The HGV Road User Levy

Page 10

Page 11

If you've noticed an error in this article please click here to report it so we can fix it.

The idea of charging foreign-registered vehicles to use our roads has been mooted for more than a decade but it is finally set to become a reality, as the government’s HGV Road User Levy Bill works its way through Parliament. CM looks at what it will mean for UK hauliers

LAST MONTH transport minister Stephen Hammond presented the government’s HGV Road User Levy Bill to Parliament and received cross-party support for the proposals. There is still a lot of detail to iron out but a second reading of the bill is scheduled for 20 November and, if it continues to receive the support of MPs, it could become law from April 2014.

Any form of road charging has to meet strict EU rules as set out in the Eurovignette Directive. A key factor is a maximum daily fee of £10 for foreign-registered trucks. The charge must also not be seen to discriminate unfairly towards foreign vehicles. However, although the charge will apply to UK vehicles, the Department for Transport (DfT) aims to make it cost-neutral for the majority of UK hauliers via a VED rebate.

Here is what you need to know: Q: Will it apply to my whole fleet?

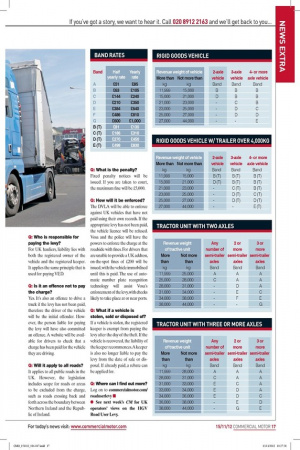

The charge applies to all vehicles weighing 12 tonnes or more. How ever, certain rigid vehicles that currently pay VED at the basic rate are exempt, and the secretary of state has the power to exempt certain categories of LGVs in the future.

Q: How much will it cost? Charges vary according to vehicle type, weight and number of axles, up to a maximum of £1,000 a year. For UK vehicles, the charge bands (A-G) will be the same as the current VED bands (see the band rates table). So if a vehicle is currently paying VED in band C, it will also pay the levy for band C.

Q: Isn’t the scheme supposed to be cost-neutral for UK hauliers?

It is. The government will reduce VED accordingly (details to be announced in the Chancellor’s 2013 Budget), and grants for vehicles with reduced pollution certificates will be introduced.

Q: So no UK haulier will be worse off?

The DfT estimates that 98% of the UK fleet of 12 tonnes or more will pay no more than an extra £50 a year, while 94% will pay nothing extra at all. For around 35% of rigid vehicles towing a trailer that do not have ‘road-friendly’ suspension, the total amount payable in VED and the levy will increase by more than £50 a year. This applies to fewer than 700 vehicles and is partly due to some of them paying VED that is below the minimum rates set in EU law. Around 40 of these types of vehicle will be hit with an extra cost of £300 a year, but the DfT suggests hauliers could consider replating to a different weight, or no longer using a trailer with that particular vehicle.

Q: Will foreign hauliers be charged the same as UK hauliers?

Foreign-registered operators can choose to pay the charge daily, weekly, monthly or annually. The maximum daily charge is set at £10 in line with EU legislation.

It is anticipated that most foreign hauliers will opt to pay the charge daily, weekly or monthly, and a higher rate for these periods has been set than the equivalent rate for a UK operator. This is due in part to the administrative costs of establishing and maintaining a system of payment, collection and enforcement of the levy for vehicles registered outside the UK.

For example, if a UK haulier pays £1,000 annually, this is a monthly equivalent of £83.33, while a foreign operator will pay £100 a month under the legislation.

Q: When will it apply to UK hauliers?

From April 2014 UK hauliers will start to pay the levy, depending on when their VED is due for renewal. All foreign-registered trucks will have to pay from the same date and prior to entering the UK.

Q: How do I pay the levy? For UK trucks, the levy will be paid at the same time as VED and using the same form. Hauliers can opt to pay for six months or a year, just as they do with VED. Q: Who is responsible for paying the levy?

For UK hauliers, liability lies with both the registered owner of the vehicle and the registered keeper. It applies the same principle that is used for paying VED.

Q: Is it an offence not to pay the charge?

Yes. It’s also an offence to drive a truck if the levy has not been paid, therefore the driver of the vehicle will be the initial offender. However, the person liable for paying the levy will have also committed an offence. A website will be available for drivers to check that a charge has been paid for the vehicle they are driving.

Q: Will it apply to all roads? It applies to all public roads in the UK. However, the legislation includes scope for roads or areas to be excluded from the charge, such as roads crossing back and forth across the boundary between Northern Ireland and the Republic of Ireland. Q: What is the penalty? Fixed penalty notices will be issued. If you are taken to court, the maximum fine will be £5,000.

Q: How will it be enforced? The DVLA will be able to enforce against UK vehicles that have not paid using their own records. If the appropriate levy has not been paid, the vehicle licence will be refused. Vosa and the police will have the powers to enforce the charge at the roadside with fines. For drivers that are unable to provide a UK address, on-the-spot fines of £200 will be issued, with the vehicle immobilised until this is paid. The use of automatic number plate recognition technology will assist Vosa’s enforcement of the levy, with checks likely to take place at or near ports.

Q: What if a vehicle is

stolen, sold or disposed of? If a vehicle is stolen, the registered keeper is exempt from paying the levy after the day of the theft. If the vehicle is recovered, the liability of the keeper recommences. A keeper is also no longer liable to pay the levy from the date of sale or disposal. If already paid, a rebate can be applied for.

Q: Where can I find out more? Log on to commercialmotor.com/ roaduserlevy n l See next week’s CM for UK operators’ views on the HGV Road User Levy.