T ipper operators have another big headache to deal with, along with late payment and vehicle maintenance—it's called the Landfill Tax.

Page 44

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

Hauliers carrying "inert" waste—material such as soil and brick—must pay the tip owner £2 on every tonne of waste deposited at a tip. This must be paid within 30 days. In turn, the tip owner pays the tax to HM Customs and Excise. Ultimately, the haulier has to increase his rates to the construction firm to compensate for the Landfill Tax. Combine the £2 per tonne being paid by the tipper owner with slow payment (commonly 90 days after the job has been done) and you

have the formula for running in the red. "It is the haulier that bears the brunt of it," says Bob Geddes, transport manager with RD Anderson. Although not directly levied on the haulier, the tax does make life more complicated.

However, one or two hauliers manage to escape the onslaught of late payment and the hassle of Landfill Tax. Nicholas Crowther, co-director of Bingley-based Jonas Crowther & Sons, which operates four tippers, hopes to win a lot of work thanks to the construction of the Aire Valley trunk road and the Bingley by-pass, which, he believes "are imminent within the next five years".

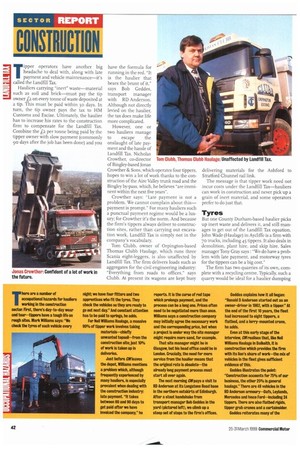

Crowther says: "Late payment is not a problem. We cannot complain about this— payment is prompt." For many hauliers such a punctual payment regime would be a luxury; for Crowther it's the norm. And because the firm's tippers always deliver to construction sites, rather than carrying out excavation work, Landfill Tax is simply not in the company's vocabulary Tom Clubb, owner of Orpington-based Thomas Clubb Haulage, which runs three Scania eight-leggers, is also unaffected by Landfill Tax. The firm delivers loads such as aggregates for the civil engineering industry: " Everything from roads to offices," says Clubb. At present its wagons are kept busy delivering materials for the Ashford to Stratford Chunnel rail link.

The message is that tipper work need not incur costs under the Landfill Tax—hauliers can work in construction and never pick up a grain of inert material, and some operators prefer to do just that.

TYres

But one County Durham-based haulier picks up inert waste and delivers it, and still manages to get out of the Landfill Tax equation. John Wade (Haulage) in Aydiffe is a firm with 70 trucks, including 43 tippers. It also deals in demolition, plant hire, and skip hire. Sales manager Tony Gray says : We do have a problem with late payment, and motorway tyres for the tippers can be a big cost."

The firm has two quarries of its own, complete with a recycling centre. Typically, such a quarry would be ideal for a haulier dumping unwanted inert loads, such as topsoil from a motorway project. Still, this would mean paying HM Customs and Excise the 12-per-tonne tax. Not so for John Wade (Haulage). The company recycles loads such as crushed concrete, which of course is transported from site. This means the firm does not pay Landfill Tax—it is only payable for loads which are dumped permanently at a site.

Although the company has the luxury of its own recycling facilities, the typical haulier must be prepared for landfill Tax calculations if he is carrying waste from a construction site. Late payment and meticulous attention to the maintenance of the fleet are also everpresent factors to bear in mind.

But one thing is certain: as long as people live in buildings and travel from A to B, the construction industry will stay in business.