An'ideal'rail customer

Page 35

Page 36

Page 37

Page 38

If you've noticed an error in this article please click here to report it so we can fix it.

who sends most by road by Brian Cottee

One of Europe's fastest-growing furniture suppliers selects transport with care — and now plans to vary wholesale prices according to handling costs

MOBEL IKEA is something of a Swedish -or at least Scandinavian — phenomenon at present, hut as well as having expansion plans which include Britain the company provides a practical example to toss into the largely theoretical arguments about road v rail freight now raging again in the UK. One has to listen closely when a highly efficient concern with private sidings, bulk traffic and two "private" trains a day still sends 85 per cent of its goods by road.

Ikea is also a company which has just decided to vary its prices to its own and other retail stores according to the economics of its handling and distribution. Quite separate from any conventional quantity discount will be a unit price which is lower for pallet-load orders than less-than-pallet-load deliveries. This incentive is based on very close calculation of storage and handling costs. , For these and other reasons I was glad of the opportunity to visit Ikea's head, quarters and 144,000 sq rn central warehouse at Almhult, in southern Sweden, in the course of a journey to meet SaabScania engineers at Sodertalje, about which I wrgte in CM earlier this year. Ikea buy furniture, much of it to its own design, from Scandinavian manu facturers. sells it through its own retail stores ind big mail-order business, and sells some wholesale to other stores.

. From a small start in Almhult in 1958 it now has Swedish retail. stores in Stockholm Sundsvall (400 km north of Stockholm). Gothenburg in the far west. Malmo in the deep south, and Koping. Outside Sweden it has stores at

Oslo, Copenhagen and Zurich and is building, or plans to build, 10 more .furniture supermarkets in Europe (mainly in Germany and Holland) over the next four years.

. This involves investing over 200m Krone '(C20m) but the company expects to see a .doubling of its present turnover of 600m krone (£60m) by 197778. All the developments are out-of-town stores with huge car parks — except in Japan where the company plans 13 "Ikea corners" in different stores.

The company runs no transport of its own. To supply this mushrooming business, selling goods which are vulnerable and often inconvenient in shape for transport, Ikea has developed a very cost-conscious distribution organization, based on almost total packaging of goods into convenient cartons for handling and carriage and/or the use of the standard 1200 mm x 800 mm ‘(3.9 ft x 2.6ft) Euro pallet. For beds, a 2000 mm x 800 mm pallet is used.

In making up truck or container loads (mainly by computer, needless to say) the computer is programmed to restrict the loading to complete pallet loads. The economics of under or over pallet load orders are then studied separately. Where Ikea's own stores are being supplied, the computer is programmed to estimate the implications of adding enough extra (un-ordered) goods to make a full pallet — eg, it is economically justifiable if the goods are of a type likely to be sold within two weeks.

Central warehouse

Furniture is bought by Ikea from six or seven local manufacturers, and from hundreds of others throughout Sweden. Some 86 per cent of Ikea's total sales goods are handled through the central warehouse at Almhult — where furniture arrives mainly by road. Ikea has its own containers for collection of supplies from local makers.

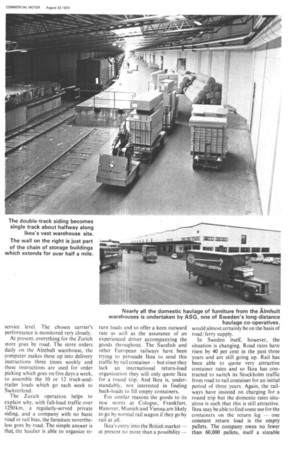

Of the outgoing goods, more than 80 per cent are for Ikea's own stores, the rest for other Swedish stores or for export. Of the latter 20 per cent, half goes by road, half by rail — the rail share being six full vanloads a day on the 600m ( 1,968 ft) private siding at Almhult, plus two vanloads-worth of smalls which go to a local rail groupage depot. The total road output from the Almhult central store is 20 to 25 truckand-trailer outfits daily, these being either 24m or 18 m long for Swedish destinations but only 18m for abroad. The 24 m (78.7ft) train length still allowed in Sweden means that each truck or trailer can be about 110 cum (3,928 cu ft) instead of 80 cum (2,857 cu ft). Since the average loading cube is 100 kg1 cum, the trucks and trailers average about 8 to 10 tons payload weight. The internal height of these tilt-covered vehicles being around 2.3 m (7.5ft), the standard load modules are 2.2 m high.

As well as customer traffic by rail, mentioned above, Ikea sends two to three rail vanloads daily to Sundsvall, north of Stockholm. By contrast, the really long-distance traffic (eg three 20 ft containers a day to a Japanese warehouse chain) goes by road and sea. Trucks take the containers by ferry to Denmark and on to Hamburg where they join a container ship. Ikea and the customer have looked at the possibility of using the trans-Siberian railway for this, but there are problems. For example, modern furniture adhesives will stand sub-zero temperatures while the train keeps moving, but if it is stationary for any length of time the "glue" deteriorates.

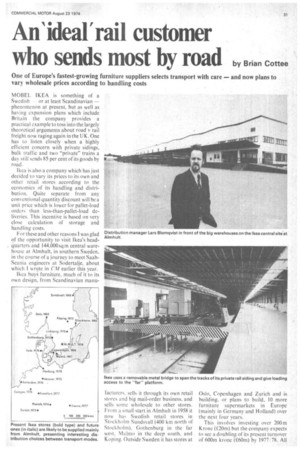

All of Ikea's road deliveries throughout Scandinavia are undertaken by ASG, one of Sweden's two big longdistance haulage co-operatives to which many sizes of haulier belong. The ASG local office is just down the road from Ikea's warehouse, and there is a trailer park almost on the Ikea site.

Volume – limited The traffic is volume-limited, not weight-sensitive, and rates are based on a per-cubic metre charge which varies with distance. ASG bills Ikea monthly on a single account — which for customers is one of the great advantages of haulage co-operatives. The customer needs minimal traffic adminstrations, saving money compared with dealing with many separate contractors, yet the business is undertaken by a variety of mainly small and medium sized hauliers who can exert close control over their own vehicles.

Ikea has a standing contract for so many vehicles a day (for example, six for Gothenburg) for which it pays a special contract rate. But it will expect to pay a slightly higher rate for extra vehicles required at short notice.

The customs and traffic section of Ikea's distribution division is responsible for seeing that economic full loads are dispatched to its own retail stores.

For overseas transport, the company always seeks tenders through shipping and forwarding agents. For instance, for Switzerland the agent is Jerre; Ikea lays down the service standards it requires for door-to-door transport over the 1250 km (800-mile) journey and the agent is expected to select the cheapest contractor who can guarantee that service level. The chosen carrier's performance is monitored very closely.

At present, everything for the Zurich store goes by road. The store orders daily on the Almhult warehouse, the computer makes these up into delivery instructions three times weekly and these instructions are used for order picking which goes on five days a week, to assemble the 10 or 12 truck-andtrailer loads which go each week to Switzerland.

The Zurich operation helps to explain why, with full-load traffic over 1250 km, a regularly-served private siding, and a company with no basic road or rail bias, the furniture nevertheless goes by road. The simple answer is that the haulier is able to organize re turn loads and so offer a keen outward rate as well as the assurance of an experienced driver accompanying the goods throughout. The Swedish and other European railways have been trying to persuade Ikea to send this traffic by rail container but since they lack an . international return-load organization they will only quote Ikea for a round trip. And Ikea is, understandably. not interested in finding back-loads to fill empty containers.

For similar reasons the goods to its new stores at Cologne, Frankfurt, Hanover, Munich and Vienna are likely to go by normal rail wagon if they go by rail at all.

Ikea's entry into the British market — at present no more than a possibility —

Nearly all the domestic haulage of furniture from the Almhult warehouses is undertaken by ASG, one of Sweden's long-distance haulage co-operatives. would almost certainly be on the basis of road / ferry supply,

In Sweden itself, however, the situation is changing. Road rates have risen by 40 per cent in the past three years and are still going up. Rail has been able to quote very attractive container rates and so Ikea has contracted to switch its Stockholm traffic from road to rail container for an initial period of three years. Again, the railways have insisted on charging for a round trip but the domestic rates situation is such that this is still attractive. Ikea may be able to find some use for the containers on the return leg — one constant return load is the empty pallets. The company owns no fewer than 60,000 pallets, itself a sizeable Local and long-distance trucks and trailers being loaded from the bank at Almhult.

investment.

Soon 10 40 ft rail containers will be filled daily at Almhult for the Stockholm store, loaded on to rail trucks using trailer-mounted transfer equipment bought by Ikea, trunked by night the 600 km to the capital and then taken by railway road vehicles to the store 10km from the station.

Previously, Sundsvall was the only store supplied from Almhult by rail. Any other switches to rail are likely to come slowly, if at all; it has taken a really big change in rates to outweigh the flexibility and close supervision provided by road haulage. Where service levels are more variable, however, as in the mail order business with which Ikea first started, rail transport provides a convenient answer. Twice a week the Ikea computer bulks up the orders by address, to see if there is at least 10 cu m (a rail van load) for a particular town or district, and these orders are then put on to rail, using the direct loading facility at Almhult.

The Almhult warehouse is in fact five adjacent warehouses on a site nearly half a mile long beside the private rail siding. The biggest and newest section is single-storey, 4.5 m (14.8 ft) high internally. The others are two-and threefloor buildings with 1storey heights from 2.7m (8.9ft) to 5.5m (18ft).

Handling throughout is by 50 Lansing Bagnall forklift trucks, all electrically powered for quietness, cleanliness and low maintenance cost. The distribution manager, Lars Blomqvist, told me he was very satisfied with them.

The warehouse complex employs 179 staff, and the total storage and handling cost of any item averages twice the actual over-the-road delivery cost. Half the total warehouse operating cost is for labour — which perhaps explains why the company, in this small town in a rural area, prefers to expand its warehousing frequently, rather than working more than five to six days a week or introducing a night shift. The warehouse turns over its capacity four times a year, and increasing the productivity of that turnover is one ol the objects of the plan, mentioned earlier, to build a storage and handling element directly into the wholesale price of articles_ One man with a forklift can handle 35. to 40cu m .(1,250 / 1,428cu ft) ol furniture an hour on full pallets or in pallet modules, but only 5 to I 0 cu m pet hour if handling single items — such as a dining chair. Ikea has made a detailed study of the individual storage and handling costs of its goods at Almhuli and the result will be reflected in the prices charged to its own stores as well as outsiders.

If the result is an even greater proportion of full pallet movements, the savings could be enormous. Going through the warehouse during my visit, we were walking past a seemingly endless mountain of cartons, each containing a small white domestic storage cabinet, when Mr Blomqvist suddenly stopped and looked back. "Hmm. We'd better order some more of those."

I suppose 1 looked surprised.

"Well, there's only about 16,000 ir stock — and that's barely 10 week'! turnover!"