SECOND CHANCE

Page 60

Page 61

If you've noticed an error in this article please click here to report it so we can fix it.

Dowfreight was a leading light in international haulage until it was brought down by VED and permit offences. Now the Dowsett brothers are back.

IN At its peak Dowfreight was easily the biggest UK haulier to Eastern Europe. It ran a fleet of 120 trucks on the intensive long haul behind the Iron Curtain, in addition to its domestic fleet which handled distribution for VAG, the VW and MAN importer.

In those heady days the drivers were salaried, and many were in the company pension scheme. Blue-chip clients were turning to Dowfreight with jobs most hauliers didn't want to consider. And then Dowfreight boss Roger Dowsett was arrested for vehicle excise duty evasion and permit offences, and the firm's main bank sent in managing receivers.

TNT took over the VAG contract: After a long and acrimonious struggle Roger Dowsett was tried and sentenced to 18 months in jail.

There was a lot of sympathy for Dow sett among some hauliers; even £40,000 worth of VED evasion was pretty small beer for a 120-tractor fleet which spent most of its time abroad; and permit offences were generally seen as no more than technical offences.

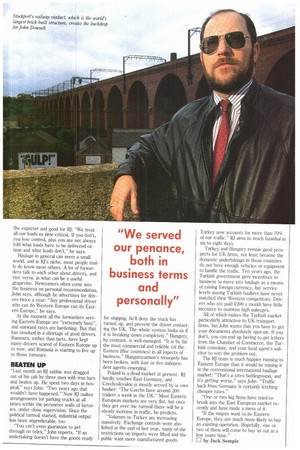

Three years on, the Dowsett brothers are back. It took Roger and John (right) almost two years to win back some of their best customers, but now they are well-established again and prepared to talk openly — at least about the future. The past is another matter.

"We served our penance," says John, "both in business terms and personally." Incredibly, Dowfreight is still in receivership.

All the former directors are prepared to say is that the company was trading profitably, had a strong asset base in trucks and property — and that the handful of haulage sub-contractors got all the money due to them: "I made sure of that," says John.

When the managing receivers walked into Dowfreight, John Dowsett walked out; straight into a new company, RJ International Freight. Despite the initials, neither of the brothers are directors; John describes them as "senior managers". The directors are Richard Hutt, formerly with Schenkers, and Julie Carty. Both were trusted employees at Dowfreight.

John says that he had virtually no startup capital for RI as almost all the profits from Dowfreight had gone back into the business. But he secured up to 10 trailers on rental from CSL, now part of TIP Europe. "I shook a man's hand on the deal," he says.

RJ trades from tiny premises in the centre of Stockport, over a branch of the retail chain Next to Nothing. "This used to belong to a jeweller," says John, explaining the high level of security.

Behind the locked doors is the nerve centre of a booming operation. RI has built up to more than 100 round trips a month to Eastern Europe. It's hard to be exact, because this year RJ will almost double its volumes. The market is booming, and RI is increasing its market share, says John.

The firm has maintained its relationship with TIP, where it now has 14 trailers on contract and up to 10 more on spot hire. RJ tops up with a few vehicles from Trailerblaze of Peterborough; it is now running over 30 trailers and controls 40 artics. Most of the business is with UKbased importers and exporters.

TACKLED SERIOUSLY

In the UK, the Eastern European market is only being tackled seriously by about 20 hauliers or forwarders, says John. All the firms use owner-drivers; it is tempting to conclude that Dowfreight's downfall proved it couldn't be done any other way: "Owner-drivers are going to become more generally important into the nineties. They are best at doing the trucking, and leave companies like ours to do the sales and marketing," he reckons.

RJ run careful checks on drivers before taking them on. For example, vehicle records are checked thoroughly, as well as insurance documents: "It gives you a good idea of the sub-contractor if you know he is looking after the vehicle." Payment is made to subbies in two instalments; £1,000 before they leave, the balance within 14 days of the return of documents. The first trip or two is made in tandem with another driver.

Payment is on a flat rate for the round trip, loaded or not, with additional payments for empty running to collect a load. The method of payment takes the onus off the driver and onto the forwarder, which is why few forwarders work that way, preferring to pay one-way money and matching payment to loading, says John. But that can be tough on the driver, especially as loads out of Eastern Europe are becoming harder to get. At RJ the driver knows where he stands, apart from the extra fuel if he's loaded.

Five years ago, Dowfreight was paying its salaried drivers 213,000-£15,000 a year, much of it tax-free. Now, the range of potential earnings is huge: it depends, for instance, on how much work you do and where you buy your diesel. Drivers have to keep to a strict timetable. John reckons that's good, for them, good for the exporter and good for RJ: "We treat all our loads as time-critical. If you don't,. you lose control, plus you are not always told what loads have to be delivered on time and what loads don't," he says.

Haulage in general can seem a small world, and in RJ's niche, most people really do know most others. A lot of forwarders talk to each other about drivers, and vice versa, in what can be a useful grapevine. Newcomers often come into the business on personal recommendation, John says, although he advertises for drivers twice a year: "Any professional driver who can do Western Europe can do Eastern Europe," he says.

At the moment all the forwarders serving Eastern Europe are "extremely busy", and outward rates are hardening. But that has resulted in a shortage of good drivers, Rumours, rather than facts, have kept many drivers scared of Eastern Europe up to now, and Romania is starting to live up to those rumours.

BEATEN UP

"Last month an RJ subbie was dragged out of his cab by three men with iron bars and beaten up. He spent two days in hospital," says John. "Two years ago that wouldn't have happened." Now RJ makes arrangements for parking trucks at all times within the perimeter walls of factories, under close supervision. Since the political turmoil started, industrial output has been unpredictable, too.

"You can't even guarantee to get through on telex," John reports. "If an undertaking doesn't have the goods ready for shippng, he'll deny the truck has turned up, and prevent the driver contacting the UK. The whole system looks as if it is breaking down completely." Hungary, by contrast, is well-managed. "It is by far the most commercial and reliable (of the Eastern Bloc countries) in all aspects of business." Hungarocamion's monopoly has been broken, with four or five independent agents emerging.

Poland is a dead market at present. RJ hardly touches East Germany, and Czechoslovakia is mostly served by is own haulier: "The Czechs have around 200 trailers a week in the UK." Most Eastern European markets are very flat, but once they get over the turmoil there will be a steady increase in traffic, he predicts.

"Volumes to Turkey are increasing massively. Exchange controls were abolished at the end of last year, many of the restrictions on imports were lifted and the public want more manufactured goods. Turkey now accounts for more than 70% of our traffic." RJ aims to reach Istanbul in six to eight days.

Turkey and Hungary remain good prospects for UK firms, not least because the domestic undertakings in those countries do not have enough vehicles or equipment to handle the traffic. Ten years ago, the Turkish government gave incentives to business to move into haulage as a means of raising foreign currency, but service levels among Turkish hauliers have never matched their Western competitors. Drivers who are paid 2200 a month have little incentive to maintain high mileages.

All of which makes the Turkish market particularly attractive to UK transport firms, but John warns that you have to get your documents absolutely spot-on. If you don't, you can end up having to get letters from the Chamber of Commerce, the Turkish consulate, and your local agent's solicitor to sort the problem out.

The RJ team is much happier running to Eastern Europe than it would be mixing it in the conventional international haulage market: "That's a rates battleground, and it's getting worse," says John. "Traffic back from Germany is certainly fetching cheaper rates."

"One or two big firms have tried to break into the East European market recently and have made a mess of it.

"If the majors want to do Eastern Europe, they are much more likely to buy an existing operation. Hopefully, one or two of them will come to buy us out in a few years time."

by Jack Semple