Nexday Express's debts of £1.3m, shows just how vulnerable small

Page 26

Page 27

If you've noticed an error in this article please click here to report it so we can fix it.

franchisees can be — some Nexday operators could be forced to 'sell their homes.

The 35 Nexday franchisees saw their world collapse when parent company Speedwell Group went into liquidation on 8 June. Nexday was one of four Speedwell companies liquidated on the same day and the franchisees are among the many unsecured creditors owed 2793,000.

Individual franchisees are owed up to 2100,000 by Nexday. It invoiced customers on their behalf from its Congleten, Cheshire base which is also home to the Speedwell Group. In August 1991 Speedwell acquired 76% of Nexday shares from former owner Jim Zockoll in August 1991.

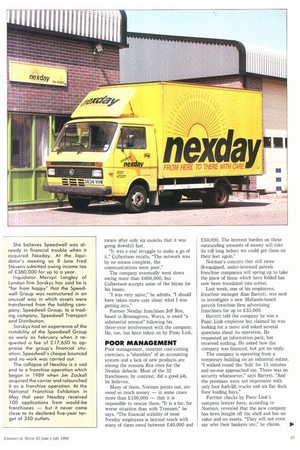

Yvonne Jones is one of the survivors. She and her husband ran the Nexday franchise in Cardiff and are owed 223,000. "The collapse was devastating but we have been able to carry on," she says. The business is now trading as ii Fowarders.

But she is bitter at the Speedwell takeover: They took a company that was financially sound and sold

it to a monster," she says of Zockoll's decision to sell.

Jones had never run her own business before buying a Nexday franchise in January 1990; her husband later became a partner. "I've got a background in sales and marketing which is what the parcels business is all about," she explains.

Speedwell's founder, Fred Stevens, has blamed the collapse of the whole group on what he sees as the inability of the franchisees to generate enough business for Nexday, but Jones believes the fault lies in the opposite direction. "What has come out loud and clear is that however much we sold we needed to three or four times as much to support Speedwell's overheads — we've put years of our lives into this and our houses have gone into the melting pot," says Jones. sell She believes Speedwell was already in financial trouble when it acquired Nexday. At the liquidator's meeting on 8 June Fred Stevens admitted owing income tax of 2360,000 for up to a year.

Liquidator Mervyn Langley of London firm Sorskys has said he is "far from happy" that the Speedwell Group was restructured in an unusual way in which assets were transferred from the holding company, Speedwell Group, to a trading company, Speedwell Transport and Distribution.

Sorskys had an experience of the instability of the Speedwell Group as early as February when it requested a fee of 217,650 to appraise the group's financial situation: Speedwell's cheque bounced and no work was carried out.

The collapse of Nexday is a sad end to a franchise operation which began in 1989 when Jim Zockoll acquired the carrier and relaunched it as a franchise operation. At the National Franchise Exhibition in May that year Nexday received 100 applications from would-be franchisees — but it never came close to its declared five-year target of 350 outlets.