IN THE FUTURE

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

The survey also asked operators about their future purchasing plans. One message came through loud and clear: the continued uncertainty over the economy means many operators are looking at extending contract hire and leasing contracts rather than buying new vehicles.

The average number of vehicles bought new in the past 12 months was 7.1; looking ahead to the coming year revealed a marginal drop, with operators expected to purchase, on average, seven new trucks. When it came to extending contract hire or leasing deals, however, there was a jump from 2.7 vehicles in the past 12 months to 5.7 in the coming year. Again, there were some variations depending on fleet size. Fleets with more than 50 trucks purchased an average of 24 new trucks in the previous year and planned to buy about the same in the coming 12 months. But the number of contract hire or lease extensions planned jumped from 7.2 to 10.7 in the same period.

Both small and medium-size fleets planned to buy fewer new vehicles in the coming 12 months, but operators with 21-50 trucks expected to extend contract hire on far more vehicles – up from 3.2 in the previous 12 months to 11.7 in the coming year.

Overall, 41% of respondents planned to buy at least one new vehicle in the coming 12 months – exactly the same proportion who had bought a new vehicle in the previous 12 months.

When asked what make of truck they were most likely to purchase, DAF looks set to remain market leader, coming top of the list with 35% (compared with its 24% share of the 2010 truck market above 6 tonnes). Volvo looks likely to see major sales gains, being named by 26% of operators (it took 12% of the market in 2010). Mercedes-Benz and Scania might also gain ground, with 25% of buyers planning to buy into the three-pointed star (18% share in 2010) and 19% favouring Scania (13% in 2010). MAN looks set to retain its 10% share, with Iveco and Renault both looking less popular among buyers.

DAF and Volvo were more popular among smaller fleets, with big fleet buyers eyeing Mercedes-Benz and Scania. While popular with big and small fleets, MAN needs to work harder to convince medium-size operators of its trucks’ merits.

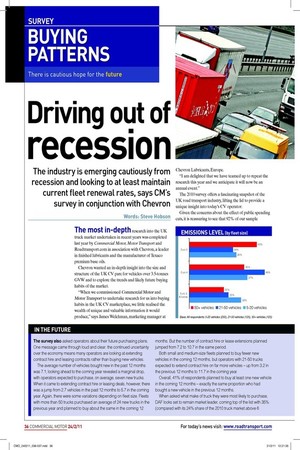

When it comes to specifying new vehicles, 44% of big fleets will now only buy Euro-5 trucks, while 24% of small fleet operators are not concerned about Euro-5. Despite plenty of coverage in CM about the impending arrival of the even tougher Euro-6 emissions standard, only 8% of our sample knew that it was coming into force in 2013 and 67% admitted they had not considered how Euro-6 would affect their purchasing strategy. Most pundits expect a surge in sales of lighter, cheaper and less-complex Euro-5 trucks in 2012. But this clearly hasn’t filtered through to most truck operators yet. Not surprisingly, large fleet operators are more likely to be thinking about Euro-6, with “only” 50% admitting to not giving it any thought compared with 78% of small fleets.

Overall, the study revealed an industry emerging cautiously from recession and, in a year that marks the return of the CV Show, looking forward to at least maintaining current fleet renewal rates.