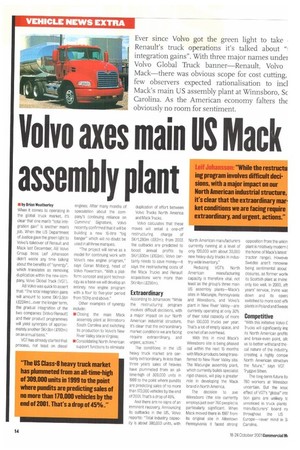

Volvo axes main US act assembly plant

Page 14

If you've noticed an error in this article please click here to report it so we can fix it.

• by Brian Weatherby When it comes to operating in the global truck market, it's clear that one man's "total integration gain" is another man's job. When the US Department of Justice gave the green light to Volvo's takeover of Renault and Mack last December, AB Volvo Group boss Leif Johansson didn't waste any time talking about the benefits of "synergy", which translates as removing duplication within the new company, Volvo Global Truck (VGT).

AB Volvo was quick to assert that: "The total integration gains will amount to some SKr5.5bn (£224m)...over the longer term, the gradual integration of the two companies [Volvo/Renault] and their product programmes will yield synergies of approximately another SKr3bn (2192m) on an annual basis."

VGT has already started that process. not least on diesel engines. After many months of speculation about the company's continuing reliance on Cummins' Signature, Volvo recently confirmed that it will be building a new 16-litre "big banger" which will no doubt be used in all three marques.

"The project will serve as a model for continuing work with Volvo's new engine program," says Goran Moberg, head of Volvo Powertrain. "With a platform concept and joint technology as a base we will develop an entirely new engine program with a four to five-year period from 150hp and above."

Other examples of synergy include: • Closing the main Mack assembly plant at Winnsboro South Carolina and switching its production to Volvo's New River Valley site in Virginia; • Consolidating North American support functions to eliminate duplication of effort between Volvo Trucks North America and Mack Trucks.

Volvo calculates that these moves will entail a one-off restructuring charge of SKr1,280m (£82m); from 2003 the cutbacks are predicted to boost annual profits by SKr1,600m (£103m). Volvo certainly needs to save money—it says the restructuring costs of the Mack Trucks and Renault acquisitions were more than SKr4bn ( 2256m).

Extraordinary

According to Johansson: "While the restructuring program involves difficult decisions, with a major impact on our North American industrial structure, it's clear that the extraordinary market conditions we are facing require extraordinary, and urgent, actions."

The conditions in the US heavy truck market are certainly extraordinary. In less than three years sales of heavies have plummeted from an alltime-high of 309,000 units in 1999 to the point where pundits are predicting sales of no more than 170,000 vehicles by the end of 2001. That's a drop of 45%.

And there are no signs of an imminent recovery. Announcing its cutbacks in the US, Volvo reports: "Total industry capacity is about 580,000 units, with North American manufacturers currently running at a level of only 120,000 with about 30,000 new heavy-duty trucks in industry-wide inventory."

Reducing VGT's North American manufacturing capacity is therefore vital, not least as the group's three main US assembly plants—Mack's sites in Macungie, Pennsylvania and Winnsboro, and Volvo's plant in New River Valley—are currently operating at only 30% of their total capacity of more than 130,000 trucks per year. That's a lot of empty space, and one hell of an overhead.

With this in mind Mack's Winnsboro site is being phased out wfthin the next 15 months with Mack products being transferred to New River Valley site. The Macungie assembly plant, which currently builds specialist rigid chassis, will play a greater role in developing the Mack brand in North America.

The decision to axe Winnsboro (the site currently employs just over 760 people) is particularly significant. When Mack moved there in 1987 from its original site in Allentown Pennsylvania it faced strong

opposition from the union plant is relatively modern ( the home of Mack's latest tractor range). However Swedes aren't renowne being sentimental about closures, as former work( its Scottish plant at Irvine only too well. In 2000, aft years' service, Irvine was down and its oper switched to more cost-effE plants in Poland and Swede

Competitive With this initiative Volvo 11 Trucks will significantly im[ its North American profitE and break-even point, alk us to better withstand the cal nature of the industry, creating a highly compe North American structurE the future," says VGT Tryggve Sthen.

The long-term future la 760 workers at Winnsbof uncertain. But the knoc effect of VGT's "global" intE lion gains are unlikely tc unnoticed in truck plants manufacturers' board ro throughout the US Europe—never mind in Carolina.