Poll predictions gloom

Page 26

If you've noticed an error in this article please click here to report it so we can fix it.

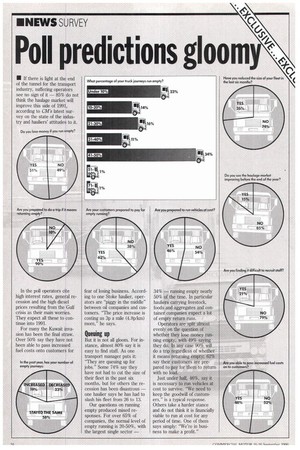

• If there is light at the end of the tunnel for the transport industry, suffering operators see no sign of it — 85% do not think the haulage market will improve this side of 1991, according to CM'S latest survey on the state of the industry and hauliers' attitudes to it.

In the poll operators cite high interest rates, general recession and the high diesel prices resulting from the Gulf crisis as their main worries. They expect all these to continue into 1991.

For many the Kuwait invasion has been the final straw. Over 50% say they have not been able to pass increased fuel costs onto customers for fear of losing business. According to one Stoke haulier, operators are "piggy in the middle" between oil companies and customers. "The price increase is costing us 3p a mile (4.8p/km) more," he says.

Queuing up

But it is not all gloom. For instance, almost 80% say it is easy to find staff. As one transport manager puts it: "They are queuing up for jobs.'' Some 74% say they have not had to cut the size of their fleet in the past six months, but for others the recession has been disastrous — one haulier says he has had to slash his fleet from 26 to 13.

Our questions on running empty produced mixed responses. For over 65% of companies, the normal level of empty running is 20-50%, with the largest single sector 34% — running empty nearly 50% of the time. In particular hauliers carrying livestock, foods and aggregates and container companies expect a lot of empty return runs.

Operators are split almost evenly on the question of whether they lose money running empty, with 49% saying they do. In any case 90% will do a trip regardless of whether it means returning empty; 62% say their customers are prepared to pay for them to return with no load.

Just under half, 46%, say it is necessary to run vehicles at cost to survive, "We need to keep the goodwill of customers," is a typical response. Others take a harder stance and do not think it is financially viable to run at cost for any period of time. One of them says simply: "We're in business to make a profit."