The 'expert? predid im oris and Drices rise

Page 36

If you've noticed an error in this article please click here to report it so we can fix it.

• Truck manufacturers can look forward to increasing sales, starting next year, and peaking in 1989.

This and other motor industry predictions* come from well-known business forecaster James Morrell, previously director of the Henley Centre for Forecasting.

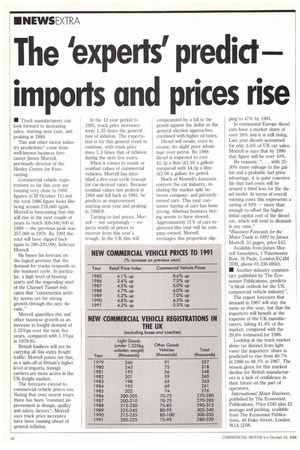

Commercial vehicle registrations so far this year are n.mning very close to 1985 figures (CM October 11) and the total 1986 figure looks like being around 276,000 again. Morrell is forecasting that this will rise in the next couple of years to reach 305-340,000 in 1989 the previous peak was 357,000 in 1979. By 1991 the total will have slipped back again to 280-320,000, believes Morrell.

He bases his forecast on the logical premise that the demand for trucks responds to the business cycle. In particular, a high level of housing starts and the impending start of the Channel Tunnel indicates that "construction activity seems set for strong growth through the next decade."

Morrell quantifies this and other business growth as an increase in freight demand of 2.25%pa over the next five years, compared with 1.1%pa in 1979-85.

British hauliers will not be carrying all this extra freight traffic; Morrell points out that, as a spin-off of Britain's higher level of imports, foreign carriers are more active in the UK freight market.

The forecasts extend to commercial vehicle prices too. Noting that over recent years there has been "constant improvement in design, quality and safety factors", Morrell says truck price increases have been running ahead of general inflation. In the 12-year period to 1985, truck price increases were 1.35 times the general rate of inflation. The expectation is for this general trend to continue, with truck price rises 1.3 times that of inflation during the next five years.

When it comes to resale or residual values of commercial vehicles, Morrell has identified a five-year cycle (except for car-derived vans). Because residual values last peaked in 1984 and fell back in 1985, he predicts an improvement starting next year and peaking in 1988/9.

Turning to fuel prices, Morrell not surprisingly expects world oil prices to recover from this year's trough. In the UK this will compounded by a fall in the pound against the dollar as the general election approaches, combined with higher oil taxes.

Diesel will retain, even increase, its slight price advantage over petrol. By 1988 diesel is expected to cost 42.2p a litre (g1.92 a gallon) compared with 44.0p a litre (g2.00 a gallon) for petrol.

Much of Morrell's forecasts concern the car industry, including the market split between companyand privatelyowned cars. This year consumer buying of cars has been strong, whereas business buying seems to have slowed. Approximately 51% of cars registered this year will be company-owned; Morrell envisages this proportion slip

ping to 47% by 1991.

In continental Europe diesel cars have a market share of over 20% and it is still rising. Last year diesels accounted for only 3,6% of UK car sales. Morrell is sure that by 1990 that figure will be over 10%.

He reasons: ". . . with 2530% more mileage to the gallon and a probable fuel price advantage, it is quite conceivable that fuel costs will be around a third less for the diesel model. In terms of overall running costs this represents a saving of 10% more than enough to offset the higher initial capital cost of the diesel car, which will tend to diminish in any case."

*Business Forecasts for the Motor Trade to 1991 by James Morrell. 51 pages, price £45.

Available from James Morrell Associates, 1 Paternoster Row, St Pauls, London EC4M 7DH, phone 01-236 6950).

• Another industry commentary published by The Economist Publications, predicts "a bleak outlook for the UK commercial vehicle industry".

The report forecasts that demand in 1987 will stay the same as this year, but that the importers will benefit at the expense of the UK manufacturers, taking 41.4% of the market, compared with the 39.6% estimated for 1986.

Looking at the truck market alone (as distinct from light vans) the importers' share is predicted to rise from 40.7% in 1986 to 48.1% in 1987. The reason given for this marked decline for British manufacturers is a lack of confidence in their future on the part of operators.

International Motor Business, published by The Economist Publications, Price g185 plus £2 postage and packing, available from The Economist Publications, 40 Duke Street, London W1A 1DW.