Time for Euro-6

Page 14

Page 15

If you've noticed an error in this article please click here to report it so we can fix it.

Just like death and taxes, Euro-6 is something no one can avoid – so operators might as well start preparing for its arrival in 2013

Words: Oliver Dixon

EURO-6 MAY be coming into force on 31 December 2013, but that is a long way away for the road transport industry. Beset by many other problems, the industry is hardly giving it a second thought.

After all, when truck operators are surviving from weekly fuel bill to weekly fuel bill, 34 months seems very distant, and having the time to worry about 2013 might be seen as a luxury.

And, as emissions legislation is a fundamental element of operating trucks, why bother about that which is inevitable anyway?

Squeaky clean

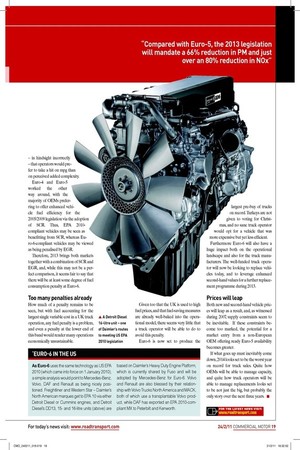

Euro-6 represents a huge change in the emissions landscape. Compared with Euro-5, the 2013 legislation will mandate a 66% reduction in PM and just over an 80% reduction in NOx. Given that Euro5 is a far-from-ilthy standard in itself, this level of reduction is very signiicant, and one likely to prove very expensive. This expense will have an impact on Europe – truck manufacturers, truck dealers, truck operators, and even the environment – in a number of different ways.

Getting the engine to work at 2013 levels should not be too hard a task, given the work that has already taken place for 2010. However, getting it to it is another matter.

The US offers considerably more latitude in terms of chassis packaging, not least because of the market’s preference for conventional over cab-over trucks.

And chassis packaging is an issue: there is now common agreement that Euro-6 will demand a combination of Selective Catalytic Reduction (SCR), Exhaust Gas Recirculation (EGR) and a particulate trap, and the addition of EGR demands that more cooling capacity is made available. Around 40% more radiator surface will be required.

European regulations mandate a maximum vehicle height of 4m, and length of 16.5m, and vehicle operations have evolved around these dimensions. So, while the 2013 engines may be ready, and, increasingly, proven in service, getting them to it into a compliant truck appropriate for European operation is another matter – and one that adds up to a signiicant cost.

Acquisition costs will hurt operators, but what about operational costs? The lesson from the US (see box), which remains relatively early days in terms of EPA 2010 adoption, suggests somewhere in the region of a 3% to 8% fuel eficiency improvement from the 2007 standard to the 2010 standard across a broad range of operations.

Bringing markets together

The US’s 2007 standard saw the adoption of EGR as a means to reducing pollutants. As fuel prices were at the time less of an issue than was the case in Europe, North American OEMs reasoned – in hindsight incorrectly – that operators would prefer to take a hit on mpg than on perceived added complexity.

Euro-4 and Euro-5 worked the other way around, with the majority of OEMs preferring to offer enhanced vehicle fuel eficiency for the 2005/2009 legislation via the adoption of SCR. Thus, EPA 2010compliant vehicles may be seen as beneitting from SCR, whereas Euro-6-compliant vehicles may be viewed as being penalised by EGR.

Therefore, 2013 brings both markets together with a combination of SCR and EGR, and, while this may not be a perfect comparison, it seems fair to say that there will be at least some degree of fuel consumption penalty at Euro-6.

Too many penalties already

How much of a penalty remains to be seen, but with fuel accounting for the largest single variable cost in a UK truck operation, any fuel penalty is a problem, and even a penalty at the lower end of this band would render many operations economically unsustainable. Given too that the UK is used to high fuel prices, and that fuel-saving measures are already well-baked into the operational model, there seems very little that a truck operator will be able to do to avoid this penalty.

Euro-6 is now set to produce the largest pre-buy of trucks on record. Turkeys are not given to voting for Christmas, and no sane truck operator would opt for a vehicle that was more expensive but yet less eficient. Furthermore Euro-6 will also have a huge impact both on the operational landscape and also for the truck manufacturers. The well-funded truck operator will now be looking to replace vehicles today, and to leverage enhanced second-hand values for a further replacement programme during 2013.

Prices will leap

Both new and second-hand vehicle prices will leap as a result, and, as witnessed during 2007, supply constraints seem to be inevitable. If these constraints become too marked, the potential for a market entry from a non-European OEM offering ready Euro-5 availability becomes greater.

If what goes up must inevitably come down, 2014 looks set to be the worst year on record for truck sales. Quite how OEMs will be able to manage capacity, and quite how truck operators will be able to manage replacements looks set to be not just the big, but probably the only story over the next three years. ■