Are Commercial Vehicles Unfairly Taxed ?

Page 57

If you've noticed an error in this article please click here to report it so we can fix it.

The Classes of Motor and the Taxes That They Pay. Why Increased Taxation Would Not Help the Railways

By a Transport Specialist

HE incidence of taxation as between the various classes of motor vehicle is an important matter which has not received the attention that it deserves, but it is reasonable to say that the only fair, sound and logical method of imposing taxation upon motor vehicles is that based upon their use of the highways. This implies consideration of size, weight and wear caused by their passage. This, in fact, is a matter that appears to be agreed between all parties, although it has not been acted upon generally, except, perhaps, in the case of higher licence charges being made for solid-tyred vehicles. Evidence directly bearing upon this matter was given before a Parliamentary Committee, in 1911, when Sheffield Corporation sought to run buses outside its city boundary. There was opposition from the road owners on account of the extra cost that would be involved in maintenance. After hearing expert witnesses at great length, Parliament laid it dawn that the corporation should pay id. per vehicle-mile towards road costs.

Again, in 1916, an Act was passed prohibiting buses upon new routes, without the consent of the local authority concerned, or, if it refused, an appeal was allowed to the Ministry of Transport, which could give permission upon such terms as it should decide. In practice, the procedure under the Act resulted in the Ministry of Transport almost invariably fixing a charge at the rate of id. per vehicle-mile. In both of these cases only solid-tyred vehicles were considered.

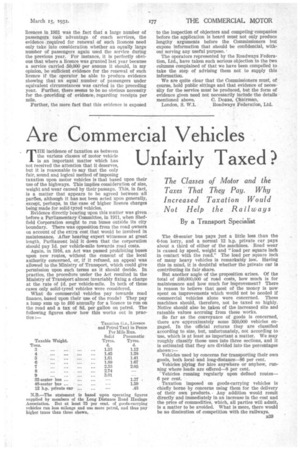

What do commercial vehicles pay towards road finance, based upon their use of the roads? They pay a lump sum up to £66 annually for a licence to run on the road and a tax of 8d. per gallon on petrol. The following figures show how this works out In practice :— N.13.—The statement is based upon operating figures supplied by members of the Long Distance Road Haulage Association. But at least 75 per cent. of goods-carrying vehicles run less mileage and use more petrol, and thus pay higher taxes than those shown. The 48-seater bus pays just a little less than the 6-ton lorry, and a normal 12 h.p. private car pays about a third of either of the machines. Road wear is caused by speed, weight and " load per square inch in contact with the road." The load per square inch of many heavy vehicles is remarkably low. Having this in mind, it is doubtful whether the private car is contributing its fair share.

But another angle of the proposition arises. Of the total of £60,000,000 of road costs, how much is for maintenance and how much for improvement? There is reason to believe that most of the money is now spent on improvements which would not be needed if commercial vehicles alone were concerned. These machines should, therefore, not be taxed so highly. Notice should also be taken of the increased site and rateable values accruing from these works.

So far as the conveyance of goods is concerned, there are approximately some 360,000 vehicles engaged. In the official returns they are classified according to size, but, unfortunately, not according to use, which is at least as important a matter. We may roughly classify those uses into three sections, and it is estimated that they are divided into the percentages shown:— Vehicles used by concerns for transporting their own goods, both local and long-distance-86 per cent.

Vehicles plying for hire anywhere or anyhow, running where loads are offered-8 per cent.

Vehicles running regularly upon defined routes6 per cent.

Taxation imposed on goods-carrying vehicles is chiefly borne by concerns using them for the delivery of their awn products. Any addition would result directly and immediately in an increase in the cost and the price of commodities, which, all parties will admit, is a matter to he avoided. What is more, there would be no diminution of competition with the railways.