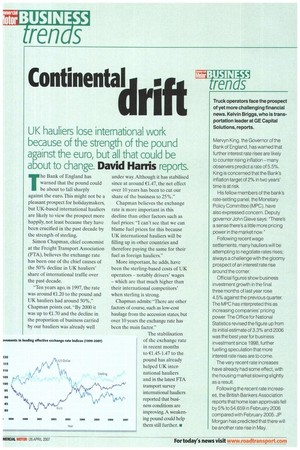

Truck operators face the prospect of yet more challenging financial

Page 52

If you've noticed an error in this article please click here to report it so we can fix it.

news. Kelvin Briggs, who is transportation leader at GE Capital Solutions, reports.

Mervyn King, the Governor of the Bank of England, has warned that further interest rate rises are likely to counter rising inflation—many observers predict a rate of 5.5%. King is concerned that the Bank's inflation target of 2% in two years' time is at risk.

His fellow members of the bank's rate-setting panel, the Monetary Policy Committee (MPC), have also expressed concern. Deputy governor John Gieve says: "There's a sense there's a little more pricing power in the market now."

Following recent wage settlements, many hauliers will be attempting to negotiate rates rises; always a challenge with the gloomy prospect of an interest rate rise around the corner.

Official figures show business investment growth in the final three months of last year rose 4.5% against the previous quarter. The MPC has interpreted this as increasing companies' pricing power. The Office for National Statistics revised the figure up from its initial estimate of 3.3% and 2006 was the best year for business investment since 1998, further fuelling speculation that more interest rate rises are to come.

The very recent rate increases have already had some effect, with the housing market slowing slightly as a result.

Following the recent rate increases, the British Bankers Association reports that home loan approvals fell by 5% to 54,659 in February 2006 cornpared with February 2005. JP Morgan has predicted that there will be another rate rise in May.