THE RIGHT

Page 54

If you've noticed an error in this article please click here to report it so we can fix it.

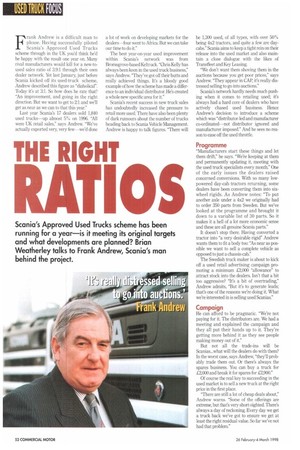

Scania's Approved Used Trucks scheme has been running for a year—is it meeting its original targets and what developments are planned? Brian Weatherley talks to Frank Andrew, Scania's man behind the project.

Frank Andrew is a difficult man to please. Having successfully piloted Scania's Approved Used Trucks scheme through in the UK you'd think he'd be happy with the result one year on. Many rival manufacturers would kill for a new-toused sales ratio of 3.9:1 through their own dealer network. Yet last January, just before Scania kicked off its used-truck scheme, Andrew described this figure as "diabolical". Today it's at 3:1. So how does he rate that? "An improvement, and going in the right direction. But we want to get to 2:1 and we'll get as near as we can to that this year."

Last year Scania's 17 dealers sold 1,840 used trucks—up almost 5% on 1996. "All were UK retail sales," says Andrew. "We've actually exported very, very few—we'd done a lot of work on developing markets for the dealers—four went to Africa. But we can take our time to do it."

The best year-on-year used improvement within Scania's network was from Bromsgrove-based Keltruck. "Chris Kelly has always been keen in the used truck business," says Andrew. "They've got off their butts and really achieved things. It's a bloody good example of how the scheme has made a difference to an individual distributor. He's created a whole new specific area for it."

Scania's recent success in new truck sales has undoubtedly increased the pressure to retail more used. There have also been plenty of dark rumours about the number of trucks heading back to Scania Vehicle Management. Andrew is happy to talk figures. "There will be 1,300 used, of all types, with over 50% being 4x2 tractors, and quite a few are daycabs." Scania aims to keep a tight rein on their release into the used market and also maintain a close dialogue with the likes of Transfleet and Key Leasing.

"We don't want them shoving them in the auctions because you get poor prices," says Andrew. "They appear in CAP, it's really distressed selling to go into auctions."

Scania's network hardly needs much pushing when it comes to retailing used; it's always had a hard core of dealers who have actively chased used business. Hence Andrew's decision to introduce a scheme which was "distributor-led and manufacturer co-ordinated—not distributor ignored and manufacturer imposed." And he sees no reason to ease off the used throttle.

Programme

"Manufacturers start these things and let them drift," he says. "We're keeping at them and permanently updating it, meeting with the used truck specialists every month." One of the early issues the dealers raised concerned conversions. With so many lowpowered day-cab tractors returning, some dealers have been converting them into sixwheel rigids. As Andrew notes: "To put another axle under a 4x2 we originally had to order 350 parts from Sweden. But we've looked at the programme and brought it down to a variable list of 30 parts. So it makes it a hell of a lot more economic sense and these are all genuine Scania parts."

It doesn't stop there. Having converted a tractor into "a very desirable rigid" Andrew wants them to fit a body too: "As near as possible we want to sell a complete vehicle as opposed to just a chassis-cab."

The Swedish truck maker is about to kick off a used retail advertising campaign promoting a minimum £2,000 "allowance" to attract stock into the dealers. Isn't that a bit too aggressive? "It's a bit of overtrading," Andrew admits, "But it's to generate leads; that's one of the reasons we're doing it. What we're interacted in is selling used Scanias."

Campaign

He can afford to be pragmatic. "We're not paying for it. The distributors are. We had a meeting and explained the campaign and they all put their hands up to it. They're getting more behind it as they see people making money out of it" But not all the trade-ins will be Scanias...what will the dealers do with them? In the worst case, says Andrew, "they'll probably trade them out. Or there's always the spares business. You can buy a truck for £2,000 and break it for spares for £2,900."

Of course the real key to succeeding in the used market is to sell a new truck at the right price in the first place.

"There are still a lot of cheap deals about," Andrew warns. "Some of the offerings are extreme, but that's very short-sighted. There's always a day of reckoning. Every day we get a truck back we've got to ensure we get at least the right residual value. So far we've not had that problem."