Leading growth industry

Page 99

Page 100

If you've noticed an error in this article please click here to report it so we can fix it.

Andy Thorns looks at prospects for CV sales in Europe during the next 10 years

LANNING a new vehicle model or a complete range of ehicles is a costly and timeonsuming business. Today's lans may not come to fruion for five, 10 or 15 years. The plans are passed on iformation gathered from a ariety of sources, carefully hecked and meticulously nalysed. Nothing can be left 3 guesswork.

Vehicle manufacturers ientify their market share on conomic trends and thereore the planned development of the commercial ehicle industry is a fairly ccurate barometer of the ational economy.

Most manufacturers use ighly sophisticated analysis methods to reach their objecives and we invited the iews of Ford's director of ruck sales, A.F.M. Thorns, ,n the prospects for the inlustry in the next decade. Mr 'horns has looked at the inlustry in general and proluced significant figures and nteresting, perhaps even ontroversial, opinions.

HE commercial vehicle busiess in Europe is heading for ?.cord figures this year. Some .2m commercial vehicles of all ategories will be sold in 1978 eating the prevlous best of .17m achieved in 1973. The larket has rebounded strongly -om the low of 931,000 in 975 resulting from the oil risis and the outlook for next ear is for further growth at round two per cent.

But what of the next five ears, or even the next 10 ears? Many factors of course rill influence the market and lose emanating from political r government sources are otoriously unpredictable. With nponderables like the

hanging attitudes of OPEC it is bvious that no one can claim to precast with any great degree f accuracy. However, a careful study of past figures and the making of a qualified estimate at how Europe will develop, reduces the amount of guesswork involved quite considerably. If we look back to the Sixties and Seventies, long-term growth trends are evident despite the cyclical nature of the business arid these can be extrapolated into the future.

Winning freight We can also study the role of road transport ,n Europe and fairly safely project how it will

develop. Road transport will almost certainly continue to win traffic from the railways, particularly for journeys away from major routes, and where speed of delivery to the customer is a significant factor. Bulk loads and regular shipments of large quantities of goods will, of course, continue to go by rail.

Most economists agree that the growth of international trade within Europe will be at a faster rate than the growth of the individual national economies and that road transport is most likely to benefit from the extra trans

port required as a result. The natural growth in intra European trade will be helped by the consolidation of Europe's motorways, autoroutes, autobahnen and autostrada into a road network resembling the interstate highway system of the USA.

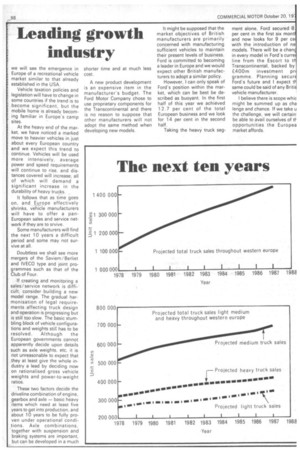

Even allowing then for cyclical patterns, we expect the pre sent trend in growth to continue and by 1982 we are forecasting that the total European market will have reached 1.3m units with further growth to 1.4m by 1987.

Within these overall market totals we see the relative strength of the light, medium and heavy segments staying fairly static, except that the medium commercial segment is likely to gain marginally at the expense of the light and heavy segments. In round figures this means that the light, car-derived van market will increase from the 294,000 units this year to 296,000 in 1982 and 336,000 in 1987. We expect too, that medium commercial sales will increase from this year's 567,000 to 614,000 in 1982 and 683,000 in 1987. Over the same period heavy truck sales (that is vehicles over 3.5 tonnes gross) will increase from 327,000 this year to 370,000 in 1982 and 414,000 in 1987.

Looking back over the last 15 years, we can identify two major trends the rapid growth in many countries of the medium van market; and the drift away from middle-weight trucks and a consolidation at the maximum legal weight.

Medium vans

The medium van segment as we have seen, already accounts for about half of commercial sales, but we expect it to become more important still. In a few years' time it is possible that we will see the emergence in • Europe of a recreational vehicle market similar to that already : established in the USA.

Vehicle taxation policies and legislation will have to change in some countries if the trend is to become significant, but the mobile home is already becoming familiar in Europe's camp sites.

At the heavy end of the market, we have noticed a marked move to heavier vehicles in just about every European country and we expect this trend to continue. Vehicles will be used more intensively, average power and speed requirements will continue to rise, and distances covered will increase, all of which will demand a significant increase in the durability of heavy trucks.

It follows that as time goes on, and Europe effectively shrinks, vehicle manufacturers will have to offer a panEuropean sales and service network if they are to srvive.

Some manufacturers will find the next 1 0 years a difficult period and some may not survive at all.

Doubtless we shall see more mergers of the Saviem /Berliet and IVECO type and joint programmes such as that of the Club of Four.

If creating and monitoring a sales/service network is difficult, consider • building a new model range. The gradual harmonisation of legal requirements-affecting truck design and operation is progressing but is still too slow. The basic stumbling block of vehicle configurations and weights stilI has to be resolved. Although the European governments cannot apparently decide upon details such as axle weights, etc, it is not unreasonable to expect that they at least give the whole industry a lead by deciding now on rationalised gross vehicle weights and power-to-weight ratios.

These two factors decide the driveline combination of engine, gearbox and axle — basic heavy items which need at least five years to get into production, and about 10 years to be fully proven under operational conditions. Axle combinations, together with suspension and braking systems are important, but can be developed in a much shorter time and at much less cost.

A new product development is an expensive item in the manufacturer's budget, The Ford Motor Company chose to use proprietary components for the Transcontinental and there is no reason to suppose that other manufacturers will not adopt the same method when developing new models. It might be supposed that the market objectives of British manufacturers are primarily concerned with manufacturing sufficient vehicles to maintain their present levels of business. Ford is committed to becoming a leader in Europe and we would expect other British manufacturers to adopt a similar policy.

However, I can only speak of Ford's position within the market, which can be best be described as buoyant. In the first half of this year we achieved 12.7 per cent of the total European business and we look for 14 per cent in the second half.

Taking the heavy truck seg

ment alone, Ford secured 8 per cent in the first six mont and now looks for 9 per ce with the introduction of ne models. There will be a charic in every model in Ford's curre line from the Escort to thr Transcontinental, backed by E4 0 Om investment pr gramme. Planning secure Ford's future and I expect thr same could be said of any Briti vehicle manufacturer.

I believe there is scope whic might be summed up as cha lenge and chance. If we take u the challenge, we will certain be able to avail ourselves of th opportunities the Europea market affords.