cOtriing U .

Page 39

Page 40

Page 41

Page 42

Page 43

Page 44

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

7osei,

T: urn any corner in West Yorkshire and you're likely to find yourself in a haulage yard. This region appears to have weathered the recession better than the troubled south and its excellent transport links make it an attractive proposition for hauliers. A new project, the Yorkshire Link Road, linking the Al -M1, will be one of the first major roads built by the private sector. A freight village is due to be completed near Wakefield next year, handling up to 400,000 tonnes of freight a year through the Channel Tunnel and partly funded by the European Regional Development Fund. The viability of the region is underlined by the fact that one of its key towns, Halifax, was named as the fifth most profitable place in Britain in a report by Dun & Bradstreet. However, Government figures reveal that Yorkshire has Britain's highest proportion of low-paid workers. Patric Cunnane headed north to find out if the winds of affluence are indeed blowing across the Yorkshire Moors, or whether the green shoots of recovery remain as

hesitant as in the once-prosperous South... .

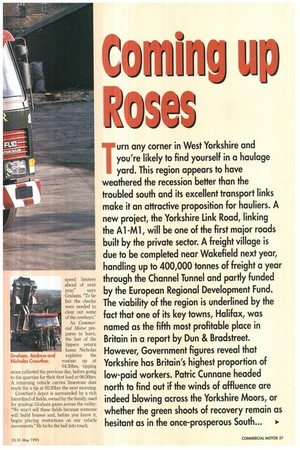

FACTFILE CLAUDE HELLOWELL

Sowerby Bridge. FOUND, 1930, Mill Bank,

West Yorkshire. -TOP. Peter and Paul Hellowell.

Five Seddon Atkinson rigids, four Seddon Atkinson tractors, Iwo ERF tractors, one Mercedes-Benz 7.5-tanner. Buys new. Most recent purchase—an ERF tractor in January 1995. 'Ty COt. Distributing raw materials for the food industry. I URNOVER E750,000.

Claude HeHowell's spacious site nestling in the deeply wooded Ryburn Valley at Sowerby Bridge looks for all the world like a military encampment. The impression is given credence by a neat row of pale green Nissen huts and, nearby, a corner where Second World War aircraft engines have come to die.

The military impression is not entirely erroneous. The seven-acre Hellowell site was an army drill ground after the war although these days the Nissen huts harbour nothing more deadly than foreign beer, food products and clays. Hellowell does a lucrative line in storage—a couple of the huts are rented to other operators, including a parcel carrier.

But why the aircraft engines? Director Peter Hellowell identifies the rusting remains as the business ends of a pair of Hercules bombers and a Hurricane fighter, in storage for a London millionairess. But why? "God Knows," laughs Peter.

He introduces his brother Paul, fellow director in an enterprise specialising in transporting and storing raw food materi

als. The business owes its origins to the brothers' grandfather, Claude Hellowell, who in 1930 put a horse and cart into service removing mill waste. Coal and grain followed. And motorised trucks.

Now the business has 12 vehicles: five Seddon Atkinson rigids; four Seddon Atkinson tractors; two ERF tractors; and a Mercedes 7.5-tonner. Vehicles are kept up to 10 years, "until they cost us money", says Peter. One of the ERFs was purchased as recently as January The company's main client is Manchesterbased Cenestar, for which it has worked locally since 1957. Cerestar produces corn products and other food materials which Hellowell delivers to bakeries and breweries within Yorkshire.

Hellowell's best-known client is sugar producer Tate & Lyle, for which it both delivers and stores. The job is frequently routed to the company's main plant in Silvertown, London, where backloads are conveniently provided by Tate & Lyle.

A contract for clay distributor Lawrence Industries takes Hellowell all over the UK— the clays find use in the printing, building and food industries.

Hellowell's decision to specialise in food related distribution has stood it in good stead during some bleak years. "The recession has not really affected us," says Paul, "because people still have to eat don't they?" But he admits that getting a rate increase has proved tough: "We've had point-blank refusals from some customers."

The brothers bought the business from Cyril Hellowell, an uncle who was managing director until 1993 and a former partner to their father, whose shares they inherited on his death 14 years ago. They divide their responsibilities. Paul's role as operations director is helped by his past experience as a transport manager in a London-based TDG company. Peter, with seven years engineering experience at Seddon Atkinson, looks after the fleet and can be pressed into service as a spare driver. Which loads does he take out? "The easy ones," he laughs.

In line with a family tradition, Peter lives on site in the "mechanic's bungalow", formerly. his father's home: "If wagons don't start in the morning lam on hand."

Since the six-death tragedy nearby brought notoriety to the town's name, the brothers have noticed an upsurge in enforcement at Sowerby Bridge. Three multi-agency checks near the scene of the accident have led to three Hellowell vehicles facing routine inspection.

More recently the firm has been the victim of an entirely new crime, mobile phone cloning. Peter shows Commercial Motor a stack of average monthly bills, seldom totalling more than £10 ("Drivers only make one call a day to find out where they are going,"). Then he produces one for £235, detailing a series of calls made illegally from the Birmingham area. Fortunately the service provider is accepting responsibility

Peter grins ruefully—there's progress and there's progress.

WILL MURRAY UNIVERSITY OF HUDDERSFIELD

CIAL VEHICLE ACE It hen an accident occurs, how many hauliers stop WV to examine the circumstances in detail and work out how that accident could be avoided? How many know the true cost of even a minor shunt, let alone a fatal?

These are questions that Will Murray, senior lecturer at Huddersfield University's Department of Transport and Logistics, will be exploring on 11 July when the University hosts a conference: Reducing Commercial Vehicle Accidents. Participants will include LAs, police and transport companies which have taken part in case studies to analyse the cause of accidents and work toward prevention.

So what is the cost of an accident? A merely "bad" accident will cost £30,000, says Murray, including vehicle downtime, stock loss and insurance excess. A fatal accident can push that bill up to £760,000, including loss of future earnings. No cost can be placed on the grief and suffering of loved ones. And what can a transport company do to reduce the chance of accidents? Murray has devised a model known as CCSSM (Cost, Causes, Systems, Solutions and Monitoring). An Oldham reefer operator claims to have cut accidents by 50`A after introducing this system, according to Murray, who outlines some questions hauliers should be asking:

• Do some depots have more accidents than others?

• Do they happen on a particular day/time?

Do they happen when drivers have been on the road for some hours? (After around 100 miles he believes that drivers tend to lose concentration).

Are a few drivers involved in a high proportion of accidents? Are they young drivers?

Do recruitment policies eliminate aggressive, impetuous types?

Are accidents happening at known blackspots? Solutions can include defensive driver training to which insurance companies such as General Accident are prepared to contribute. At the very least hauliers need to develop a safety culture—one where drivers check rudimentary things such as tyre pressures before leaving the depot.

For more details contact Will Murray on (01484) 422288.

ACTFILE PATERSON BULK LIQUIDS ASED: Birstall, Batley. FOUNDED: 1974, Batley, distributing pig feed. ROPRIE1OR: Sara Battye, director. FLEET: 60 tankers in a mixed fleet of new and used. ought three new tveco Ford EuroTechs since January. SPECIALITY CONTRACT: istributing liquid chocolate. TURNOVER: 2.4.5m.

magine drowning in warm chocolate. Depending on your perspective, this glorious or inglorious fate awaits those lucky or unlucky enough to fall into one of Patterson Bulk Liquid's chocolate tankers. The Batley firm moves liquid chocolate for use in coatings for chocolate biscuits and confectionery. The coating must be moved at a onstant 40°C, created by a water-fed central heating system beneath the tank. "A very difficult product to move," according to Patterson director Sara Battye.

If the chocolate goes cold, it goes hard. "If that happens, the only thing you can do is et a man inside the tank to chip it away, "says Battye. This was a common occurrence 20 years ago. Heaven for some, hell for others. Now the tanks have polyurethene insulation with special heat retention properties. Customers include suppliers to United Biscuits,

ars, Cadbury and Burton Biscuits (coating for the ubiquitous Wagon Wheels). The com

any works directly for Bradford chocolate manufacturer Meltis, with two vehicles in its ivery.

The volatile nature of the cocoa market serves to push up the value of chocolate conignments. But the market suffers from seasonality, with a flat summer given only a partial 'nip by the recent introduction of chocolate bar icecreams. Fortunately, Patterson's volme lies in the distribution of edible oils, accounting for 75% of its work. Some of this goes

o the same customers that require chocolate, such as biscuit maker Burton, while other consignments are for producers such as Von Den Burgh in London, Anglia Oils in Hull and others in the Merseyside region.

The firm also delivers liquid yeast into bakeries technologically so advanced that atterson transport manager Eddie Storr says there's not a soul in sight: "One bakery in akefield makes one million loaves a day, yet you will be lucky to see six people.' Patterson's operation has agricultural origins. Battye's father Wesley Patterson came to Yorkshire from Northern Ireland and went into pig farming in the 1960s after a stint in the ivil service. He ran a couple of tankers for moving animal feed. In 1974 he identified a eed for moving bulk liquids, both chemical and foodstuff. But he became unhappy about oving chemicals and foodstuffs in the same tanks, even though it was legal, and by 1977 dedicated the firm to foodstuffs. In those couple of decades the company has grown

o a 60-strong fleet and, last year, invested 2750,000 in new equipment. But despite a

arge fleet, little work is formerly contracted, most hiring is on a spot-hire basis: "Customers ring up and want an order tomorrow morning," says Battye. Starr agrees: "Years ago, you could route a vehicle for a week, now you can't route it for a day." All of which makes it imperative that the cabs are linked to base by Band-3 radio. Sara Batiye took over running the firm after a manager left suddenly and her father anded her the reins. She is more relaxed around trucks than in the early days but says, "I don't feel I've got engine oil coursing through my veins." What gives her a buzz is watch'ng the business develop.

In any case, if the market for liquid chocolate melted tomorrow, there

re other irons in the family fire A nightclub,and a pub in atley and a new retail centre on a 16-acre site

hich was formerly a mill. Brass in ocket, ndeed.

1 hen Irish businessman Neil Magee

bought A One Transport from founder Jack Robinson in 1987 he set about a programme of acquisition to expand the then 40-year-old company. Smaller operators and their vehicles were acquired. But Magee reckoned without the severity of the impending recession.

By the turn of the decade the company was in severe financial trouble and losing money. Because of its large fleet, nationwide depots and corresponding staffing costs it faced a crisis of overheads at a time when hauliers were going down like ninepins in the wake of the general collapse of UK industry.

Things could not go on as they were if the company was to survive. Casting about for a solution, Magee decided to put an accountant in charge to stem the flow of losses. Enter Bond, Keith Bond.

At that time, 1992, Bond was managing finances at another Magee company, Knaresborough-based loudspeaker manufacturer RE Inghams. Magee offered him the poisoned chalice—general manager of a loss-making haulage company at a time when no haulier was finding things easy.

Three years on Bond points to a small profit in 1994 as evidence that the medicine is working. The bitter pill included closing depots at Felixstowe and Tilbury and sacking 10% of the workforce at the least profitable depots. A year ago Barry Kitchen, whose experience includes a long stint at Scottish Road Services , joined as operation manager. Like a super tanker, the company is slowly turning round.

Kitchen is realistic about the challenge, "We are not fat and successful like Stobart, we've got a fight on our hands. But slow progress is bringing us back into line—success breeds success."

A programme of reshaping the company's direction is under way. The equipment and facilities are there if the right formula is found—depots in Newport, Glasgow; Bradford, Leeds and South Mimms; 240 employees and 140 vehicles. The company offers general haulage to the UK and Continent, the latter long-distance only: We are not interested in channel hopping," says Kitchen.

Bond is keen to move the UK operation from general haulage to dedicated contracts, allowing him to "get closer to the customer and the customer's customer."

In 1993 the company won a contract with York-based US firm Welstar to run 50 trailers in the customer's livery. The contract survived a recent blip when Welstar changed its name to Constar and the curtainsiders required resigning.

Bond claims success for a 16-vehicle dedicated contract for Boots in Yorkshire. In March the retailer awarded A One its quality award for northern distribution at its annual logistics meeting in Nottingham.

The company also works for major northern manufacturers such as Zeneca, Courtaulds and ICI, including a recently won European distribution contract for the latter. It operates a dedicated Volvo FLIO on a regular Bradford to London run for AE Engine Parts.

Tidying up the fleet is the next priority The spate of acquisitions in the late 80s led to a mix 'n'match of liveries and vehicle types. Bond has harmonised liveries and is starting a replacement programme of tractors and trailers.

Flats and boxvans are being ditched in favour of triaxles and curtainsiders-10 triaxles have just been acquired for the European operation. The oldest tractors have been pensioned off. "We want to replace a couple of dozen a year, " says Bond of his 140vehicle fleet.

FAaFILE BRIAN YEARDLEY CONTINENTAL BASED: Featherstone. Southern depot at Headcorn, Kent opening soon. FOUNDED: 1975, Hull on UK container work. PROPRIETOR: Brian Yeardley, chairman. FLEET: 70 vehicles, 100 trailers. Buys Volvos new. Engaged in a £6m replacement/addition programme of tractors and trailers ending in March 1996. Most recent purchases include several Volvo FH12s. SPECIALITY CONTRACT: General haulage to the Continent, including hanging garments. TURNOVER: £10m; up to C400,000 profit.

Unusually for a Monday afternoon, Brian Yeardley's depot in sleepy Featherstone is full of trucks kicking up dust as they prepare to set off on the long haul to the Continent. The yard should be empty since Yeardley's fleet of roadtrains and drawbars normally ship out on a Sunday bound for France, Italy, Spain and points south. But this is Monday 1 May, a holiday and a day of empty workplaces and curtailed truck movements throughout Europe. Hence, the delayed start to the week.

It is also a day when Yeordley takes delivery of a new Volvo FH12, part of a batch of 55 Volvos, including 10 additions to the 70-vehicle fleet, which will set the firm back nearly 'Um by the time they are all delivered next March. The company is also spending more than £2m on new trailers.

Rotherham-born Yeardley runs all his vehicles on Continental work. He set up 20 years ago,with a single Scammell, taking containers out of Hull, Felixstowe and Southampton. In 1979, he made the switch to Continental work, reasoning that the greater mileage would bring in greater revenue. "Besides," he adds, "if you deliver to UK supermarkets these days, they just you have you standing about." The vehicle replacement programme is designed to modernise the fleet to meet Continental standards. By year end Yeardley plans to have switched all his tractors for low-height units, hauling flat-floored megatrailers with 3m ceilings, eliminating the step that is so unpopular on the Continent. "I hope the new stuff will last five or six years," says Yeardley, "The only thing that will bolls it up is legislation." The investment in new equipment is being paid for out of a healthy start to the nineties. Yeardley says he has increased turnover by 10% a year for the past four years—he reckons the new-model recession bit less deep in the North.

A soon-to-be opened southern depot at Headcorn, Kent, licensed for 10 trucks and 15 trailers, will put him five hours closer to Europe. This should help the company avoid the trouble it got into earlier this year when deputy LA Brian Homer rebuked it after its drivers exceeded hours regulations (CM 26 January-1 February). The hearing to obtain a licence for the Headcorn depot was not without its difficulties. At an Eastbourne public enquiry LA Brigadier Michael Turner questioned the company's repute in the light of hours offences committed by its drivers in 1990 and 1993 together with a number of overloading offences. However, Turner was satisfied that the offences were the result of driver error rather than company operation and granted the licence for the full five years (CM 23-29 March). Yeardley says that breaches of the 90-hours-a fortnight driving rule had been exacerbated by speed limiters adding to journey time: "It's legislation gone barmy because a bloke with an F-reg lorry can still do 70mph," he points out. "People hang on to old stock for that reason but the vehicles cannot be as well maintained as new. The law should insist that all vehicles have speed limiters by next June."

FACTFILE CONNECTION FREIGHT BASED: Bradford. FOUNDED: 1985, Bradford. PROPRIETOR: Charles Bancroft, managing

director. 12 vehicles, including 10 7.5-tanners and two 35cwt vans. Most of the vehicles are MAN L2000s; all are on three-year contract lease schemes. SPECIAL1TY CON Auto components overnight to the Continent. TURNOVER: Elm.

At some time or other most of us have been tempted to buy things in pubsdogs...video recorders...unwise quantities of shellfish at closing time. Accountant Charles Bancroft went a step further. He bought a European express freight company.

The unconventional acquisition came about when Bancroft, with no previous form in transport, got chatting in the bar to Robin Stead, founder of Connection Freight, who mentioned that his three fellow directors wanted to sell up. "I said, show me some figures," says Bancroft. The upshot was that Bancroft and his brother George bought the 10-year-old operation which specialises in delivering car parts overnight to Europe.

Fortunately Bancroft also inherited John

Denker, the company's able operations director, a multilingual German who came to Britain in 1971. His German fluency was instrumental in the company winning a contract for Opel's special consignments.

Unusually, for an international operation, the company runs nothing larger than 7.5 tonnes in its 12-vehicle fleet. As Denker explains the company tackles "hotshot runs" when a production line is threatened.

Bancroft elaborates: "Perhaps a production line in Germany has come unstuck and needs a couple of pallets of exhaust pipes to keep it going. Just-in-Time marries so closely to the needs of the production line that if it gets slightly out of sync they call us in."

While 85% of the company's export work is auto related, the art is to fill the returning vehicles, says Bancroft. Backloads include hazchem products for firms such as ICI and Air Products but the company's 7.5-tonners specialise in low-weight/high-value cargoes: 60% of the loads are confectionery, mostly Belgian chocolates.

On the day CM called the firm had just imported an extreme combination of high value and low weight: 7kg of drugs from Switzerland for Zeneca in Macclesfield, valued at a cool Llm.

When Bancroft took over the company vehicles were bought on HP and they fleet was of varying ages and condition: "We could not budget for maintenance," he says. He soon switched to contract leasing, deciding that it wasn't his brief to find and service vehicles. Two main dealers, LCW in Halifax and Browns in Leeds, supply the vehicles; mainly MAN L2000s, although recently the firm has begun trials with a Leyland Daf. This offers an extra 200kg in payload thanks to its lighter chassis-cab and a second is on order. But why use two dealers to lease such a small fleet? Denker smiles: "You can play one off against the other—if one dealer has all the work they think they've got you."

FACTFILE SHAWFLEET BASED: Slaithwaite, near Huddersfield. FOUNDED: 1984, Slaithwaite (after Sykes Group relinquished the name). PROPRIETOR: Geoff Ellis and Hylton Large, directors. FLEET: 14 tankers run by owner-drivers, mixed marques. Drivers choose new or late-model used vehicles. SPECIALITY CONTRACT: Distributing bulk chemicals and lubricants. TURNOVER: £1.5m.

Slaithwaite (pronounced "Sloweth") is one of those places that gives you a sense of deja vu. Perhaps because its picturesque mills and streets sometimes feature in period dramas and programmes such as The Last of the Summer Wine.

It is also home to Shawfleet, a tanker company specialising in the UK carriage of chemicals and lubricants. The operation has been run for 11 years by partners Geoff Ellis and Hylton Large who pooled their redundancy money from the Sykes Group, which then owned Shawfleet but had decided to opt out of transporting bulk liquids. Ellis was transport manager and Large worked alongside him in the transport office. Part of the redundancy package was the right to bear the Shawfleet name. The 14 trucks are run by owner-drivers although Ellis and Large originally bought three tankers from Sykes and were joined by three redundant drivers. Despite these upheavals the Shawfleet identity remains intact "We run as one fleet," says Ellis, who counts BASF, BP Oil, Rhone-Poulenc and Carless among his customers.

Choice of vehicles are up to the drivers, says Large: "Some buy new, some buy two to three-year-olds from larger fleets." Whatever they choose, the equipment must be presentable and reliable. Shawfleet takes responsibility for ensuring that hazardous goods regulations are adhered to: "We have to be professional to work for the type of companies that we do," explains Ellis. He admits that business is slow: "We keep them busy but it's a lot quieter than it used to be," he says. The fleet has been trimmed from a peak of 18. However, the two men have proved there is life after redundancy and their survival has prompted other ex-Sykes drivers to join them. But, having tasted ownership, neither has any plans to go back to being an employee.