEM will bring. According to Danzas, competition will be as fierce in the industrial sector as it will be in transport, forcing many manufacturers to concentrate on their core business, leaving the distribution of their products to transport professionals.

"There was a period when the big companies wanted to do their own forwarding, but more and more the opposite is true," says Pfab. "Manufacturers have to concentrate on what they do best and then negotiate with professional companies such as ours to handle the distribution."

INDUSTRIAL GROWN

Danzas officials have predicted a 40% increase in freight volume by the year 2000, much of it coming from the growth in industrial distribution. Danzas has been preparing for years to offer special services in this field, which it defines as total transport management from the factory to point-of-sale in fullor part-load shipments, with or without intermediate warehousing, under long-term contracts.

Over the past few years, Danzas has been investing heavily to strengthen its full-service network.

In 1985, Danzas bought Unilever's distribution and warehousing companies in France (Satem SA) and Spain (SAD). In 1987, it bought another Unilever distribution subsidiary, SBT in Belgium. It was "a strategic step in industrial distribution throughout Europe," according to Danzas.

Last year, Danzas also entered Europe's fiercely competitive full-truckload business with a service designed to complement its well-established Eurapid express part-load consolidation service. Eurapid is a scheduled regular route service between points in 16 western European countries with more than 100 depots linked by a computer system that can track the shipments from pick-up to delivery. Last year, Danznet was created, bringing together in a single system all Danzas computer terminals, including hook-ups between Danzas offices and big customers.

In the past few years, Danzas has also made its first serious attempt to develop a UK business of its own. Until 1981 Dan zas had operated in the UK only through partnerships and joint ventures. But that year it bought Gentransco, a group of companies mainly involved in European, sea and air freight forwarding.

In 1987, it bought Overall Transport, which had been granted the Eurapid franchise in the UK in 1983, and merged its operations with Gentransco to create Danzas UK.

The acquisition allowed Danzas to regain full control of its fast developing express business and also took Danzas into Scotland where Overall was strong but where Gentransco had barely ventured.

Danzas UK now employs 500 people with 16 depots nationwide and air freight offices at Heathrow, Manchester and Bristol airports.

The latest expansion of Danzas UK was the purchase in July of CAT Nationwide Carriers, which operates vehicles for parcels and general cargo. A joint venture was also announced in April with the Swedish freight forwarder Rationell Spedition AB to link its major British terminals with Gothenburg, Malmo, Stockholm and Trellborg with a twice-weekly groupage service. Groupage trailers leave both the UK and Sweden on Wednesdays and Fridays and arrive on Fridays and Mondays. Full-load shipments are also supplied on demand.

"For both companies, the new partnership is important," says Horst Frohling of Danzas UK. "For us it is a new service to a new country and signals the company's intention to take a larger share of the Scandinavian market."

Actually, Danzas is already operating in Scandinavia through its ownership of Overall, which markets under its own name a groupage service between Castle Donington and Stockholm and an express service called Nordic Express between the UK, Sweden, Finland and Norway.

Ultimately, the goal is to integrate the Danzas UK network into the system on the Continent to provide pan-European services when the final barriers to the SEM fall. For Danzas, that should mean further development in the UK where it is relatively small but keen to expand. For Danzas UK the benefits are potentially greater. Few companies of its size will be able to sell a European network as its own operation.

To what extent Danzas distribution services such as warehousing will be marketed in Britain remains to be seen, according to UK managing director, Michael von der Nue11, who is not convinced that UK customers need or want such services.

"The larger UK retailers have developed in-house distribution systems which are among the most advanced in the world," he says. "Although they have often sub-contracted haulage, by and large, they have retained control of the warehouse and thus the overall distribution operation.

"This is in stark contrast to countries such as France, where third-parties have been entrusted with responsibility for complete retail distribution operations," he says. "This has justified the development within Danzas of specialist divisions such as Transvet which concentrates on garment warehousing and distribution."

What role the Channel Tunnel will play in linking Danzas UK with the Continent is also unclear.

TUNNEL ALTERNATIVE

"At present, a trailer leaving London at 17:00hrs can expect to be unloading at 08:00hrs in Paris or Aachen, for example. The ferry services are generally efficient and reliable," siys von der NueII. 'The shuttle trains through the tunnel will provide an alternative to the ferries and will be considered according to rates, efficiency and driver acceptability."

Danzas expects the competition in the truckload business to get even more cutthroat as 1992 approaches, but through attrition to stabilise after a short time.

"The majority of those who venture into Europe will find it more demanding and less profitable than they had envisaged and they will withdraw," he says. "We suspect that those who remain will do so on the basis of specific contracts with manufacturers or subcontracts with larger transportation concerns such as ourselves."

And with its big brother to the south, von der Nue11 believes Danzas UK will record rapid growth in groupage and consolidation services from manufacturers wanting to expand into Europe.

"While we are not alone in providing such a comprehensive offering," he says, "We feel we are well ahead of the pack." 0 by John Parker